An increase in labor productivity will have this effect on the AS/AD graph

What is shift the AS line to the right.

According to John M. Keynes, what is the government's role in the economy during troubling times?

What is active involvement through manipulation of spending and taxes.

If marginal propensity to consume is 0.8, what is the largest total increase in Real GDP that can result from $500 of new spending?

What is $2,500

What relationship exists between Price Level and Real GDP? (This is why the AD curve is downward sloping)

What does MPC stand for?

What is Marginal Propensity to Consume.

If the business cycle is in its expansion phase, what would we most likely see change on the AS/AD graph?

What is an AD shift to the right

According to John M Keynes, increased government spending during a recession would have what effect on price levels and Real GDP?

What is no effect on price levels and an increase in Real GDP

The tax multiplier increases in magnitude when:

C. The MPC increases

(A: The MPS Increases)

(B: The spending multiplier falls)

(D: Gov't spending increases)

(E: Taxes increase)

This gap occurs when actual gdp is below potential gdp in the business cycle. Cyclical unemployment also becomes an issue.

A: Recessionary Gap or Negative Output Gap.

Why is the tax multiplier always one less than the spending multiplier?

An increase in labor productivity would most likely cause Real GDP and price levels to change in what ways?

RGDP to increase and price levels to decrease.

What is the classical economist explanation for how the economy will recover from a recession?

What is it will self correct (Government doesn't need to get involved) ...over a long period of time the cost of resources, including labor, will reduce allowing Aggregate supply to shift right and get back to the LRAS at full employment.

With the budget initially in balance, suppose that the federal government increases spending by $20 billion. The increase in spending is financed by a $20 billion tax increase. The MPC is .75. What will be the impact on Real GDP?

The Real GDP will increase by $20 billion.

What are the shifters of AD?

C+I+G+(Xn)

If price levels increased. How would that be reflected in the AS model?

What is upward movement along the curve.

The LRAS curve rarely shifts, but if it did, name one reason why.

What is 1. Gain more resources in the long run, 2. Improve human capital through training 3. Improved technology to be more efficient.

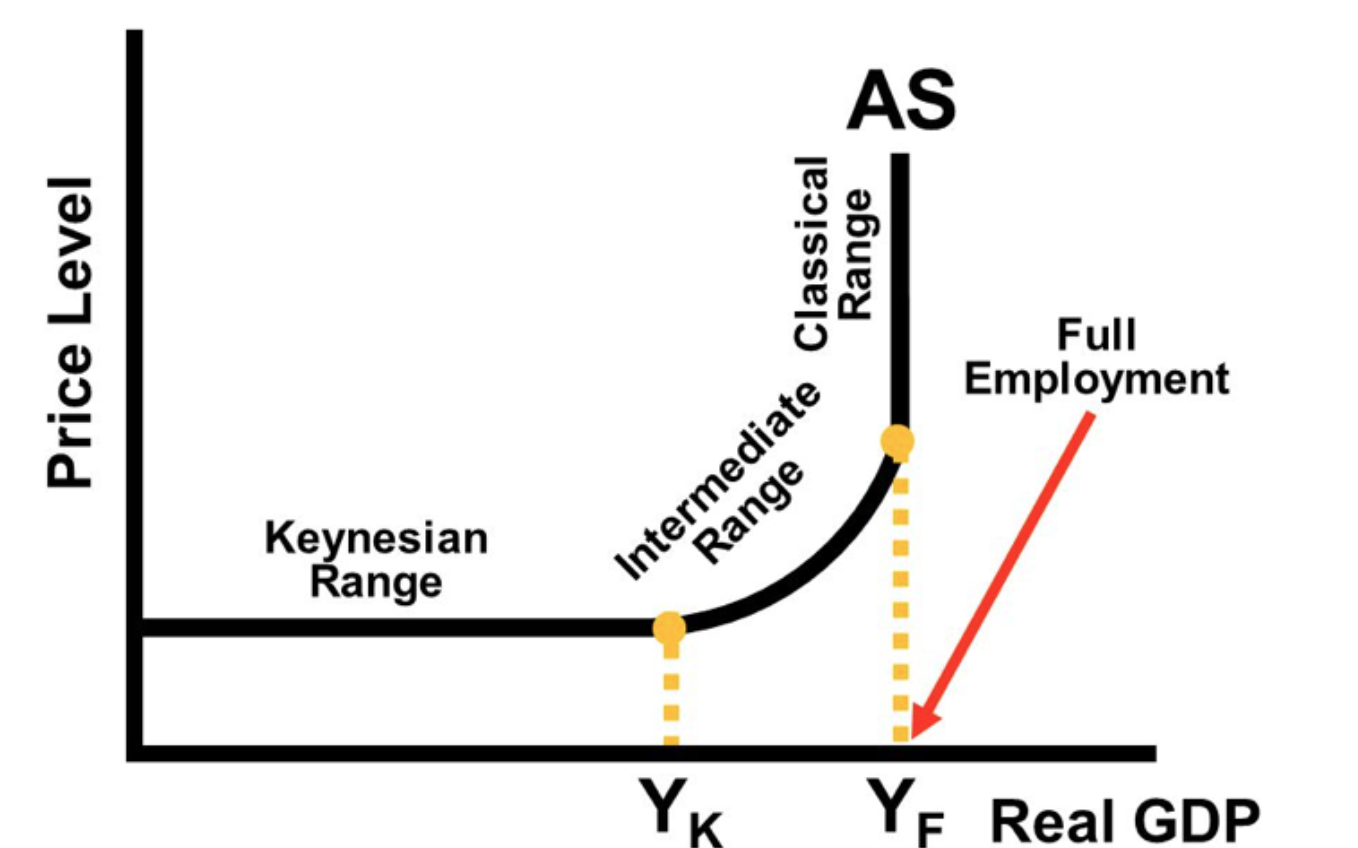

Draw the AS curve showing the Keynesian Range, Intermediate Range, and Classical Range.

If Maria's disposable income increases from $600 to $650 and her level of personal consumption expenditures increases from $480 to $520, her marginal propensity to save must be?

0.20

What does this economy have in the short run?

What is a Recessionary Gap

What economic theory has the Multiplier effect?

Keynesian

An increase in personal income taxes will most likely result in what changes in Real GDP and price levels in the short run

What is decrease in RGDP and a decrease in Price Levels.

According to Keynesian analysis, if government expenditures and taxes are increased by the same amount, what will happen to Aggregate Demand and the Real GDP?

What is AD will shift right and Real GDP will increase.

If the tax multiplier is -4 and government spending increased by $20 billion, what will be the impact on Real GDP based on the spending multiplier?

What is $100 billion.

Which point is showing an inflationary gap?

What is Z? (Why: because it has moved ahead of the LRAS curve. (Actual GDPr is ahead of potential Yf)

What is long term negative supply shock called?

What is Stagflation