What bacterial infection fighting drug did Scottish scientist Alexander Fleming create by discovering mold which held antibiotic properties?

Penicillin

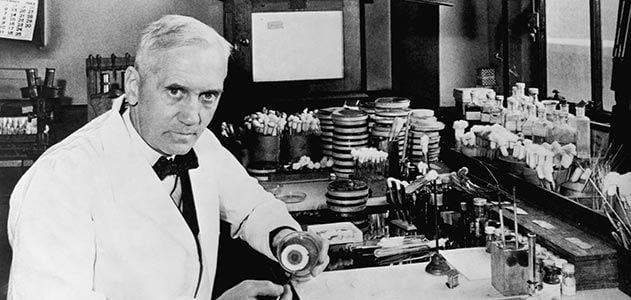

It's one of the most famous discovery stories in history. In 1928, the Scottish scientist Alexander Fleming noticed a bacteria-filled Petri dish in his laboratory with its lid accidentally ajar. The sample had become contaminated with a mold, and everywhere the mold was, the bacteria was dead. That antibiotic mold turned out to be the fungus Penicillium, and over the next two decades, chemists purified it and developed the drug penicillin, which fights a huge number of bacterial infections in humans without harming the humans themselves.

What day is Tax Day on every year?

April 15th

Traffic accidents increase significantly on or around April 15th, so watch out for frantic drivers making a beeline for the post office! The Federal income tax filing deadline is midnight on April 15th of every year, with extensions occurring when the 15th lands on a Saturday, Sunday, or a holiday. In those circumstances, the returns are due the first succeeding day which is not a Saturday, Sunday, or a holiday.

True or False: The Viking who discovered Greenland was Sven the Blue.

False, it was Erik the Red!

The Norwegian Erik the Red, a Viking warrior and explorer, visited Greenland in 982 CE, the first known European to do so. He is credited for giving the country its name 'green land'. His son Leif Eriksson is credited in history as the first Viking to discover North America.

True or False: Americans submit their taxes to the FBI every year.

False, they are submitted to the IRS!

The Internal Revenue Service (IRS) is the revenue service for the United States federal government, which is responsible for collecting U.S. federal taxes and administering the Internal Revenue Code, the main body of the federal statutory tax law. It is an agency of the Department of the Treasury and led by the Commissioner of Internal Revenue, who is appointed to a five-year term by the President of the United States. The duties of the IRS include providing tax assistance to taxpayers; pursuing and resolving instances of erroneous or fraudulent tax filings; and overseeing various benefits programs, including the Affordable Care Act.

What was the first spacecraft to land on the moon?

a. Apollo 11

b. Apollo 8

c. Gemini 2

d. Sputnik

b. Apollo 11

Apollo 11 landed on the moon on July 20, 1969, the first spacecraft to do so. After four days traveling to the Moon, the Lunar Module Eagle, carrying Neil Armstrong and Buzz Aldrin landed on the Moon. Neil Armstrong exited the spacecraft and became the first human to walk on the moon. As an estimated 650 million people watched, Armstrong proclaimed "That's one small step for man, one giant leap for mankind."

Who would you hire to help file your taxes?

a. Investment Banker

b. Accountant

c. Cost-Effective Cowboy

d. Management Consultant

b. Accountant

Cahan & Sun (2015) used archival study to find out that accountants' personal characteristics may exert a very significant impact during the audit process and further influence audit fees and audit quality. Practitioners have been portrayed in popular culture by the stereotype of the humorless, introspective bean-counter. It has been suggested that the stereotype has an influence on those attracted to the profession with many new entrants underestimating the importance of communication skills and overestimating the importance of numeracy in the role.

What scientific theory was Charles Darwin the architect of through his discoveries about the animals on the Galapagos Islands?

Bonus: What was marine biologist Jacques Cousteau known for inventing through his research and exploring?

The Theory of Evolution through Natural Selection

The theory of natural selection was explored by 19th-century naturalist Charles Darwin. Natural selection explains how genetic traits of a species may change over time. This may lead to speciation, the formation of a distinct new species.

Bonus: With his partner Emile Gagnan, Cousteau created the Aqualung, a self-contained system that made it possible to breathe for long periods of time underwater.

During which war did the United States begin taxing personal incomes in order to raise money?

The Civil War

In 1862, Abraham Lincoln signed a bill that imposed a 3% tax on incomes between $600 and $10,000 and a 5% tax on higher incomes. The law was amended in 1864 to levy a tax of 5% on incomes between $600 and $5,000, a 7.5% tax on incomes in the $5,000-$10,000 range and a 10% tax on everything higher. The law was repealed in 1872 and declared to be unconstitutional.

What did the following explorers map out which helped to connect the world?

1. Ferdinand Magellan

2. Marco Polo

3. Amerigo Vespucci

4. Lewis, Clark and Sacagawea

1. Explorer for Portugal, and later Spain, who discovered the Strait of Magellan while leading the first expedition to successfully circumnavigate the globe.

2. Traveled throughout China and wrote a book about his travels and discoveries which helped establish trade routes between China and Europe.

3. Discovered present-day Rio de Janeiro and Rio de la Plata. Believing he had discovered a new continent, he called South America the New World. In 1507, America was named after him.

4. Mapped uncharted land, rivers, and mountains. They brought back journals filled with details about Native American tribes and scientific notes about plants and animals they'd never seen before.

What are the three main things which are taxed in the United States?

Income, Property, Goods and Services

Most U.S. states charge a state sales tax, but some do not. However, states without a sales tax or an income tax may add or raise other taxes to make up for the deficit, such as implementing higher property tax rates. Finally, most governments that levy taxes charge different percentages based upon the amount of income or type of goods being taxed. For example, a person who makes $40k a year may pay 12% in income taxes while their next-door neighbor, who makes $200k, pays 25% or more. Similarly, sales of basic needs such as groceries are typically taxed at a much lower rate than sales of luxury items such as tobacco products or a new car.