What is money?

Anything that is accepted in payment for a good or service

Where does most of your income come from?

A paycheck

In order to calculate earnings, you have to deduct _________, ____________, and ______________ from the _____________ pay.

Mandatory, non-mandatory, exemptions, original gross pay

Banks do what?

Sell financial services, help people manage money, safe place for money

What is the difference between a fixed expense vs a variable expense?

A fixed expense is an expense whose total amount doesn't change when there is an increase in activity and a variable expense is an expense that changes to the need or want of the consumer.

The two issues with the barter system is that ...

It's difficult to find someone who wants the item

You can't make change for an item that costs less than the form of payment

True or False: Deductions is an expense subtracted from the net income: If false, correct the statement.

False: Deduction is an expense subtracted from gross income

What is the ideology behind FICA?

True or False: All regulated deposits, in all banks, up to $250,00 are insured by FDIC. If false, fix the statement.

False: All regulated deposits up to $250,000 are insured by FDIC BUT not all banks are regulated.

True or false: A short term goal can last for 1-5 years.

False, a short term goal can last up to a year

What are the functions of money? Explain each

Medium of exchange: Use it to get what you want

Standards of value: Express value of different items

Store of value: Saved for future use

What is the different between a FICA SS tax and a 401k?

A FICA SS tax is a mandatory tax and a 401k is optional

If the total amount of deductions is $290.26 and the following deductions are taken out:

FICA Med tax: $14.50

FICA SS Tax: $62.00

FED Tax: ?

CA ST Tax: $44.26

SDI: $10

What is the federal tax?

$159.50

Where do banks get the money to give out loans?

Customers deposits and fees charged

What is the purpose of a SMART goal?

Step by step process to achieve a goal realistically

True or false: Relative Scarcity is the idea that the value doesn't change rapidly. If false, give the true meaning.

False: The idea that there is not enough resources to meet our needs and want

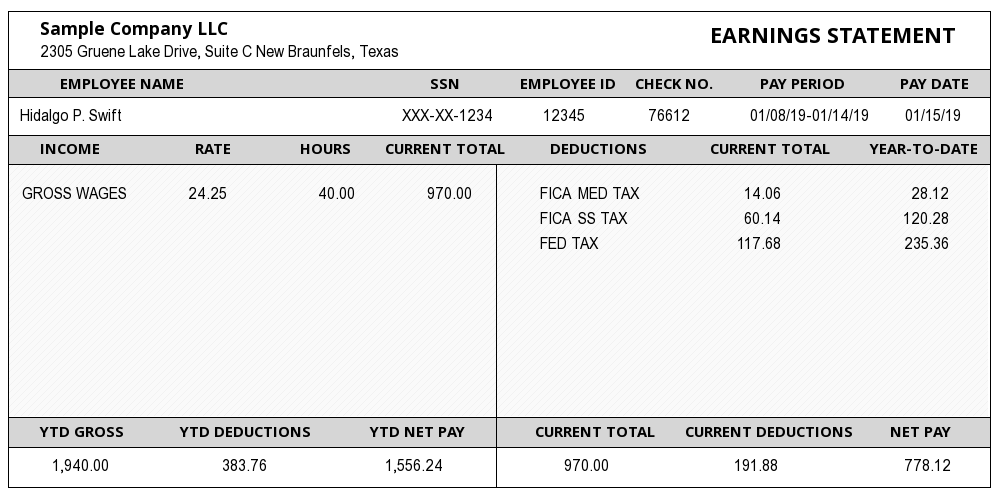

What is the amount that Hidalgo takes home after deductions are taken out?

What is the amount that Hidalgo takes home after deductions are taken out?

$778.12

Determine the total amount of deductions on Sandra's salary if she works $13.50/hour for 32 hours

Determine the total amount of deductions on Sandra's salary if she works $13.50/hour for 32 hours

$116.12

True or false: Online banking is available to customers for a fee

False. Online banking is free with an account

$135

responsible for the amount of money in circulation

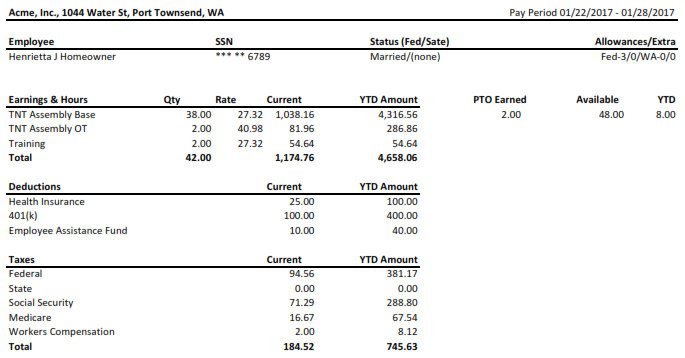

What is the amount taken out for the mandatory taxes stated above for (YTD)

What is David's take home pay if he works $15.00/hour for 40 hours?

What is David's take home pay if he works $15.00/hour for 40 hours?

$440.10

Banks work under the assumption that ...

You will not withdraw all their deposits at the same time

How much money did Harold get paid for his work? How much did he take home?

How much money did Harold get paid for his work? How much did he take home?

$2,308.69--current amount

$1,808.08--Net Pay