Funds are transferred through an exchange of electronic signals rather than through an exchange of cash, checks, or other types of paper documents.

What is the definition of electronic banking?

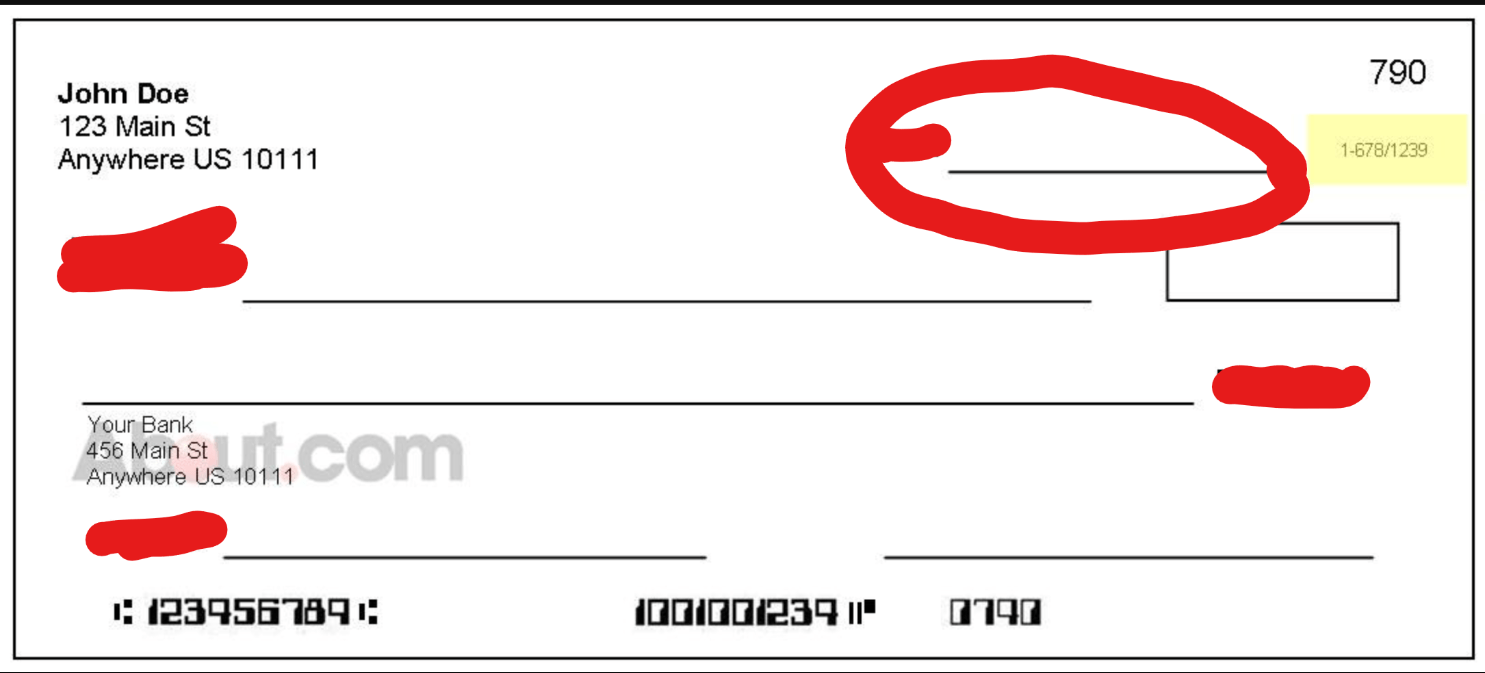

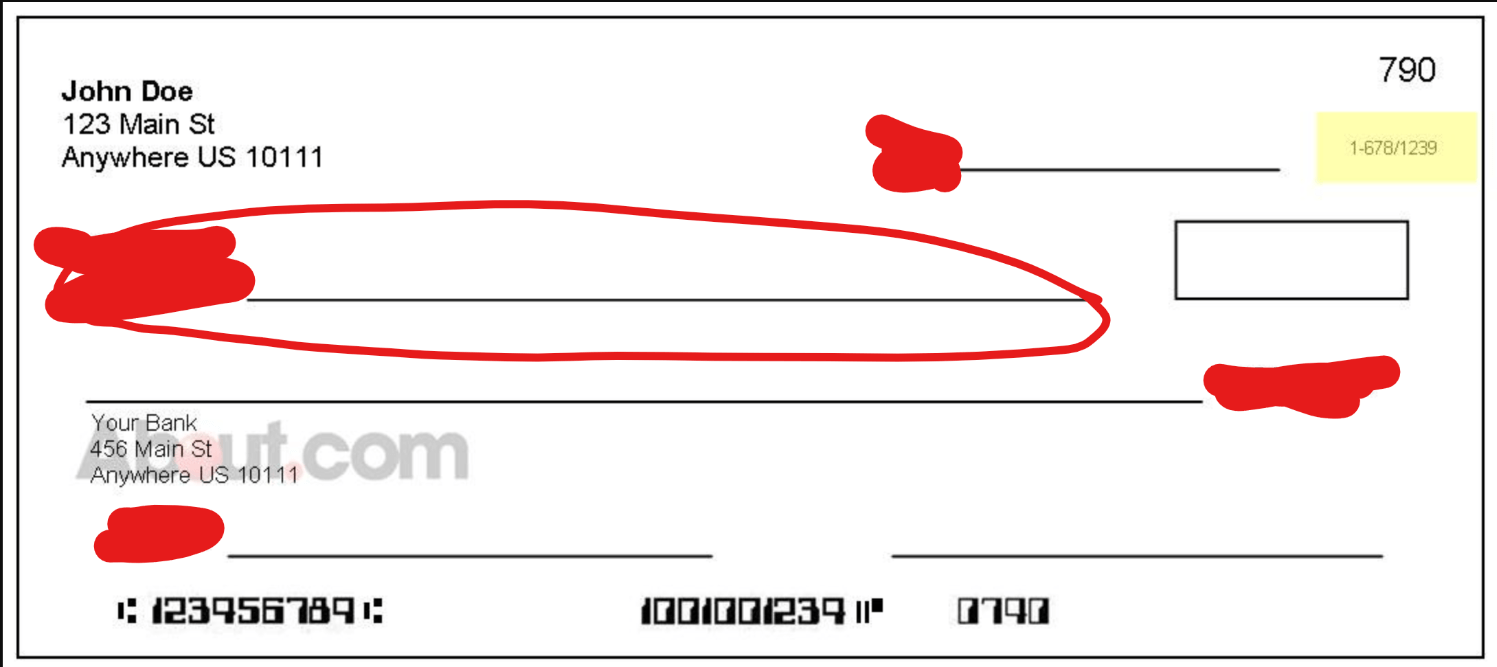

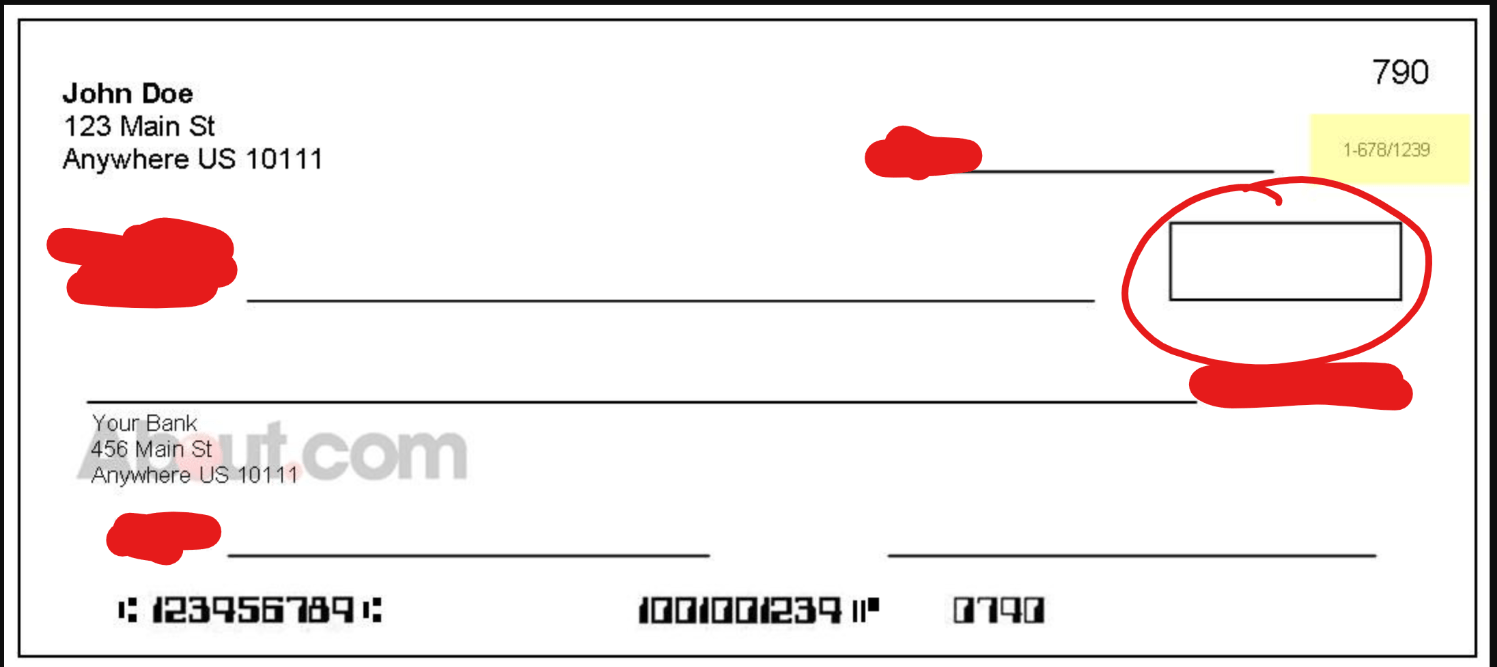

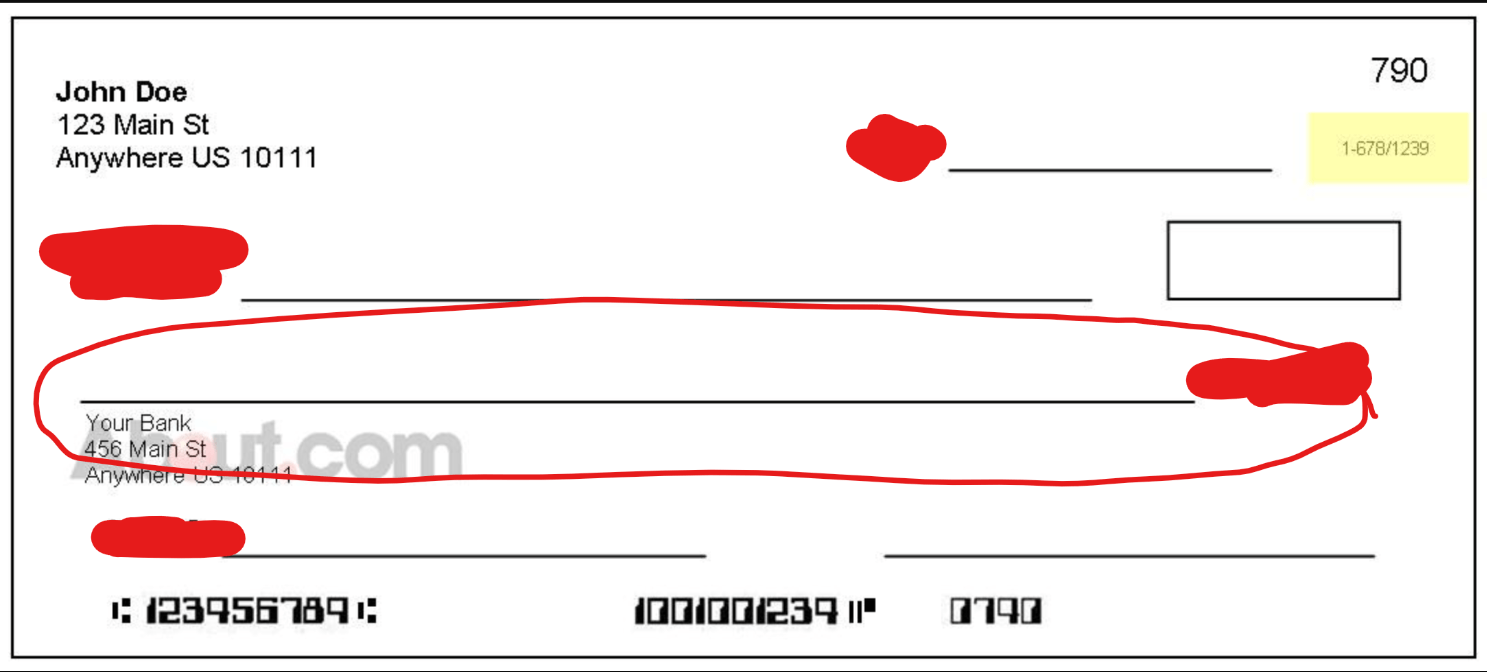

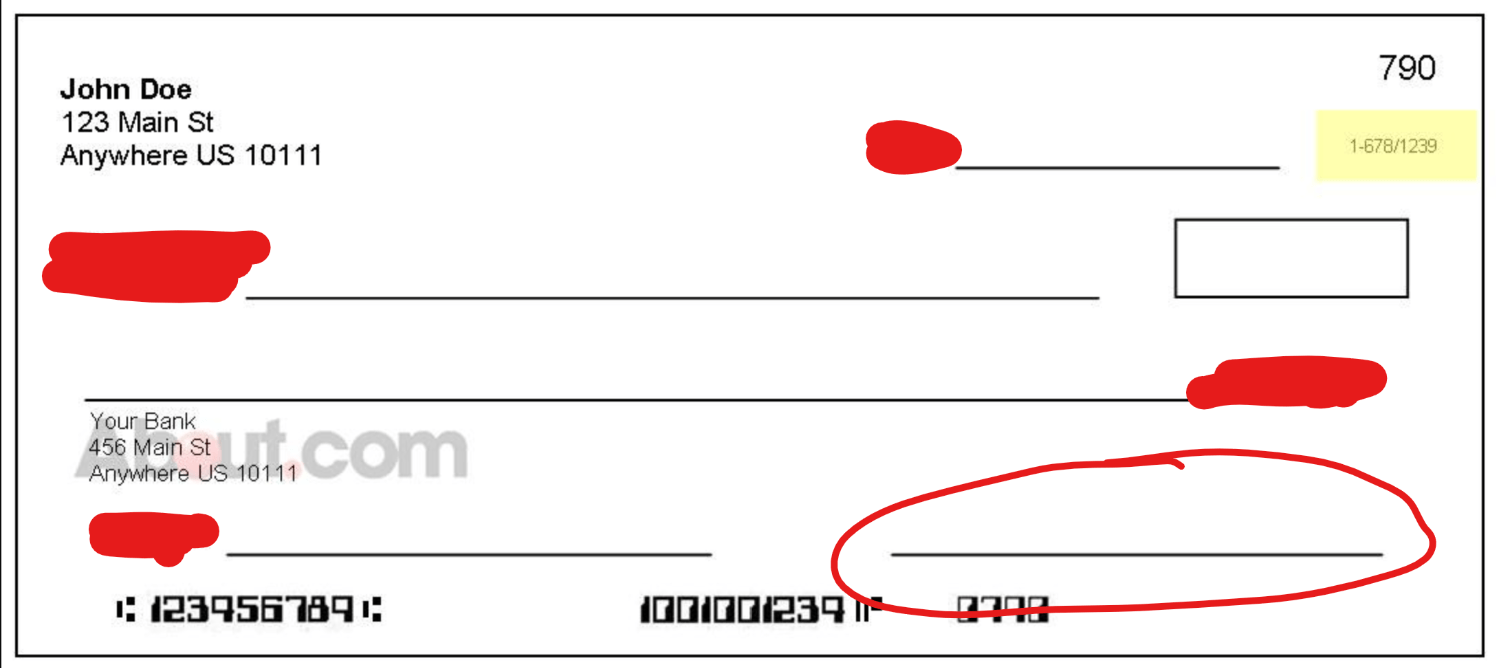

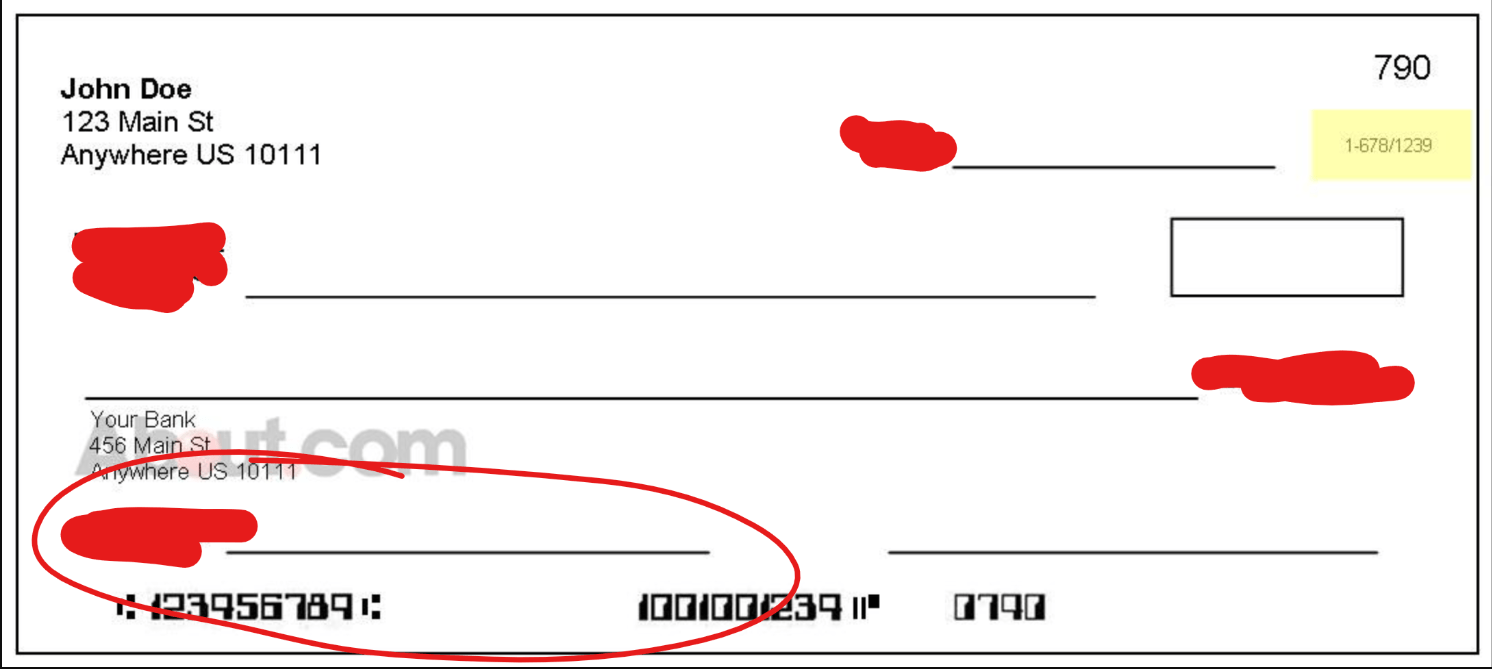

This determines when the check was written.

What is the date?

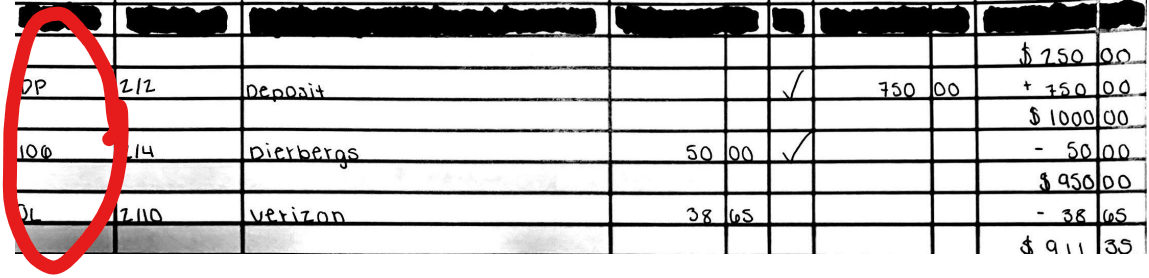

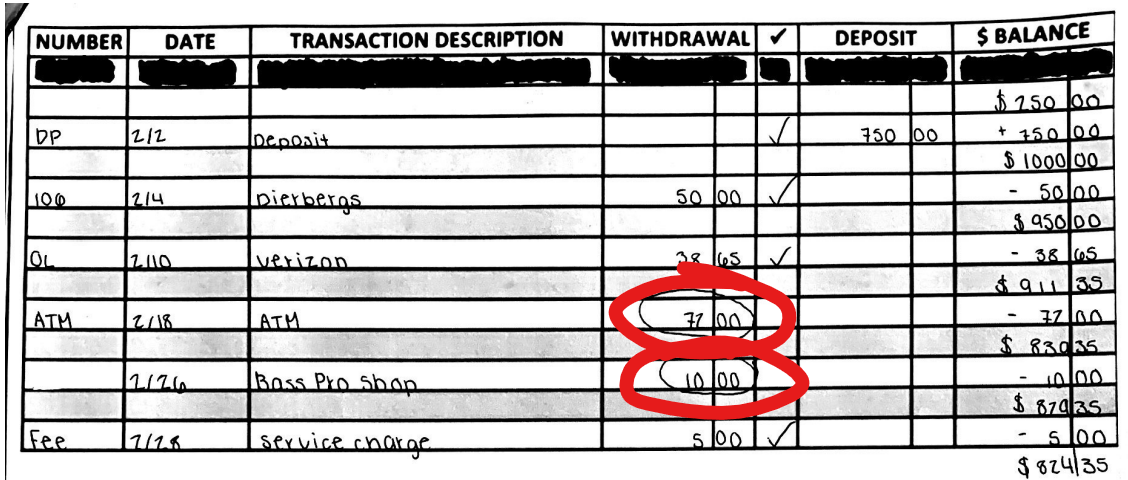

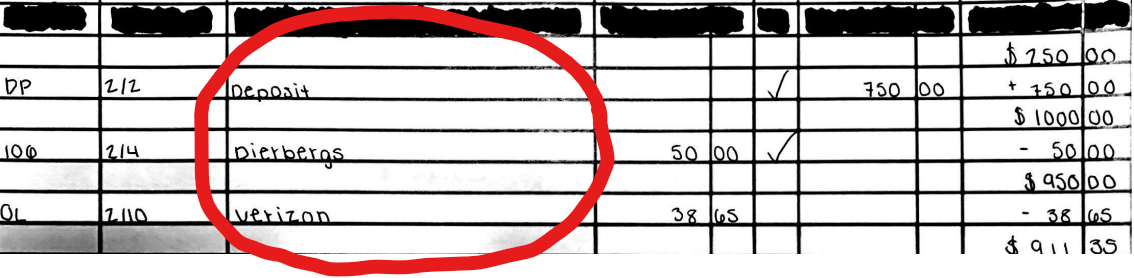

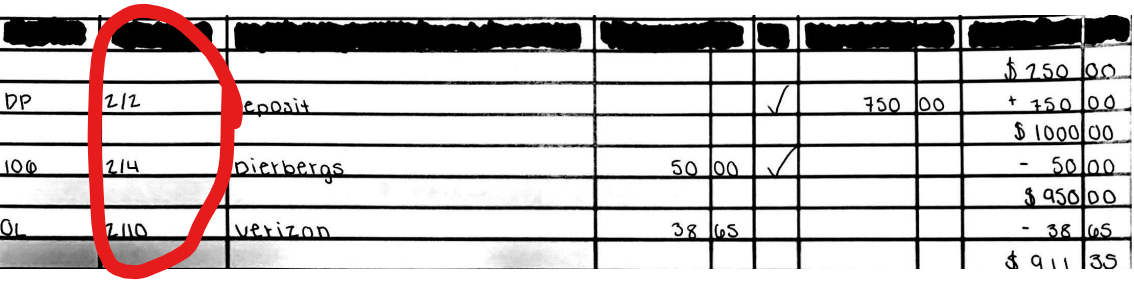

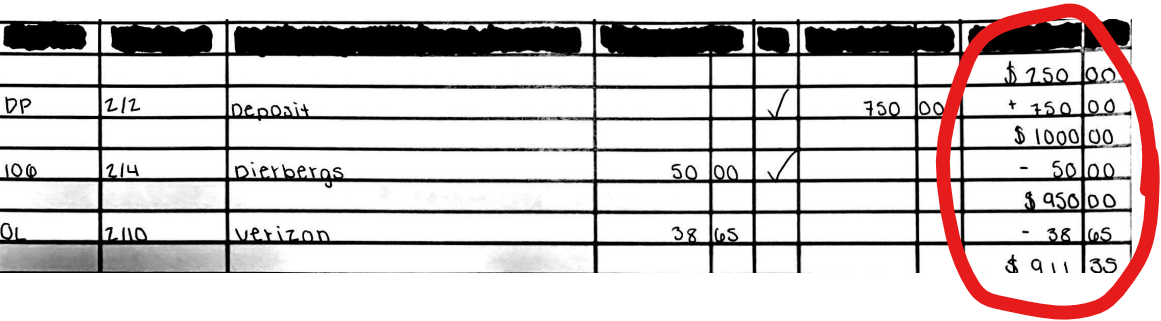

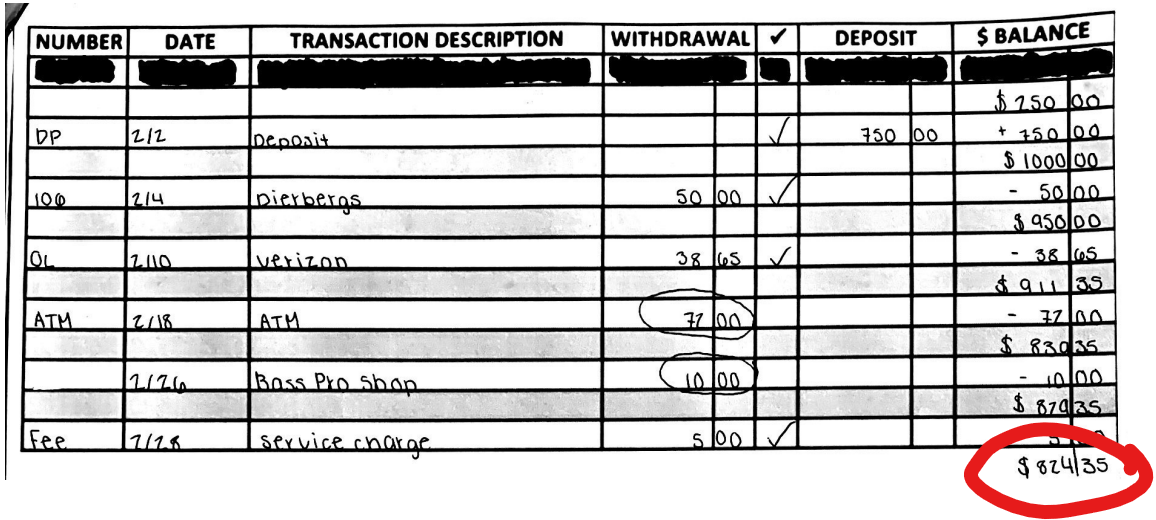

This type of transaction specifies the check number or the type of transaction

What is the number?

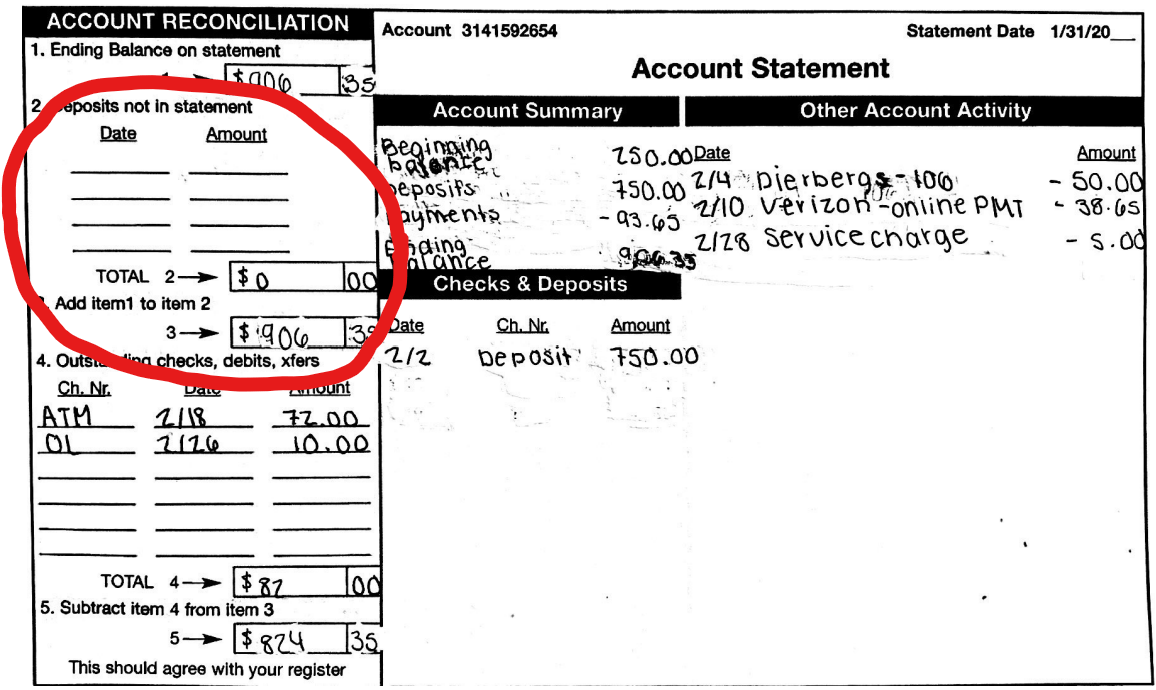

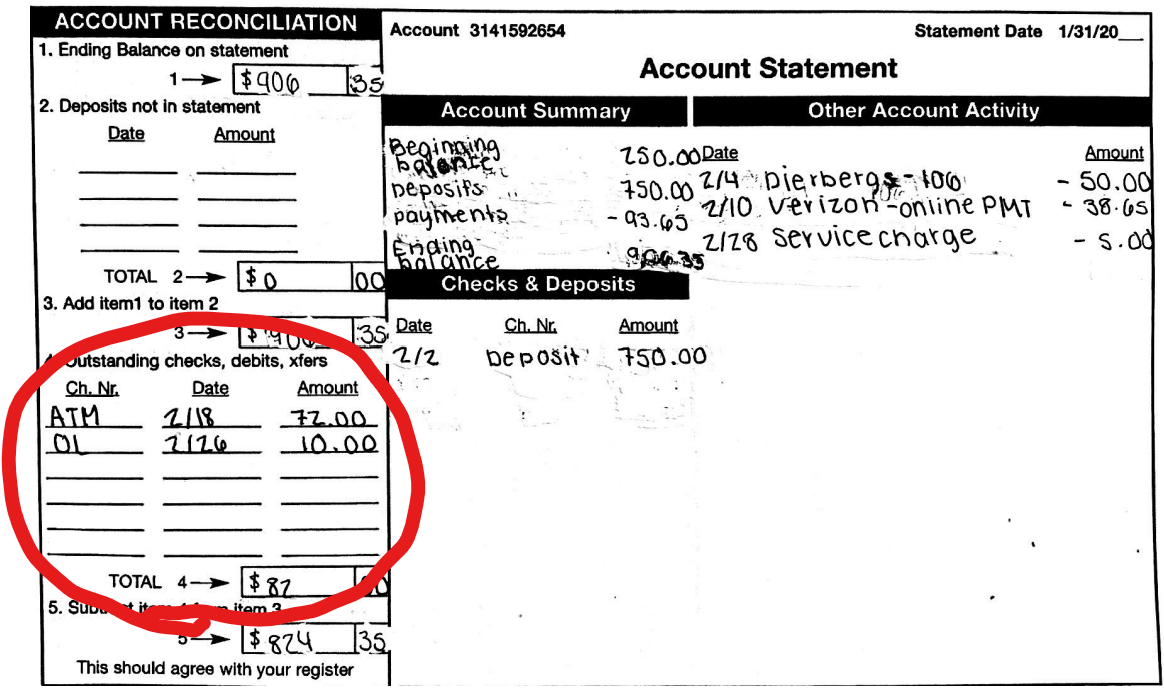

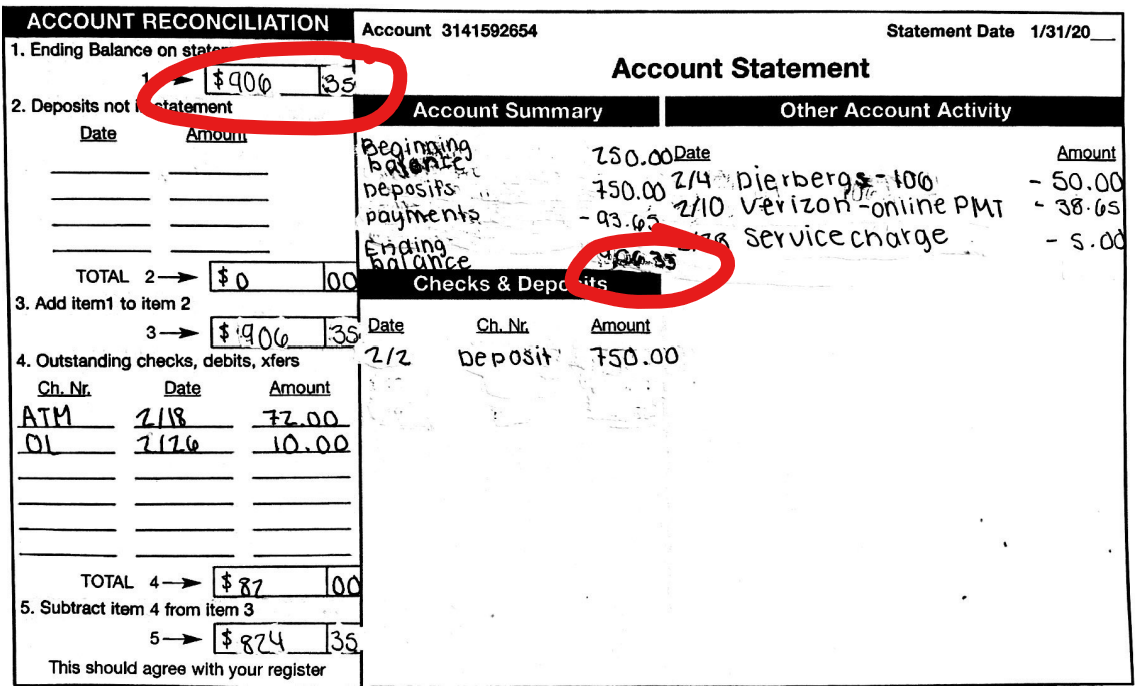

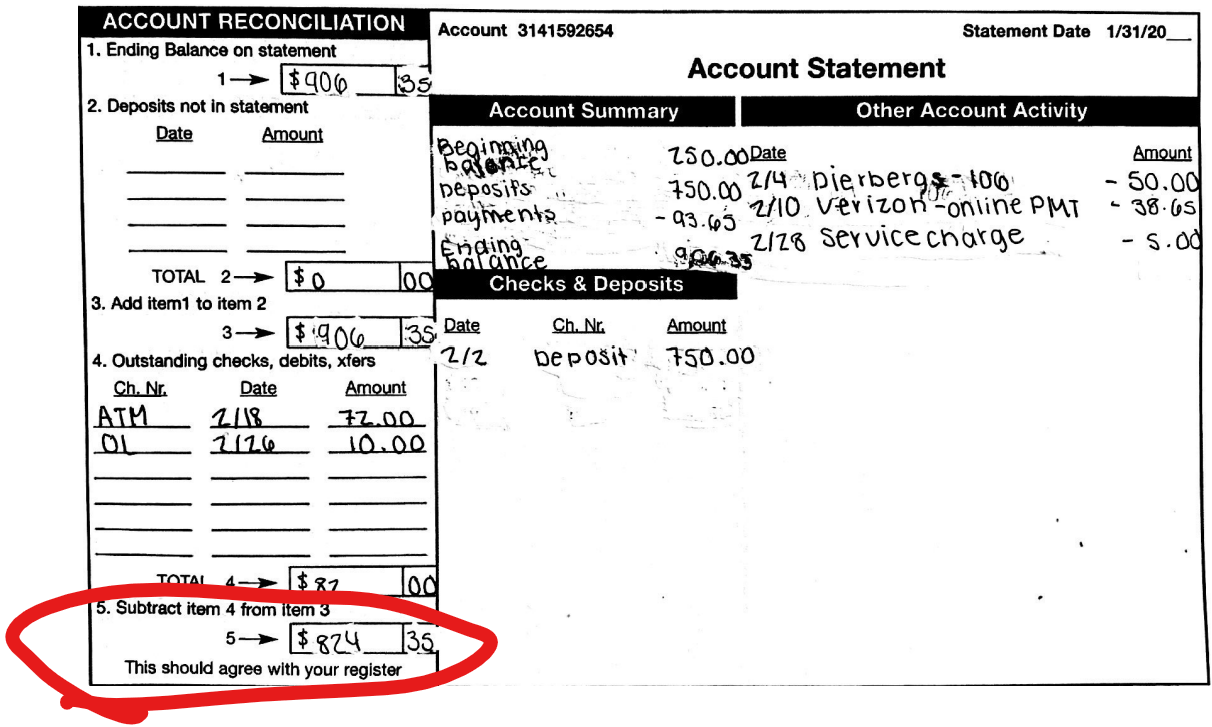

Identify outstanding transactions-items not listed on your bank statement that appear in your register.

What is step 2?

Paying bills before they are due to account for the time it takes to process a payment.

What is advanced pay?

Protects you from punishment if you were to spend more than the amount in your account.

What is overdraft protection?

Adding money through an electronic source into an online bank account.

What is an online deposit?

This determines who the check is being written to.

What is the recipient?

This type of transaction states who the check was written to or where the transaction took place.

What is the description?

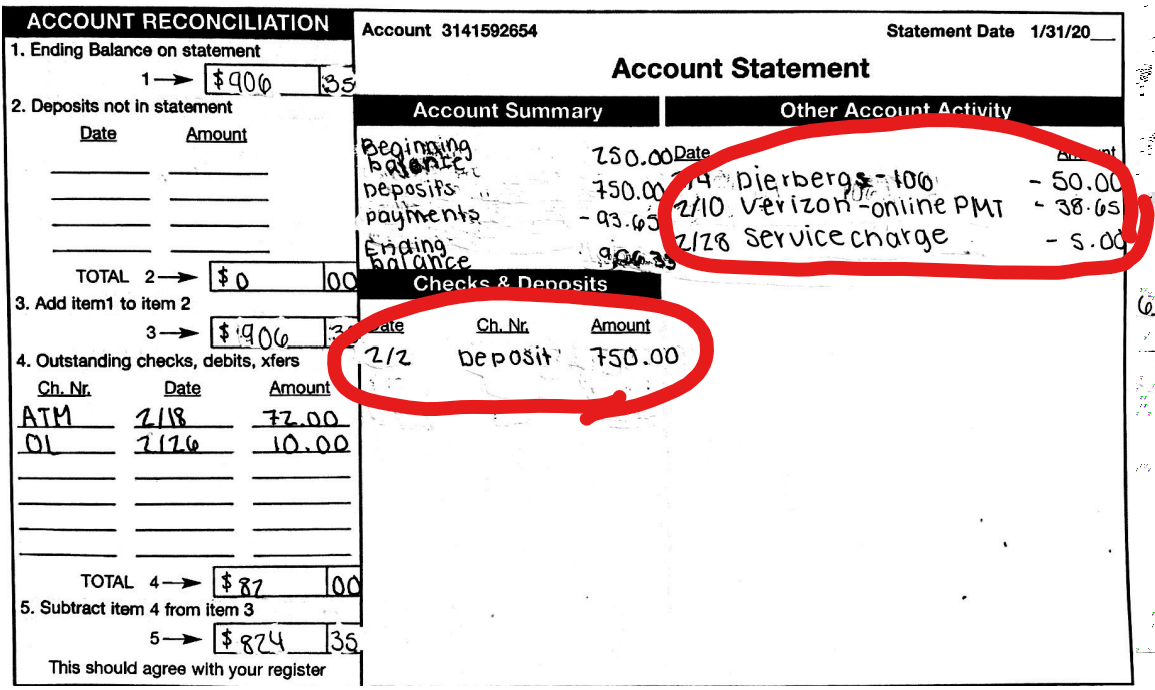

Use the bank statement to check the transactions on your register.

What is step 1?

A banking website known to be secure and legitimate.

What is a trustworthy online bank?

Spending more than what is in your account.

What is overdraft?

Less Security, more vulnerable to information or money being stolen. Delayed Process times. Danger of auto payments

What are the cons of electronic banking?

Where cents is written smaller than the dollars with a line underneath, also directly after the dollar sign.

What is the numerical dollar amount?

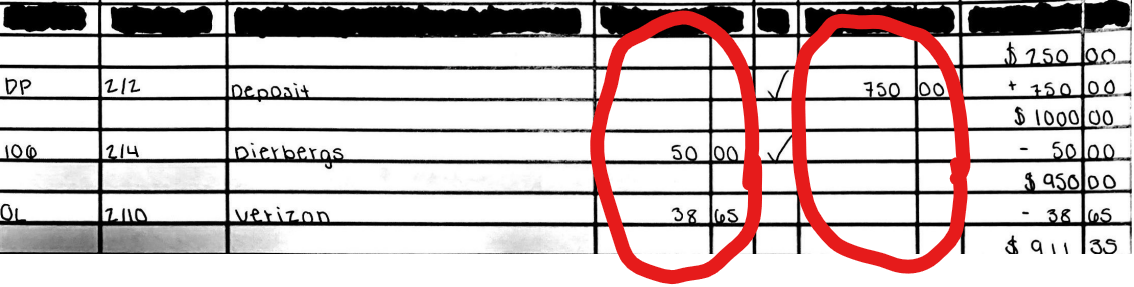

This type of transaction shows the exact day a transaction took place.

What is the date?

Add up all of the outstanding deposits and add them to the ending balance on statement.

What is step 4?

A notification to inform you of the status of your bank account.

What is an alert?

A fee for spending more than the amount in your account.

What is an overdraft fee?

Paying off all required payments by submitting a form online.

What is online bill pay?

Where "and" separates dollars and cents. Cents can be written numerically over 100, with a line across any empty space.

What is the written dollar amount?

These type of transaction shows money that is either being subtracted or added to the checking account.

What is withdrawal and deposit?

Add up all of the outstanding withdrawals and subtract it from the new total (ending balance + deposits)

What is step 5?

A sequence of numbers or letters designed to keep any personal information safe.

What is a password?

A bank's stance on spending more than what is in your checking account. (Should factor when choosing a bank or credit union)

What is Overdraft policy?

One can pay bills, check balances and transactions, transfer funds, convenient, offer financial wellness tools, make check deposits with mobile app, and manage alerts.

What are the pros of electronic banking?

Where one writes their name the same way every time.

What is the signature?

This type of transaction measures the amount of money currently standing in an account. The last number recorded in this column represents the amount of money you have in your account by the end of the month, or when your check register should be completed before starting a new one.

What is the balance?

Start with the balance on the bank statement.

What is step 3?

Protects a computer from hackers and any other malicious force, keeping your personal info safe.

What is an anti-virus system?

A payments made for violating bank policy, If a bank has lots of these you may want to reconsider using their services.

What is a fee?

An app that allows the transfer of money from one person to another that is NOT online banking.

What is a cash management app?

Information about what the check was written for.

What is the memo?

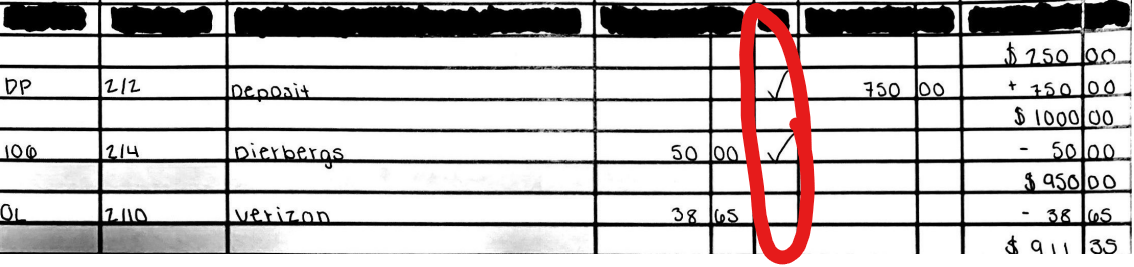

This type of transaction is used to check off transactions that show up on the bank statement.

What is a check mark?

Compare the result with the balance on the register-they should be the same.

What is step 6?

A public network that should not be used to access personal data.

What is public wifi?

The money added in to an account simply for choosing to have that account. This should be taken in to consideration when choosing a bank.

What is interest?