Credit Card Companies will send you a bill how many times per month (statement cycle)?

Once/month.

Sasha uses her Debit Card to make a purchase at a local boutique.

The money will be deducted from which of her account(s)?

Checking

Adding money to your Checking or Savings account is called a __________.

Taking money out of your Checking or Savings account is called a____________?

Deposit

Withdrawal

Name three reasons why you should save money?

Cost of living/transportation

Emergencies/Nest egg

College

Luxuries

Retirement

Health Expenses

Anabelle used her debit card to make a purchase at Marshall’s. When will the money be deducted from her Checking account?

A. At the end of her statement cycle (30 days).

B. A few hours after she makes her purchase.

C. 2-3 business days after she makes her purchase

D. Immediately

D

*DAILY DOUBLE*

1. SCENARIO-Ally is shopping for a Student Credit Card! Give her some options! What are two examples of a Credit Card Company/provider?

2. How many digits are on a credit card?

1. American Express, Visa, Discover, MasterCard

2. 16 digits

Name 3 types of transactions you can make using a debit card?

Bill payment

ATM withdrawal

Purchase

Cash Advance

Cash back at Stores

SCENARIO

Last night, Lisa made a purchase with her debit card on Fashion Nova for $100.00 She only had $80.00 in her Checking account. Lisa spent more money than she actually had. This morning, she checks her account balance in her Online Banking and realizes she is $20.00 in the negative and her bank has charged her an __________.

Overdraft Fee

SCENARIO

Jill works at six Flags. Jill just got paid and uses her check to pay her cell phone bill, puts gas in her car, purchases a Tablet, adds money to her Savings Account, and stops by Wendy’s for a "4 for 4".

Which of the above stated are considered “impulse buys.”

*Consider "wants" versus "needs".

The Tablet and the Wendy's "4 for 4" are most definitely "impulse buys".

Name two ways you can check your balance in your Checking Account without stepping foot in a branch.

Telephone Banking

Online Banking

Mobile Banking

ATM

Usually represented by a percent, ___________ is the amount a Credit Card provider charges a consumer to borrow money.

Interest

Which one of the following statements are true?

A. Debit cards build credit; Credit cards do not.

B. Credit cards build credit; Debit cards do not.

C. BOTH Debit & Credit cards build credit.

D. NEITHER Credit nor Debit Cards build credit.

B

When using you debit card to make purchases, you are asked to enter your 4-DIGIT PIN. What does the acronym “PIN” stand for?

Personal Identification Number

GUARD IT WITH YOUR LIFE; DO NOT GIVE THIS NUMBER OUT TO ANYONE!

There are multiple types of Savings accounts. Name 2.

Money Market Accounts

Certificate of Deposits (CD’s)

Individual Retirement Accounts (IRA’s)

Online Savings Accounts

Club or Goal-orientated Accounts

Basic Savings Account

College Savings Account (529 Plan

Health Savings Account (HSA)

SCENARIO

London received a check from his grandmother for his Birthday for $100. Lucky London! Name 4 features you would see on this check.

Routing Number

Memo Line

Amount (written)

Amount (numerical)

Payee

Maker’s name, address, phone number etc.

Account Number

Bank Name

Maker’s Signature

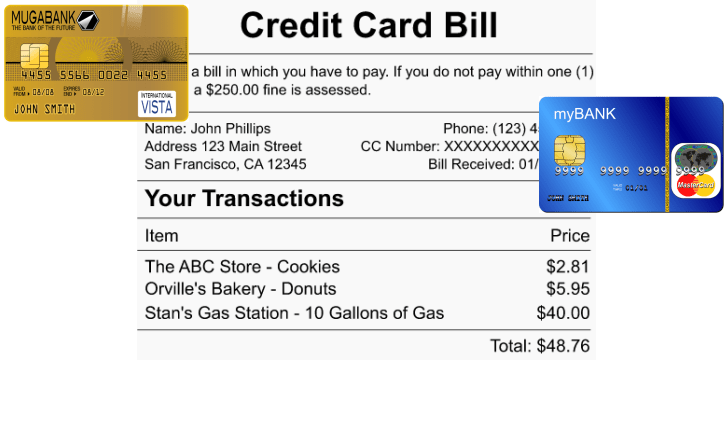

Name 2 features published on the front of a Credit Card?

Name 2 features published on the back of a Credit Card?

FRONT

Name

Expiration Date

Account Number

Bank Logo

Credit Card Provider

EMV Security Chip

BACK

Authorized Signature/ Signature line

3-digit Security Code

24-hour Cardholder Service Phone Number

ATM Network logos

Under Federal Law you have a maximum of _______ days to report unauthorized charges.

A. 30 days

B. 3 days

C. There is no Maximum.

D. 60 days

D

*DAILY DOUBLE *

1. What does the acronym ATM Stand for?

2. Name 3 transactions you can do at an ATM?

1. Automated Teller Machine

2. Withdrawal, Deposit, Transfer, Balance Inquiry, Mini Statements,

Cencap is paying you 1% APY (interest) on your Savings account. If your balance is $5,000. How much in interest will you get at the end of the month (statement cycle)?

A. $4.17

B. $ 50.00

C. $45.00

D. $525.00

A

$4.17

SCENARIO

Shannon works at Citi Trends. Shannon received her first Direct Deposit into her Checking account for a net of $250 today. She received her paystub which showed her gross pay of $375 minus all of the deductions taken out. Name TWO of the deductions she might have received.

Social Security (FICA) Tax

State Tax

Federal Tax

Medicare (or other Healthcare costs)

Retirement Savings/Benefits

Donations

Name 5 pieces of general information commonly seen on a Credit Card Statement?

Summary of account activity

Payment information

Late payment warning

Minimum payment warning

Notice of changes to your interest rates

Other changes to your account terms

Transactions

Fees and interest charges

Year-to-date totals

Interest charge calculation

When swiping your debit card, the card can be processed two ways. Name them.

Credit (offline transaction; usually takes 2-3 business days.)

Pin- Based (online transaction; Completed in real-time.)

A nine- digit number that identifies your financial institution is called a____________.

Routing Number

The Government limits how many times you can take money from your Savings account electronically. You are limited to ___times per statement cycle?

A. 10

B. 5

C. 6

D. 3

C

Which of the following check endorsements are acceptable?

*PICK ONE*

A. “For Deposit Only”

B. “Payee’s Signature”

C. “Pay to the Order of”

D. A, B, and C

E. None of the above

D