Decrease $68 by 78%

$14.96

Tom earns $12.70 an hour. How much does he earn for 8 hours of work?

$101.60

“Just keep swimming.”

Finding Nemo

John has a gross income of $45 000 and a net income of $20 000. How much did his deductions come to?

$25000

What is the compound interest formula?

A=P(1+r)^n

A manufacturer produces an item for $400 and sells it for $540. Determine the profit made.

$140

Talib earns $16 697.20 per year at a fast-food restaurant. What is his fortnightly pay?

$642.00

"To Infinity and Beyond"

Toy Story

Liam has an annual salary of $52 800. His payslip each month shows deductions for taxation of $968. Calculate Liam’s net income each month.

$3432

Calculate the compound interest earned if the principal is $1000, the rate is 5% p.a. and the time is 3 years.

$1157.63

Lenny marks up all computers in his store by 12.5%. If a computer cost him $890, what will be the selling price of the computer?

$1001.25

A saleswoman is paid a retainer of $1500 per month. She also receives a commission of 1.25% on the value of goods she sells. If she sells goods worth $5600 during the month, calculate her earnings for that month.

$1570

’I feel the need – the need for speed.’

Top Gun

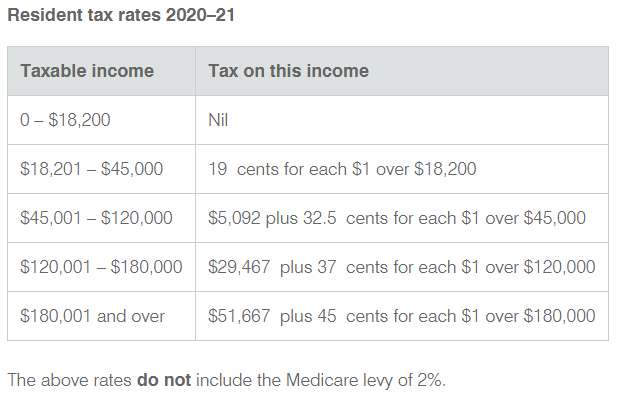

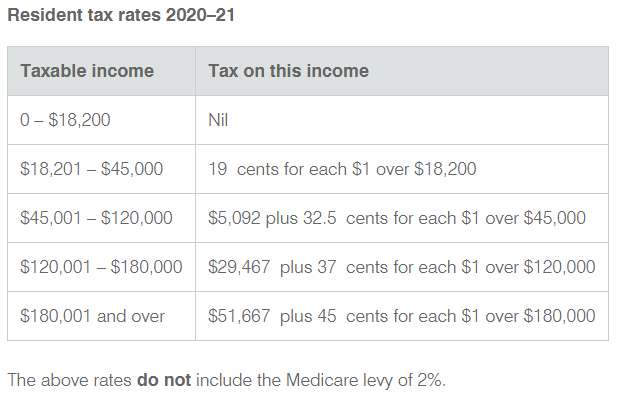

Using the tax table, find the income tax payable on a salary of $45000.

$5092

What is the difference between compound interest, and simple interest?

Simple Interest - PxRxN

A TV costs a manufacturer $250 to make and is sold for $280. Calculate the percentage profit

12% Profit

A job has a normal working hours pay rate of $9.20 per hour.

Calculate the pay, including overtime, for 10 hours at the normal rate, 8 hours at time and a half and 3 hours at double time.

$257.60

"Some people are worth melting for."

Frozen

Ed earns $1400 per week and pays 27% of his annual income in tax. Calculate the amount of income tax that Ed pays in one year.

$19 656

Wally invests $15 000 at a rate of 6% p.a, compounded monthly. Calculate the total amount available at the end of 3 years.

$17 950.21

A refrigerator is discounted by 25%. If Paula pays $460 for it, what was the original price? Round to the nearest cent.

$613.33

Jim, a part-time gardener, earned $261 in a week. If he w orked 12 hours during normal working hours and 4 hours overtime at time and a half, what was his hourly rate of pay?

$14.50 per hour

“My mama always said life was like a box of chocolates. You never know what you're gonna get.”

Forrest Gump

William earns $450 a week. Using the tax table, determine how much tax is deducted from his pay each week.

$1026

Annie invested a $6000 into an investment account that compounds annually. After three years, she had $7045.45. What was her interest rate?

5.5%