We know that more elastic demand has elasticity > 1 and a more inelastic demand has elasticity < 1. How does this reflect in the ratio of the percentage changes in price and quantity for more elastic and inelastic demand?

Elastic goods reflect higher consumer price sensitivity and greater changes in Q when P changes.

Inelastic goods reflect lower consumer price sensitivity and greater changes in P when Q changes.

Is profit the same as producer surplus?

No, producer surplus is the welfare measure of how much better the producer is after trade. Profit includes the fixed costs in its calculations so PS > Profit.

If we are operating under a binding price floor where Qs < Qd at the price floor, why do we take Qs as the new market quantity?

We always take the smaller of the two quantities resulting from a binding price control. In this case, there is more demand for the good than the sellers have available to sell, therefore we are constrained by the producer's quantity.

True or False? Under free trade, the domestic equilibrium price of a good (Pd) is greater than the world price (Pw), the country will export the good.

False. If Pd > Pw, the country imports the good.

Suppose the Iowa Department of Revenue decides to impose a sales tax (paid by consumers) on pumpkins. Assume that at current prices, the elasticity of supply of pumpkins is 0.98 and the elasticity of demand for pumpkins is 1.67. Which curve will be steeper? Who will bear most of the tax burden?

The supply curve will be steeper since it's more inelastic. So, suppliers will bear most of the tax burden.

Categorize the following goods as more elastic or inelastic goods:

Blue Jeans, Breakfast Cereal, Sunscreen, Clothing, Insulin, Cruises

Elastic: Breakfast Cereal, Blue Jeans, Cruises

Inelastic: Sunscreen, Clothing, Insulin

At what point on a demand and supply graph have we maximized the gains from trade?

At the equilibrium

The equilibrium price and quantity for milk is $3 per gallon and 4000 gallons respectively. The government imposes a price floor of $4.50. Is the price floor binding? Why or why not? If it is binding, who is likely to be better off as a result of the price floor? Buyers or sellers?

The price floor is binding because it is above the equilibrium price, preventing the price from going below the price floor.

Sellers are more likely to be better off because producer surplus may increase. Buyers on the other hand will be worse off because consumer surplus will decrease.

Tariffs and Quotas result a loss in social welfare because ___

a) producer surplus declines

b) revenues from tariffs are misspent

c) consumer surplus declines

d) all of the above

c) consumer surplus declines

a) Producer surplus before the tax: ½ x 3 x 90 = 270/2 = $135

b) (i)Tax revenue: $2 x 60 = $120

(ii) $4

(iii)Producer surplus after the tax = ½ x 2 x 60= $60

c) The indirect tax causes society to have lesser goods compared to the initial equilibrium quantity.

Suppose a 4% increase in your income leads to a 12% increase in your consumption of apples. What is the most you can say about the income elasticity of demand? Would apples be considered a normal or inferior good?

Income elasticity = 3 > 0, therefore it is a normal good.

What do we call the loss in revenue, or surplus, resulting from government interventions such as price controls or taxes?

The Dead Weight Loss

Which of the statements is correct?

A.) A price ceiling is not binding when the price ceiling is set above the equilibrium price

B.) A price floor is not binding when the price floor is set below the equilibrium price

C.) A binding price ceiling causes a shortage and a binding price floor that causes a surplus

D.) A and B are correct

E.) All of the above are correct

E.) All of the above are correct

How does international trade benefit society?

a) Consumers enjoy more variety of goods

b) Producers sell to a larger market

c) Foreign competition increases market power of domestic firms, which increases total welfare

d) A and B are correct

e) All of the above are correct

d) A and B are correct

Foreign competition may decrease market power of domestic firms, which would increase total welfare

Suppose the daily demand for hotel rooms in San Diego is given by Qd = 11,000 - 20P, and supply is given by Qs = 20P - 1,000.

a. Sketch the supply and demand curves for hotel rooms in San Diego, making sure to label the axis and curves accordingly.

b. In the absence of any government intervention, what is the equilibrium price and quantity for hotel rooms in San Diego? Show your work.

c. Calculate the consumer and producer surplus and label them on your graph.

d. Now suppose the government imposes a tax on consumers of $50 per night on each hotel room. What will be the new equilibrium price and quantity of hotel rooms? Show your work.

e. How much will consumers pay for a hotel room after taxes?

f. What’s the loss in total economic surplus as a result of the tax? Show your work.

b. Qd = Qs will give Q* = 5,000 and P* = 300

c. CS = (550 - 300)(5000/2) = $625,000 per day

d. After tax the demand curve is given by Qd’ = 11,000 - 20(P + 50) = 10,000 - 20P. Setting Qd’ = Qs will give Pt = 275 and Qt = 4500

e. After taxes, consumers pay 275 + 50 = 325

f. DWL = ($325 -$275)(500/2) = $12,500 per day

Suppose the elasticity of demand for camping supplies is 6 and there is a 30% increase in demand for camping supplies following a 10% decrease in the price of marshmallows. Solve for the percent change in price pf camping gear and determine whether camping gear and marshmallows are substitutes or complements.

% Change in Price of camping gear = 5%

Camping gear and marshmallows are complements

In the event of a tax on luxury items, who ends up paying the Luxury Tax, the producers or the consumers? Explain.

The producers pay most of the tax. While demand for luxury items is elastic, supply is inelastic, so it is much more difficult for suppliers to leave the market.

What's the area of the deadweight loss if a price ceiling of $4 is imposed?

DWL = 1/2 x 3 x 2,000 = 3,000

The world price with a tariff is $110. The world price without tariffs is $90.

a) What is the quantity of imports with a tariff?

b) What is the quantity of imports without a tariff?

c) Which area represents government revenue with a tariff?

a) 285 - 225 = 60

b) 310 - 200 = 110

c) Area C

Assume a linear demand function of the form: Qd = 120 - 5P and a linear supply curve of the form: Qs = -30 + 10P

a. Find the equilibrium price and quantity.

b. If the government gives a subsidy per unit of $3, plot the new supply curve on the original supply and demand diagram.

c. Find the new equilibrium price and quantity.

d. Calculate the amount spent by the government on the subsidy.

e. Calculate the revenue received by the firms:before the subsidy and after the subsidy

f. Calculate consumer expenditure:before the subsidy, after the subsidy

a. P* = 10, Q* = 70

b. (graph)

c. New equilibrium price = $8, New equilibrium quantity = 80

d. $240

e. PS = 700, PSs = 880

f. CS = 700, CSs = 640

The demand for t-shirts is given by Qd = 200 - 4P. Calculate the elasticity of demand at $30 and $40. Next use the percentage change formula to find the elasticity of demand when price increases from $30 to $40.

Price Elasticity of Demand Formulas:

1) P/Q x 1/slope

elasticity at $30 = 30/80 x 1/-0.25 = -1.5

elasticity at $40 = 40/40 x 1/-0.25 = -4

2) % change in quantity demanded / % change in price

% change in quantity demanded / % change in price = (80 - 40 / 80)/(40 - 30 / 30) OR (40 - 80/60)/(40 - 30/35)

= 0.5/0.33 OR -.6666/.2857

=-1.67 OR -2.33 (approximately)

Compare City A and City B. Suppose that even though the elasticity of demand for housing is the same in both cities, the elasticity of supply for housing is much smaller in City A than in City B. If a rent ceiling is imposed in both cities, in what city will the resulting deadweight loss be the greatest? Assume that the

initial equilibrium rent is the same in both cities and that the rent ceiling is effective in the sense that it is set below the initial equilibrium rent.

If the supply of housing is more inelastic in City A than in City B, then the deadweight loss of the tax will be smaller in City A than in City B. Intuitively, this occurs because if the supply for housing is inelastic, then the imposition of a rent ceiling will have little effect on the equilibrium quantity of housing.

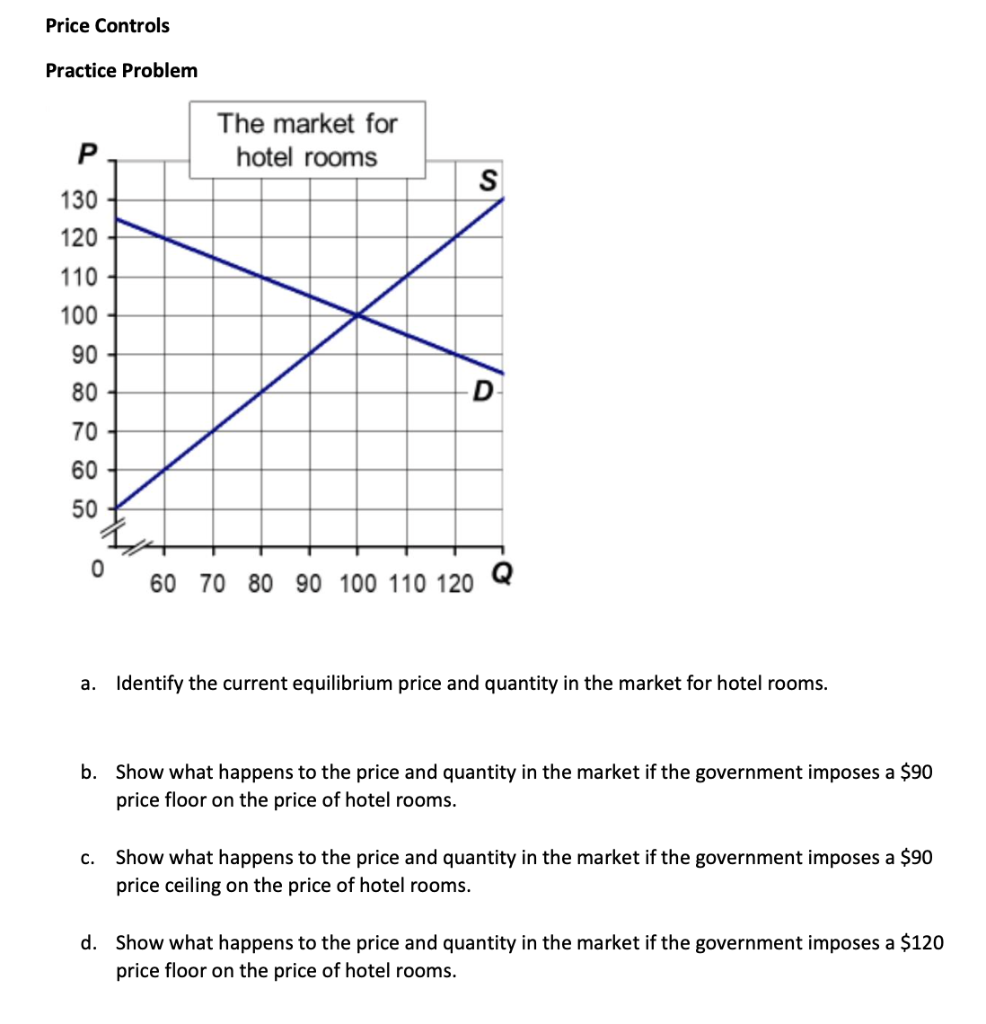

a) current equilibrium price level is $100 and equilibrium quantity is 100 units.

b) no effect

C) when government imposes a price ceiling of $90 which is less than equilibrium price, so it's binding

Qd= 120 , Qs= 90

So there is excess demand of 30 units.

d) when government imposes a price floor of $120 then at this price ,

Qd= 60, Qs= 120

Excess supply= 120 - 60 =60 units

Consider a domestic market that faces potential trade as a small open economy. Domestic demand is given by Qd = 200 - 2P and domestic supply curve given by Qs = 1/2 P.

a) What is the equilibrium price and quantity under autarky (no free trade)?

b) If the world price is $90 per unit, what quantities are supplied and demanded domestically? Is the domestic country a net exporter or importer of the good?

c) Calculate consumer surplus and producer surplus at part b). Draw a graph if necessary.

a) P = 80, Q = 40

b) Qs = 45, Qd = 20. The country is a net exporter of the good. It will export 45 - 20 = 25 units.

c) CS = 1/2 x 10 x 20 = 100. PS = (1/2 x 90 x 45) = 2025

a) How will producer surplus change when a price ceiling of $3 is introduced?

b) What’s the deadweight loss?

c) How will consumer surplus change if a price floor of $7 is introduced?

a) It will decrease to $4,500

b) DWL = (½ x 3,000 x 4.5) = $6,750

c) It will decrease to $4,000