Mystery

The section of the Internal Revenue Code dealing with exclusion of gain from sale of principal residence.

What is IRC Section 121?

https://www.law.cornell.edu/uscode/text/26/121

A Manager or Lead who recently provided an answer in a Slack thread on how to handle IRS Notice 2014-7 income.

Who is -

(many possible correct answers, can quickly search in Slack to verify)

Some of many search terms in Slack which will allow the pro to answer this question:

2014-7

IRS 2014-7

IRS Notice 2014-7

The general rule in TurboTax for entering multiple state returns.

What is resident state last?

Also acceptable: what is non-resident state(s) first?

The tab number of the Tax Credits article from Tax Book's homepage.

What is 11?

The law which allows a nonmilitary spouse of a service member to keep the same resident state of the military spouse regardless of which state they live in.

What is the MSRRA?

Military Spouse Residency Relief Act.

https://ttlc.intuit.com/community/military/help/military-spouses-and-state-taxes/00/26149

The line of the 2020 1040 (and 1040-SR) where the Recovery Rebate Credit can be found.

What is Line 30?

https://www.irs.gov/pub/irs-pdf/f1040.pdf

The keyboard shortcut which allows you to quickly Jump To a channel or conversation in Slack

What is Ctrl+k?

Since 1979, this state has famously offered a "kicker" state tax credit to its taxpayers when personal income tax revenues exceed forecast by at least 2% during a 2-year budget cycle.

(The 2021 "kicker" appears to be a record $1.9 billion and will be paid in 2022.)

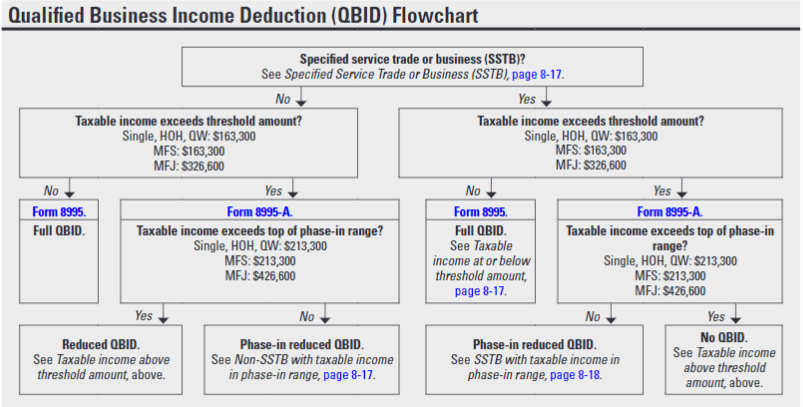

In the Qualified Business Income Deduction (QBID) Flowchart in the Tax Book - hint, from Home click on Q in the Index and go to the first article - the flowchart first checks for this type of trade or business.

What is an SSTB?

Also acceptable: What is a Specified service trade or business?

Key #2 of the TurboTax Live Four Keys to Delightful Service, as stated in the Tax Expert Handbook.

What is EMPATHY?

The joint AGI at which the ARPA $1,000-or-$1,600-per-child, for-2021-only additional Child Tax Credit amounts begin to phase out.

What is $150,000?

https://www.irs.gov/newsroom/irs-offers-overview-of-tax-provisions-in-american-rescue-plan-retroactive-tax-benefits-help-many-people-now-preparing-2020-returns

See paragraph headed

Expanded Child Tax Credit for 2021 only

A Manager or Lead who recently provided a response in Slack regarding a K-1 Box 20 Code Z error issue.

Who is -

(many possible correct answers, can quickly search in Slack to verify)

Some of many search terms in Slack which will allow the pro to answer this question:

Box 20 Code Z

Box 20 error

K-1 Box 20

This state borders five other US states (and also Canada!), but per the ttlc.intuit.com state reciprocal agreement chart, it does not have reciprocal agreements with any other states.

What is New York?

ttlc.intuit.com state reciprocal agreement chart:

https://ttlc.intuit.com/community/state-taxes/help/which-states-have-reciprocal-agreements/00/25576

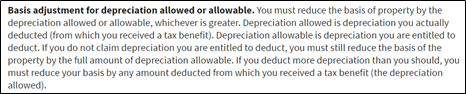

The IRS publication where the infamous rule stating a property's basis must be reduced by "allowed or allowable" depreciation can be found.

What is Publication 946?

https://www.irs.gov/publications/p946

Google search term: irs publication allowed or allowable

The URL for the IRS's Whom May I Claim as a Dependent? Interactive Tax Assistant.

The section of the IRC dealing with the Qualified Business Income (QBI) deduction.

Also acceptable: What is 199A?

Google search phrase: irc qbi

The exact characters you can type in a Slack message which will display an emoji depicting the current Intuit CEO, either just his face or his face superimposed on a piece of bread.

Note: there are several correct answers because there are several Slack emojis featuring our CEO, either breaded or breadless.

What is (any of the following are acceptable):

:sasan:

:sasanwich:

:sasan-intuit-captain:

:bread-sasan:

TurboTax allows a customer to prepare a printable version of this form for claiming the Minnesota Property Tax Refund.

In Publication 970, one of the "Tips" states You may be able to increase the combined value of an education credit and certain educational assistance if the student does THIS.

What is includes some or all of the educational assistance in income in the year it is received ?

The number of years most military taxpayers can add to the regular Section 121 lookback period for exclusion of capital gain on sale of principal residence.

What is 10?