Define interest in your own words

Money paid regularly at a particular rate for the use of money lent, or for delaying the repayment of a debt.

Why is a budget helpful

helps you take control of your money and to help you achieve short and long-term goals, Seeing where your money is going, Plan for upcoming expenses, Save for the future, Get out of debt

Describe what it means to buy something on "credit"

An agreement for a borrower receives something of value now and agrees to pay back the lender at a later date.

Define what "collateral" is

An asset or amount of money provided as security for repayment of loan.

Bar Harbor, Mascoma Bank, Northfield Savings Bank, White River Credit Union, Claremont Savings Bank

Name 2 instances when you may have to pay interest on an item/object/circumstance.

Buying a car, paying credit card, buying a house

What is the name of the document that details what you get paid from your job, how much in taxes and benefits is taken out of your paycheck, and other important information regarding your compensation from your job?

A pay stub

In your own words, explain how a credit card works.

A card issued by a bank or other business for purchases using borrowed funds to be paid back later.

When you buy a car and you put some money towards the purchase but not paying the whole amount, what is that chunk of called?

A down payment

What object is linked to a checking account and used to make purchases, as well as deposit and withdraw cash at ATMs.

A debit card

True or false, interest is always a bad thing and never benefits you.

False. Lots of savings accounts with earn interest off the money you leave in it.

Net pay

How are loans and credit scores related to one another?

One's credit score (how good or how bad) depends on how good of a loan you may get from a lender.

Why can't we just print more money?

More money in circulation=money now having less value

Ex: if we print more money, the dollar then may have the value of only $0.75 now

Explain the difference between a savings account and a checking account.

A checking account is a bank account where you can deposit or withdraw money using a debit card or checks. Primary uses are for daily spending and paying bills where a savings account is an account where money is kept for future use.

The rate at which a borrower pays interest for borrowing an item or money; or the percentage rate earned on a given investment is know as what term?

Interest Rate

What is the difference between net and gross pay?

Net Pay: The amount of money an individual earns once taxes and other items are deducted from the gross pay.

Gross Pay: The total amount of money an individual has earned before taxes are taken out.

What is the range of credit scores that you can earn?

300-850

What are the two types of inflation?

Cost-push inflation and demand inflation

Name at least 2 types of savings accounts.

Basic savings account, money market account, 529 savings account, retirement account

What is the difference between simple interest and compound interest?

Simple Interest: based only on the original amount. If you have an account with $100 in it and it earns 2% simple interest per year, you would end up with $102

Compound interest: Compounding means that whenever interest is calculated, it is based not only on the original amount in the account but also on any interest that has accumulated

What is the difference between a need and a want? Does everyone have the same needs?

A want isn't always essential to survival or living, but a need is essential to living. Not everyone has the same needs (think medications, dietary restrictions, health impairments)

When someone "runs your credit", what appears on the credit report?

How promptly you have paid off credit cards and loans. How reliably you have paid other bills, like rent and utilities. Your total outstanding debts. Your available credit on mortgages, bank cards, auto loans and other lines of credit.

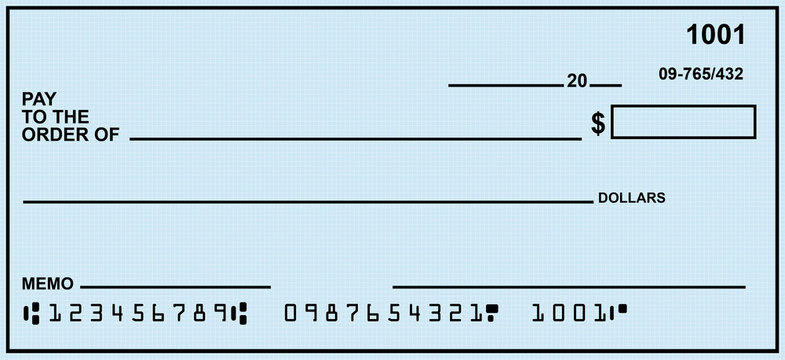

Tell me how to write this check

date, money amount in numbers, amount in words, who the check is being paid to, what the check is for in the memo box, and a signiture

What is the purpose of the FDIC?

The FDIC or Federal Deposit Insurance Corporation protects the money depositors place in insured banks in the unlikely event of an insured-bank failure.