True or false: Grants have to be paid back.

False- grants and scholarships don't have to be paid back!

What is the 50/30/20 rule for college students?

50% Needs: rent/mortgage, utilities, groceries, transportation, etc. 30% Wants: dining out, entertainment, shopping, travel, etc. 20% Savings & Debt Repayment

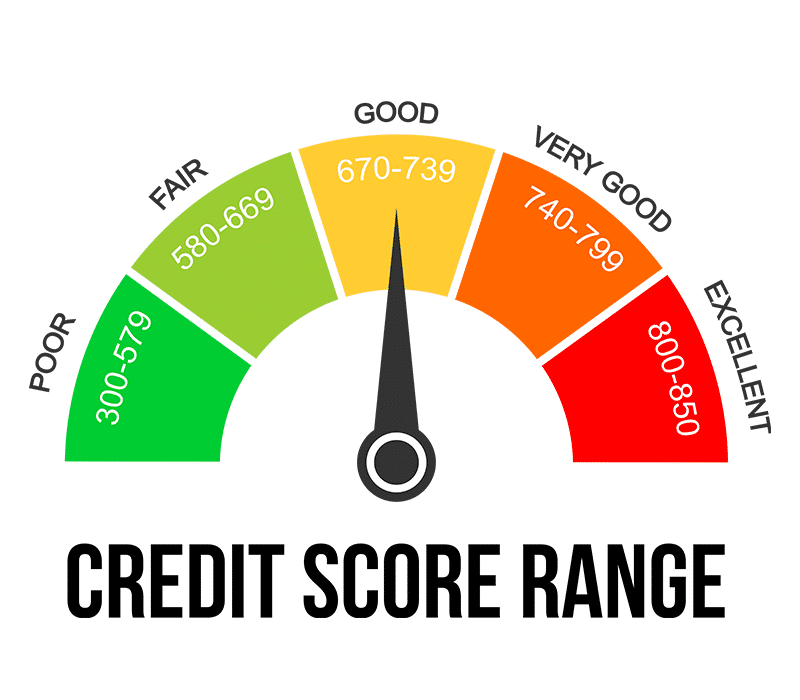

Although the score needed depends on the lender, what is typically the score needed for a personal loan?

580, must be "fair"

What does "FICA" stand for OR who are they?

OR

What does "IRS" stand for OR who are they

Federal Insurance Contributions Act, which funds Social Security and Medicare.

Internal Revenue Service, U.S. government agency responsible for collecting taxes and enforcing tax laws.

A savings account that offers a higher interest rate than traditional savings accounts.

High yield savings account

Student loan that accrues interest even when you're in school.

Unsubsidized

What is a fixed expense? Give an example relevant to a college student.

A fixed expense is a cost that stays the same each month, like rent or a monthly subscription (e.g., Netflix).

annual percentage rate- the yearly cost of borrowing money.

What tax form do you get back from AU? This usually includes your scholarships/grants, amount of tuition paid, etc.

1098T

Interest calculated on both the initial principal and the accumulated interest from previous periods.

Compound interest

DOUBLE: What student loans do not accrue interest while you are in school at least half-time or during deferment periods.

Subsidized

AS STUDENTS, what percentage of your income should ideally go towards savings? 50%, 30%, or 20%

20%

What are the 3 bureaus where you can check credit score?

Equifax, Experian, and TransUnion.

A tax form employers send to employees detailing annual earnings and tax withholdings.

W2

A ____ card pulls money directly from your bank account, while a ____ card borrows money that you must pay back later.

debit, credit

What does it mean to default on a student loan, by about how many days?

Hint: its within a 200-300 day range (your answer can be off by 30 days)

Default occurs when you fail to make payments for an extended period (typically 270 days for federal loans)

What is the cost of attendance (COA), and what does it include besides tuition?

- Must name at least 3 outside of tuition to get points

COA is the total estimated cost of college, including tuition, fees, room and board, books, supplies, transportation, and personal expenses.

A detailed statement of your credit history, including borrowing and repayment habits, used by lenders to assess creditworthiness.

Credit report

50 BONUS POINTS IF YOU CAN NAME ONE PLACE WHERE YOU CNA FIND YOUR CREDIT REPORT

What tax form does a self-employed person file?

1040

When you have money in a federally insured bank account, what federal organization is who insures it? DOUBLE POINTS IF YOU KNOW UP TO HOW MUCH THEY WILL INSURE

FDIC (Federal Deposit Insurance Corporation)--250,000

What is Satisfactory Academic Progress (SAP), and why is it important for financial aid?

200 bonus points if you know the center on campus that can help if you are under SAP and at risk of losing your financial aid

SAP is the academic standard students must meet (often a minimum GPA and credit completion rate) to remain eligible for federal financial aid.

CASE- Center for Advocacy and Student Equity

DOUBLE: expenses fluctuate month to month, like groceries or entertainment. tracking them helps prevent overspending!

Variable expenses

What is the credit utilization ratio? DOUBLE PTS IF YOU KNOW WHAT THE IDEAL % IS TO HELP IMPROVE YOUR SCORE!

The percentage of your available credit that you’re using. A lower ratio (typically under 30%) helps improve your credit score.

How much do you have to make to file taxes? (Your answer can be off by up to $850

13,850+

___ income is the total amount you earn before taxes and deductions, while ___ income is what you take home after taxes and deductions.

gross, net