What is the formula for contribution margin per unit?

Selling price per unit - variable cost per unit

A company wants to know how much of their sales' revenue can go towards covering fixed costs and become profit

Contribution margin

Sales price is $40 per unit, variable cost is $18 per unit, total fixed costs is $15,000. 11,000 units are produced.

What is the contribution margin per unit?

$22

Sales price is $56 per unit, variable cost is $24 per unit, total fixed costs is $12,000.The company wants to achieve a profit of $40,000. How much sales revenue does the company need to reach this goal?

$91,004.55

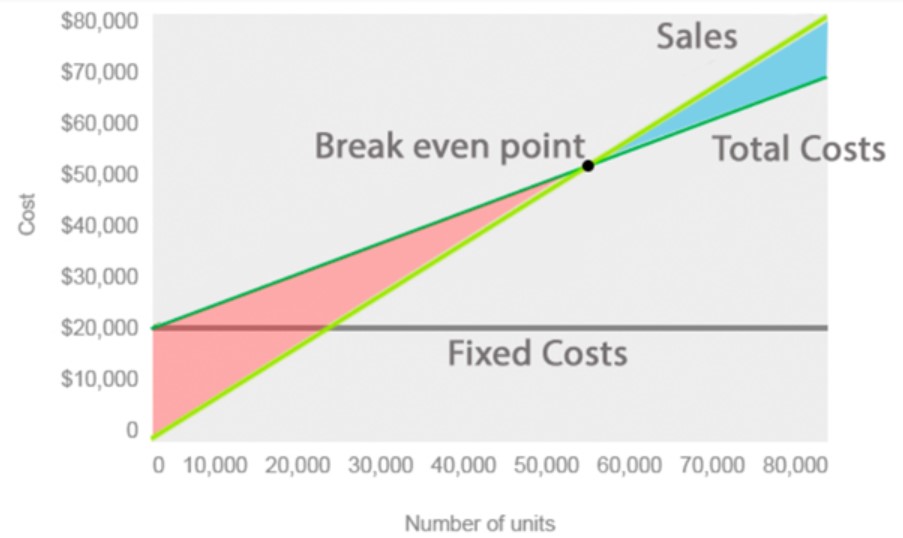

Draw a CVP graph & label all parts

What is the formula for breakeven in units?

Fixed costs + operating income / contribution margin per unit

A company wants to set their revenue equal to their expenses, and is interested in knowing how many units they'll need to sell to achieve this

Break-even units

Sales price is $160 per unit, variable cost is $105 per unit, total fixed costs is $24,000.

What is the contribution margin ratio?

34.38%

A company's sales is $130,000, and their breakeven in sales is $113,000. What is the margin of safety in dollars?

$17,000

If the sales price is increased, what happens to the breakeven point?

It decreases

What is the formula for breakeven in revenues?

Fixed expenses + operating income / contribution margin

A company wants to reach their projected operating income, and wants to know how much profit they're going to have to generate through sales in order to reach their projection

Target operating income in revenues

Sales price is $79 per unit, variable cost is $18 per unit. Total fixed costs are $39,467. 13,500 units are produced.

What is the breakeven in units?

647 units

A company projects that they will sell 50,000 units during the holiday season. To break even, they need to sell 39,000 units. What is the margin of safety in units?

11,000

If the variable costs decrease, what happens to the breakeven point?

It decreases

What is the formula for target operating income in revenues?

fixed costs + target operating income / contribution margin %

A company is anticipating an upcoming drop in sales following the holiday season, and wants to know how much of a hit in sale of product they can take before it becomes a loss

Margin of safety in units

Sales price is $320, total fixed expenses is $30,000. Variable expenses is 16% of the sales price.

What is the breakeven sales ($)?

$35,714.29

A company is currently reporting sales of $56,000, which is above their breakeven of $47,000. Find their margin of safety percentage.

16.07%

How does an increase in fixed costs affect the unit contribution margin?

It has no effect on unit contribution margin

What is the formula for margin of safety in dollars?

Budgeted (or actual) revenues - breakeven revenues

A company wants to know how much their operating income will change given a 1% change in volume

Degree of operating leverage

Sales price is $90 per unit, the variable cost is $46 per unit, and total fixed costs is $60,000.

How many units need to be sold if the company wants to have a profit of $94,000?

3,500 units

A company has a total sales revenue of 37,000. Their total variable costs is 24,000. Their operating income is $50,000. Find their degree of leverage.

.26

List some characteristics of a high operating leverage company.

-Higher fixed costs

-Lower variable costs

-Higher contribution margin ratio

-Higher risk

-High potential reward