This is the total amount of money earned per year and is not dependent on the number of hours worked.

What is a salary.

The Gross pay of an employee who works 15 hours at $12.50/hour.

What is $187.50.

An angle that is less than 90o.

What is an Acute angle.

Supplementary angle to 80o.

What is 100o.

(Supplementary angles add to 180o.)

The longest side of a right triangle.

What is the hypotenuse.

Total amount earned before deductions.

What is Gross Pay.

The Gross pay of a restaurant employee who works 25 hours per week, and makes $14.15 per hour plus $130 in tips.

What is $483.75.

An angle larger than 180o.

What is a reflex angle.

Complementary angle to 54o.

What is 36o.

(Complementary angles add to 90o.)

The best way to estimate the length of a hypotenuse.

What is to add the legs, and find a value that is larger than the longest leg, but shorter than the added value.

The way you calculate Net Pay.

What is subtract Deductions from Gross Pay.

The bi-weekly Gross pay of an employee who has a yearly salary of $45 700.

What is $1757.69.

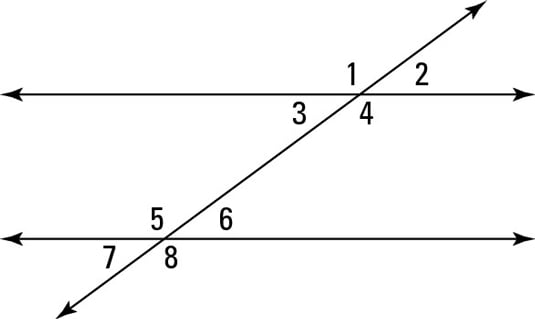

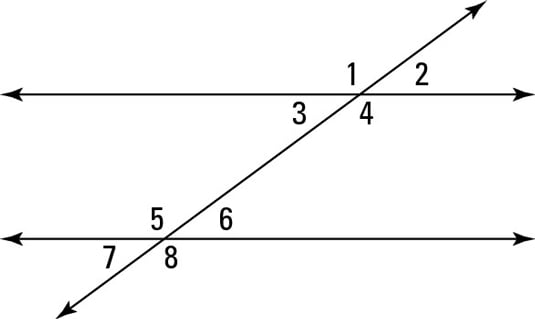

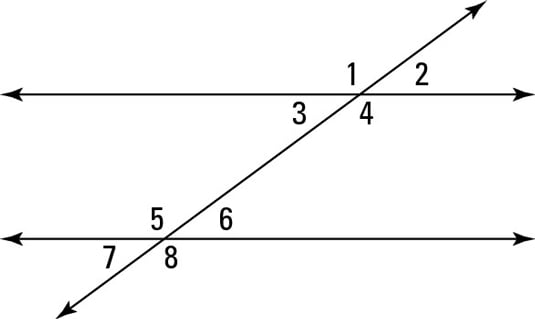

A line that crosses a set of parallel lines.

What is a Transversal Line.

Angles 5 and 8 have this kind of "relationship." (How would you describe them?)

What are Opposite angles.

The modified Pythagorean Relationship if you are looking for one of the legs of a right triangle.

What is either c2-b2=a2 or c2-a2=b2 .

Mandatory deductions that the government requires from each employed person.

What is income tax (Provincial and Federal).

MB Provincial: 10.8% of Gross Pay

Federal: 15% of Gross Pay

The Net Pay of an employee who works 30 hours per week, earns $24 per hour, and pays $108 to Federal Income Tax, $77.76 to Provincial Income Tax, $37.80 to CPP, and $11.38 to EI.

What is $485.06.

Two equal angles on the same side of a transversal.

What are Corresponding Angles.

This is the value of angle 5 if angle 4 is 135o, along with their relationship.

This is the value of angle 5 if angle 4 is 135o, along with their relationship.

What is 135o and Alternate Interior Angles.

(Remember: Alternate Interior Angles are equal)

The length of the hypotenuse if the legs are 4.6" and 7.2".

What is 8.5".

A form of income based on a percent of sales.

What is Commission.

The total monthly Deductions for an employee who has a salary of $62 050 per year.

(Remember: Federal Income Tax is 15%, Provincial Income Tax is 10.8%, CPP is 5.25%, and EI is 1.58%)

What is $1687.25.

(Monthly Salary: $5170.83, Federal Income Tax: $775.63, Provincial Income Tax: $558.45, CPP: $271.47, EI: $81.70)

Pairs of equal angles on the opposite sides of a transversal.

What are Alternate Angles.

This is the value of angle 7 if angle 1 is 145o, along with their relationship.

This is the value of angle 7 if angle 1 is 145o, along with their relationship.

What is 35o and supplementary angles.

The length of the leg if the hypotenuse is 34 m and the other leg is 22 m.

What is 25.9 m.