What is scarcity? Relate it to the study of economics.

Scarcity: limited resources in society --> we cannot produce all of the goods and services that people wish to have

Economics: the study of how society manages its scarce resources

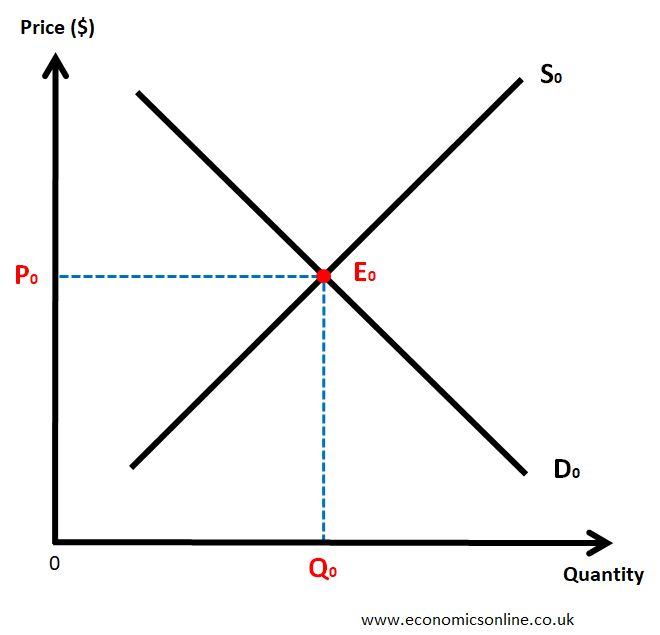

Identify the market equilibrium price and quantity.

Equilibrium price: P0

Equilibrium quantity: Q0

Name the 4 types of unemployment

frictional, structural, seasonal, cyclical

Name two (or more) types of taxes.

Income, sales, excise, property, carbon

Top 4 countries w/ highest GDP (doesn't have to be in order)

United States: $30.34 trillion

China: $19.53 trillion

Germany: $4.92 trillion

Japan: $4.38 trillion

What is opportunity cost?

The loss of potential gain from alternative choices when one choice is chosen; the cost of the next best alternative

What is this curve called?

The production possibilities frontier / production possibilities curve (PPF / PPC)

What is a bank run?

bank run

What are the liberal and conservative points of view on taxes?

Liberal POV: want more taxes, especially corporate taxes / tax on the rich --> that way we can fund government projects for the public's benefit

Conservative POV: want less taxes, less government intervention

How to calculate GDP

C - consumer spending on goods and services

I - investor spending on business capital goods

G - government spending on public goods and services

Net exports = exports - imports

Name at least 3/5 factors of production.

Labor, human capital/knowledge, land/natural resources, capital, entrepreneurship

as, lras ad

What president enacted the New Deal OR what was its goals?

FDR

regain confidence in economy, create jobs

Name 4 different uses of taxes

education, military, research, etc

Name a limitation of GDP

Excludes work you do in the house (cooking, cleaning, growing vegetables) that you don’t pay someone for, illegal transactions (black market, drug dealing, etc)

- Does not account for income inequality in society, pollution, health, stress

What is the difference between macro and microeconomics?

Macroeconomics: large-scale, includes unemployment, inflation, economic growth, interest rates

Micro: small-scale; to how the individual, and household make decisions to allocate scarce resources,

What is this called OR explain the idea it shows?

Laffer Curve

What was 1 cause and 1 effect of Great Depression?

causes: stock market crash, low demand for goods+services

effects: 25% unemployment, bank runs

What is the difference between a progressive and regressive tax?

A progressive tax taxes the wealthy more, while a regressive tax means the poor pay a larger percent of their income in tax. (They're opposites)

What is a tariff and what is a quota?

tariff: tax on imports

quota: limit to # imported

Are public goods: rival or nonrival AND excludable / nonexcludable

nonrival, nonexcludable

The following is a graph of an international market. Identify the world price, price after tariff, tax revenue rectangle, and quantity imported after a tariff is applied.

World price: P1

Price after tariff: P2

Tax revenue rectangle: middle rectangle made from Q2 and Q3 lines

Quantity imported after tariff: Q3-Q2

Name one famous economist and what they are known for

Adam Smith, Keynes, Karl Marx, David Ricardo, Alfred Marshall, Laffer

Name one of the economic policies Trump has said he will implement as president / has already implemented and its effect

- tariffs (especially on goods from China)

- lower corporate taxes to 15%

- eliminate income taxes

- deportation (leads to labor shortages)

What does the Federal Reserve do?

controls money supply, determines monetary policy, regulates commercial banks, etc