In the USA, men are paid better for the same job, than women.

An employer is required by law to provide a full explanation of your paycheck.

You pay taxes to the federal government and to this __ government.

State government

True or False: if you have a conflict with your co-worker, report it to your supervisor.

True

What are all these: Indeed, monster.com, glassdoor, ZipRecruiter

The examples of online job search sites and social media

What are these three agencies have in common?

Each of them is a Credit Reporting Agency, that tracks your paying history.

A New Year is an example of paid holiday. Give 3 more examples.

- Martin Luther King's Birthday 3rd Monday in January.

- Memorial Day last Monday in May.

- Juneteenth National Independence Day June 19.

- Independence Day July 4.

- Labor Day 1st Monday in September.

- Thanksgiving Day 4th Thursday in November

- Christmas Day December 25

What amount do you actually receive on your pay day, gross amount or net amount?

You will receive a net amount: gross amount minus taxes and deductions.

True or False: Your employer withholds taxes from your every paycheck.

True.

You are expected to stay at your first job for at least that long.

6 months

True or False: your employer verifies your credit score as part of your background check.

True, especially if the work has access to money or personal documentation.

True or False: Experian, Equifax, and TransUnion know your Social Security Number, and can trace all your financial activity.

True.

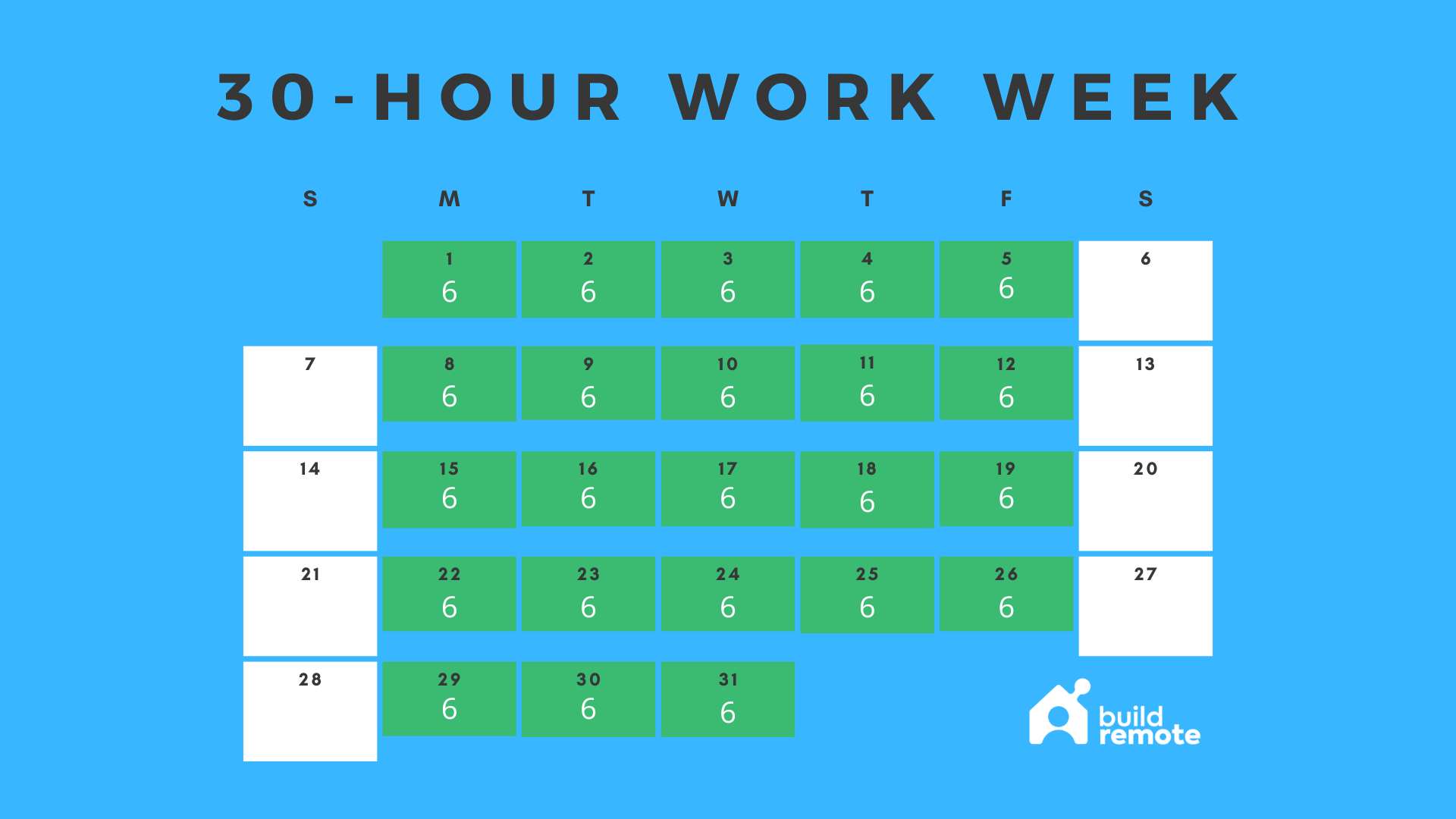

If somebody works 30 hours a week, is it FT or PT?

Full time (30-40 hours)

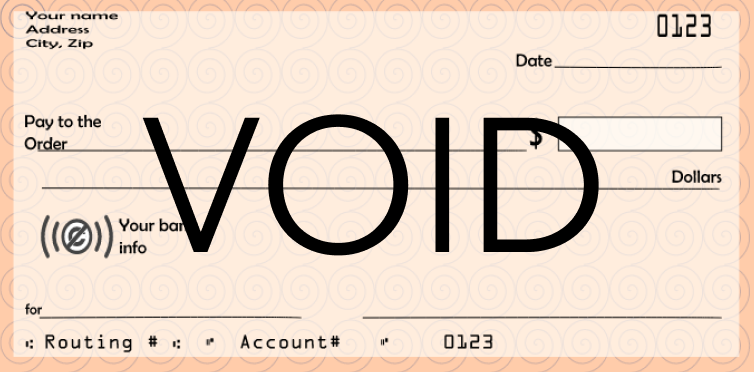

Why do you need to provide your bank account information to your employer?

So that your employer could pay you by Direct Deposit

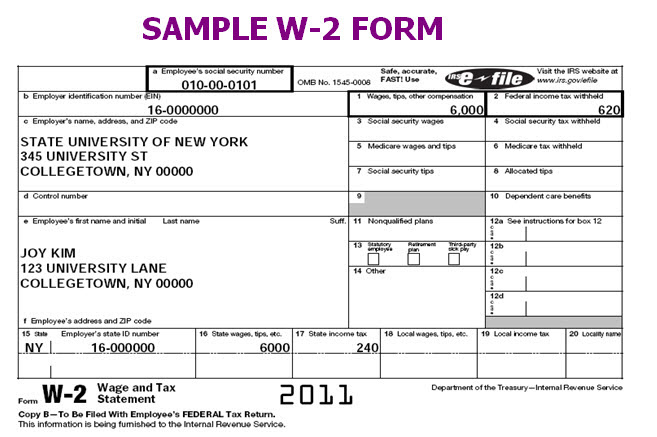

After the year ends, you will receive this form (or electronic access to this form), that will quote your earnings for the year.

W2

1099

1040

W2

Give any 3 examples of behavior that would be considered unprofessional.

- Clothing

- Using bad language

- Sexual Harassment

- Coming late to work

- Drugs or alcohol at workplace

- Being incompetent's

- Neglecting duties & deadlines

- Not following company rules

- Not checking or not answering phone calls emails, or messages

What does the N/A mean in the job application?

Give at least one example of the case, when you need to put N/A.

Not Applicable, when the questions is unrelated to you (no middle name, no apartment number, no leaving date-still employed)

Which one of the factors, listed below, do NOT affect your Credit Score:

1 declaring bankruptcy

2 paying interest

3 paying late fees

4 earning a lot of money

"4 making a lot of money" does NOT have any impact on your Credit Score

When does your employer pay you overtime?

When you work more then 40 hours a week

True or False: your employer shares with you the cost of the health insurance, taken from each paycheck.

True: the company pays most of the cost as a benefit.

What is IRS?

Internal Revenue Service, a federal tax agency

When you are leaving your job, you are expected to give your supervisor notice at least this time in advance.

Give at least a 2-week notice to your supervisor, if possible in person.

:max_bytes(150000):strip_icc()/what-is-two-weeks-notice-2062048_final-edit-9f3dcca69964431c880b662714bc7b01.jpg)

What is the difference between soft and hard skills? Explain, using the example of a mine diffuser.

Hard skills: chemistry of explosion, grenade, bombs, mines, mechanisms of diffusing.

Soft skills: patience, self-composure, attention to details, good concentration, ability to focuse.

Which of the factors below boost your credit score:

1 paying off your bills on time

2 having a lot of money in the bank

3 having many credit cards

4 avoiding paying interest

1 & 4

What is PTO, and how does it work?

![]()

Paid Time Off; you earn one day of PTO after each month of work.

True or false: you are obligated by law to purchase health insurance through your work.

1. It is optional to have a health insurance.

1. It is optional to have a health insurance.

2. When you profit from Medicaid, you don't need another health insurance

3. When your Medicaid ends, you have an option and you are eligible to purchase health insurance from your work.

What is the deadline for filing a tax return?

April 15

Name at least 3 topics that are not appropriate for a workplace discussion.

1 paycheck

2 religion

3 politics

4 gender issues

Give 5 examples of soft skills, valued in America.

time management

punctuality

leadership

ability to follow and to accept criticism

positive attitude

flexibility

people skills

problem solving skills

Name any 3 things that will take down your credit score.

1. having debts

2. paying interest

3. having history of late payments or skipped payments

4. bankruptcy

Name three criteria a person must meet to be eligible for unemployment benefits.

1. you worked at this work place for at least 12 months

2. it was not your decision to leave the job

3. the termination was not caused by any questionable activity

How many types of taxes are taken from your paycheck? Can you name them all?

- Federal Income Tax.

- State Income Tax.

- Social Security (FICA)

- Medicare Tax (FICA)

Which form do you fill out when filing tax return: W2 or 1040?

Form 1040

To whom do you complain about your immediate supervisor?

1 Your supervisor's supervisor

2 Human Recourses

3 Company owner

4 EEOC (Equal Employment Opportunity Committee) of your city or state

Who can you ask for references?

1.Your supervisor

2.Your coworker

3.Your landlord, your teacher, your customer or business partner

Name any 3 scenarios when somebody would request your Credit Score: who and why

your landlord, before renting out to you

your employer, during your background check

a bank, when you apply for a loan

a store or a car dealership, when you apply for financing

What is 401K plan?

It's a benefit when your company invest your money to help you save for retirement.

Name any 3 pieces of information your employer must include in your earning statement?

First & last date of the pay period

Your rate ($ in an hour)

How many hours worked

Gross pay, earned during this period

Taxes

Other deductions

Where do you get form 1040?

Any post office, public library, any federa/state/city building, or online.

What is EEOC?

Name 3 reasons why it is important to stay in one workplace for at least 6 months.

1.Will be able to list this job in your resume

2.Will be able to ask for references

3.Makes you eligible for the inside promotion

What will happen if you request your credit report every month? Can you name at least 2 of the 3 important things you must know about requesting your Credit Report?

2_You will have to pay for the rest of them;

3_You will lose 5 points every time you request your credit report.