Name 2 examples of needs

Rent, Utilities, Food, Transportation, Insurance, Basic clothing...

What is a budget?

A budget is a plan that helps you manage your money

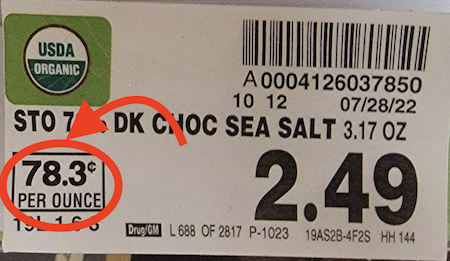

What is per unit pricing?

Per unit pricing tells you how much you're paying per ounce, per pound, or per item.

What is an rainy day fund?

Emergency fund

Name 2 examples of wants

hobbies, entertainment, eating out, shopping, travel...

What can a budget help with?

Tracking income and expenses

Setting and achieving goals

Avoiding or reducing debt

What is the unit price: $5.99 for 12 rolls?

$.50

Name a method people use to set money aside

Automatic deposit, piggy bank, budget, apps, goal setting strategies

Name something you would save for:

Emergency fund, retirement, college, expensive purchase...

What is debt?

When income is less than expenses

What is the unit price: $7.99 for 18 rolls?

$0.44

What is a planned expense

things you know are coming, like rent, a car payment, or a phone bill.

What categories make up the 50/30/20 rule?

needs, wants, and savings.

How do you balance a budget?

Increase income

Decrease expenses

What is shown in the circle?

Unit price

What is an unplanned expense

things that pop up unexpectedly—think a medical bill, car repair, or last-minute gift.

How is the 50/30/20 rule divided?

50% of your income on your needs, 30% on your wants, and 20% on your savings.

You have a monthly income of $4,000. You plan to follow the 50/30/20 rule for budgeting.

How much of your monthly income should be going towards needs?

$2,000

Which is the better deal?

The left

How many months' of income should you have saved up in an emergency fund?

3-6 months