Fiscal policy used to fix an inflationary gap

What is Raising Taxes or Decreasing Government Spending?

The equation for tax multiplier

What is mpc/mps?

Definition of NRU and what it is

What is 4-6% and is

Shifters of the PPC

What is Change in resource quality/quantity, technology, and trade?

The graph that is used for

What is Aggregate Supply and Demand Graph

Monetary Policy used to fix a recessionary gap

What is Selling Bonds?

This is the equation for GDP Deflator and Nominal GDP

What is Nominal GDP =( Deflator x Real GDP )/100, GDP Deflator = Nominal/Real x 100?

When a country's money supply increases, its value changes.

What is depreciation?

5 Factors of Supply

What is Price, Number of Sellers, Technology, Government Action, Expectations of Future Profit?

Price levels increase, Unemployment increases, and often from supply shock

What is Stagflation?

Monetary Policies Limited Reserves

What is RR, OMO, DR / Change in Sm &Nir?

Reserve Requirements are directly connected to

What is Demand Deposits?

Calculate the Labor Force AND Unemployment Rate equations

What is LF=UE+EM? UR=UE/LF

5 Shifters of Demand

What are Tastes and Preferences, Number of Consumers, Price of Relative Goods, Income, and Future Expectations?

The X and Y labels of the Reserve Market Model

What is the Policy rate and Quantity of Reserves?

Recognition Lag is

What is the time taken to realize a recession occurred?

What states that as a person consumes more units of a good or service, the additional satisfaction or utility gained from each additional unit decreases

What is the Law of Diminishing Marginal Utility?

The increase in a country's interest rates affects its currency value in the foreign exchange market

What is Appreciation?

The maximum money change, given a reserve requirement of 20% and an initial deposit of $1,000

$4,000.

Money Multiplier = 1 / 0.20 = 5

Initial Deposit × Money Multiplier = $1,000 × 5 = $5,000

Since the bank must hold 20% as reserves,

$5,000 - $1,000 = $4,000.

Graph in a recessionary gap

The primary goal of contractionary monetary policy

What is reduce inflation by decreasing the money supply and raising interest rates, which curbs consumer spending and investment?

A man deposits a $500 check into his time deposit for a course of 5 years, this happens to M1, M2, and M0.

What is M1 decreases(by $500), M2 does not change, M0 does not change?

The real interest rate is if nominal interest rate is 8% and the inflation rate is 3%

What is 5%

Real Interest Rate = Nominal Interest Rate - Inflation Rate

(8% - 3% = 5%)

On an Aggregate Supply and Demand (AS-AD) graph, what happens to the equilibrium output and price level if the central bank increases the money supply?

Aggregate Demand (AD) curve shifts to the right, leading to a higher equilibrium output and an increased price level.

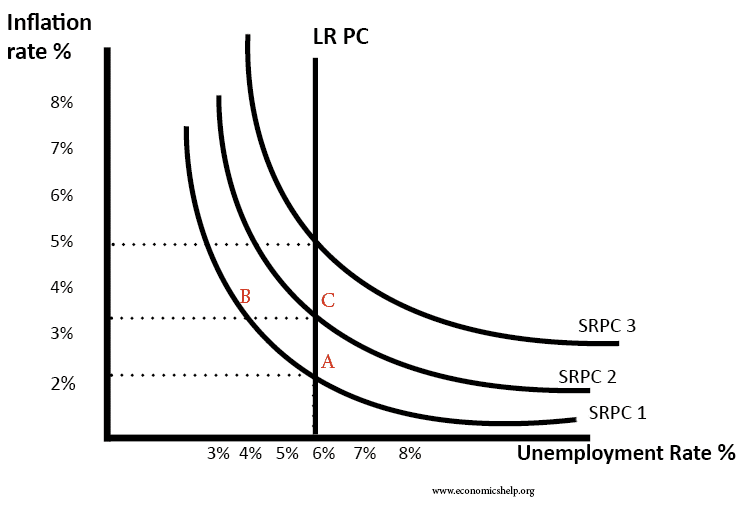

What is Philips Curve Graph?