This is a common example of a discount note. These bonds can be purchased at most banks and some employers offer their employees a program or buying them thru payroll deductions

What are U.S. Savings bonds

This term refers to the total market value of a company’s outstanding shares.

A: What is market capitalization?

Lending practices involve deceptive or unfair practices by lenders to entice borrowers into taking risky and expensive loans.

What are "predatory lending practices"?

Long-term US GDP growth rate (1911 - 2024)

What is about 2%

This popular saying advises investors to diversify to avoid putting all their money in one investment.

What is "Don’t put all your eggs in one basket"?

Q: This is the name for the amount the bondholder will receive at maturity.

A: What is the par value (or face value)?

He argued that capitalism would inevitably concentrate wealth in the hands of a few, causing class struggle.

Who is Karl Marx?

This type of stock is typically held by retirees and income-focused investors, who aren’t quick to sell when prices change.

What is a blue-chip dividend stock?

if dy/dx = 35x-6 then y is

what is -7x-5

Q: Compared to large-cap firms, small-cap companies offer this potential reward—and risk.

A: What is higher growth potential and greater risk?

Complex financial instruments that bundle various loans, including mortgages, and sell them to investors.

What are "collateralized debt obligations" (CDOs)?

The chance that an investment's actual return will be different from what is expected is referred to as this.

What is risks?

This is the potential loss or negative outcome that every investment carries.

What is risks

Q: A $50 U.S. Savings Bond typically costs how much to purchase?

A: What is $25?

This economist believed that marginal productivity justified unequal pay, seeing markets as mechanisms for efficiency.

Who is Alfred Marshall?

This asset type is highly responsive to both interest rate changes and inflation expectations.

What is a Real Estate Investment Trust (REIT)?

Suppose you invest $14,075 at 7.5% annually compounded interest. How much will this grow to over 20 years?

What is $2000 and 1971.25

A share of profits paid to a stockholder.

What is a dividend

occurs when asset prices significantly exceed their intrinsic value, driven by speculative buying.

What are "bubbles"

This economic model shows the relationship between the quantity of a good that producers are willing to sell and the quantity that consumers are willing to buy.

Supply and Demand

This financial product pools money from multiple investors and is managed by professionals to invest in various securities.

What is a mutual fund

Q: U.S. Savings Bonds are an example of this type of loan instrument, sold at less than face value.

A: What is a discount note or discount lending?

He claimed that inequality was inevitable, even desirable, as 80% of wealth would always lie with 20% of the population.

Who is Vilfredo Pareto?

This type of equity investment tends to have the most elastic demand during speculative boom-and-bust cycles.

What is a renewable energy stock?

if y = 5x2 + 4x - 3 then dy/dx is

what is 10x + 4

Q: Growth investors might ignore dividend schedules/payments because they are more focused on this.

A: What is capital or asset or stock appreciation

Rising mortgage payments, falling home values, and job losses made it impossible for many borrowers to keep up with their payments.

What is some people default on their mortgages during the crisis?

When the value of a currency falls relative to another currency, it is called this.

What is currency depreciation?

When you invest in stocks, bonds, real estate, and cash to reduce the risk of loss, you are practicing this principle.

What is diversification?

Q: These short-term government loans are sold at a discount and have maturities ranging from a few days to 6 months.

A: What are T-bills (Treasury Bills)?

His famous curve suggested that inequality first rises then falls with development.

Who is Simon Kuznets?

If the price of this stock rises 10% and demand drops 20%, the price elasticity of demand (PED) is -2. What type of stock is this?

What is a high-growth tech stock (e.g., Tesla or NVIDIA)?

Suppose Lynn invested $49,200 in discount bonds with face values totalling $50,000. The discount rate was 4%. How long will it take (in days) unit the notes mature?

what is 146 days

the total value of a company in the stock market.

What is market capitalization

These financial derivatives act as insurance against the default of a borrower

What are Credit Default Swaps

An example of a low-risk, low-return investment is a __________;

savings account

CD

Saving Bonds

This value is calculated by dividing the total value of a mutual fund’s assets by the number of outstanding shares.

What is Net Asset Value (NAV)?

Q: Unlike savings bonds, T-bills are sold using this pricing mechanism that determines their selling price.

A: What is an auction?

He argued that inequality rises when the return on capital exceeds economic growth.

Who is Thomas Piketty?

This type of fund is favored by ESG-aligned investors and maintains relatively inelastic demand even during price drops?

What is a green energy ETF or portfolio (e.g., ICLN)?

Let's say that AN loans ANNA $20,000 for 1 year at 8% simple interest. Three months later, AN sells the note to NYLE at a simple discount rate of 7 ¾%. How much does NYLE pay for the note?

What is $20,344.50.

when the value of the stock increases.

What is appreciation

How did CDSs contribute to the 2008 financial crisis?

The failure of CDS issuers to cover defaults led to massive financial losses and instability, contributing to the collapse of firms like Lehman Brothers.

With a GDP growth rate of 0.6%, an inflation rate of 1.3%, and an unemployment rate of 7.4%, the overall health of the economy would be considered _______.

weak or in a recession

This type of mutual fund can issue and redeem shares at the end of each trading day based on investor demand.

What is an open-end mutual fund?

Q: Zarofire Systems issued a $1,000 bond with an 8% coupon rate. How much is each semiannual interest payment?

A: What is $40?

Par (Face) Value (P) = $1,000

Coupon Rate (R) = 8% per year = 0.08

Time Period (T) = ½ year (since interest is paid semiannually)

I=1,000×0.08×21

This economist believed economic growth could lift up poor workers, especially with industrial expansion in the global South.

Who is Arthur Lewis?

Despite price increases, investors often continue holding this type of company for consistent income, making demand inelastic.

What is a blue-chip dividend stock?

What is a blue-chip dividend stock?

Let's say that AN loans ANNA $20,000 for 1 year at 8% simple interest. Three months later, AN sells the note to NYLE at a simple discount rate of 7 ¾%. What was AN's Actual Interest Rate % Earned?

What is 6.89%

Q: This financial metric tells you what percentage of a company’s revenue becomes profit.

A: What is profit margin?

This legislation is aimed at reducing risks in the financial system, increasing transparency, and protecting consumers to prevent another financial crisis.

What is the Dodd-Frank law

This type of tax takes a larger percentage from high-income earners than from low-income earners.

What is progressive taxation

This concept refers to how investors divide their money among asset classes like equities, fixed income, and cash based on their goals and risk tolerance.

What is asset allocation?

Q: A bond is a promise to do this, usually with interest.

A: What is repay a loan?

According to Doughnut Economics, this is one reason inequality matters: it erodes trust, damages democracy, and shortens lives.

What is social and political instability?

Stock splits are a tactic sometimes used to boost demand for these volatile, high-priced equities.

Stock splits are when a company divides its existing shares into multiple new shares to make its stock more affordable and increase liquidity, without changing the overall value of the company.

What are high-growth tech stocks?

Let's say that AN loans ANNA $20,000 for 1 year at 8% simple interest. Three months later, AN sells the note to NYLE at a simple discount rate of 7 ¾%. What is NYLE's Actual Interest Rate (%) Earned?

What is 8.23%

Q: Amgen, Apple, and Disney operate in these three very different sectors.

A: What are biotech, tech, and entertainment

What TARP was and list 2 things it designed to do?

The Troubled Asset Relief Program (TARP) was a $700 billion initiative to (1) purchase distressed assets and (2) inject capital into banks to stabilize the financial system.

When a country's exports become cheaper and imports more expensive, it usually indicates a currency phenomenon.

What is currency depreciation?

This term describes the tendency for diversified portfolios to have less volatility than individual stocks, even if they may also lower extreme gains.

What is reduced volatility through averaging or smoothing?

According to Doughnut Economics, Inequality matters because it traps people in poverty and limits access to this key driver of opportunity.

What is education?

When interest rates rise, this real-estate-based asset class can lose investor appeal due to lower comparative yields.

What is a REIT?

If 50/x0.5 = 100/y0.5 and x + y = 200 then what are x and y

What is x = 40 and y = 160

Q: Older firms tend to offer this kind of investment profile compared to newer startups.

A: What is greater stability and lower volatility?

A: What is greater stability or lower volatility?

How much was the 2009 Stimulus Package, and name 2 things it was designed to do?

The American Recovery and Reinvestment Act of 2009 allocated $787 billion for tax cuts, unemployment benefits, and public works projects to stimulate the economy.

In this economic graph, the intersection point of the supply and demand curves determines the ___________ of these two variables

What is the equilibrium price and quantity?

This type of mutual fund has a fixed number of shares, trades like a stock, and may sell at a price above or below its NAV.

What is a closed-end mutual fund?

Commercial banks create money by doing this, which tends to benefit those who already have assets.

What is issuing loans?

Demand for this asset category often hinges on political or environmental policy changes, such as clean energy tax credits.

What is a renewable energy stock?

if Mark's utility of money is Um= 3x0.5 and Judy's utility Uj = 2y0.5 Use a Lagrange multiplier to find the amount of money x and y that maximizes Ws = Um + Uj, subject to 250.

What is approximately x=173 and y=77

Q: A high P/E ratio signals this about investor expectations.

A: What is strong expected future growth?

What "perverse incentives" contributed to the 2008 financial crisis, and why is "too big to fail" a perfect example of a "moral hazard"?

What are the incentives for excessive risk-taking (e.g., subprime lending), and the belief that large institutions would receive government bailouts (too big to fail), led to reckless behavior, contributing to the crisis?

As a central banker with a Federal Funds rate of 2.25%, if you want to stimulate the economy, you would likely _______ the Federal Funds rate

What is lower?

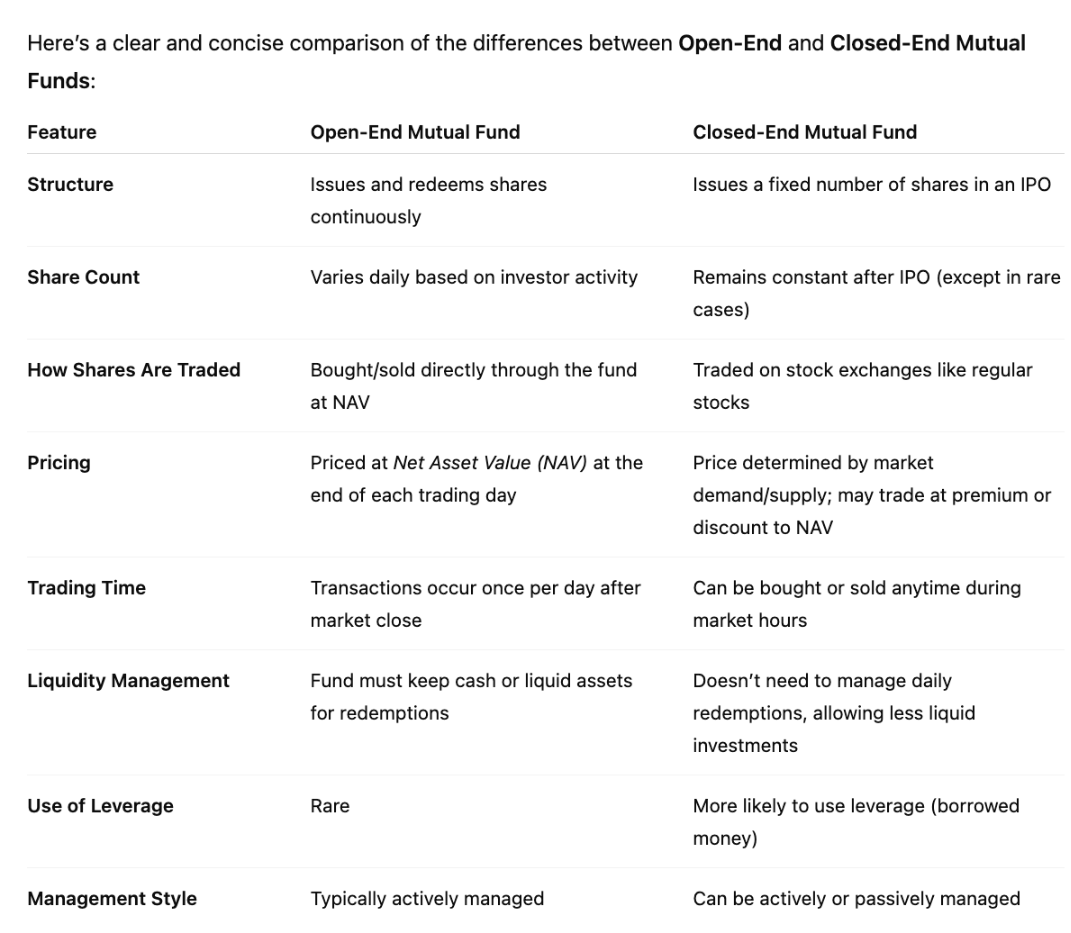

What are two differences between an Open and a Closed Mutual fund?

Because money is mostly created through debt, this group ends up paying interest to the wealthy, exacerbating inequality.

Who are borrowers or the poor?

This long-term investment fund may see stable inflows even if the market price falls, because its buyers care more about mission than return.

What is a green energy ETF (e.g., iShares Global Clean Energy)?