F

FREE

This account has no monthly maintenance fees and no minimum balance!

How many debit card transactions must a member post and settle within the cycle to qualify for Revity High Yield Checking and Revity Cash Back Checking?

15 Debit Card Transactions

This is what happens when the Member does not qualify for rewards.

The account is still free, they earn the base APY in Revity High Yield Checking and Revity Rewards Savings they can try again next month!

Potential Reasons/Causes for Members to say to you; "I prefer paper statements"

*EXTRA 100 POINTS FOR SOLUTION

Concerned about information security

Prefers a printed statement for record keeping

I don't know how to enroll in Estatements or pull it up when it's ready

Revity-Mission

“Wherever you are on your financial journey, we will meet you there.”

R

REWARDS

This account rewards you with...

This is what the MEMBER is sent monthly to let them know if they qualified or not.

End of Cycle Email, and Lifecycle Marketing

This is the reward when the member qualifies for Revity High Yield Checking?

The Member earns 6.00% APY up to $15,000, .50% above $15,000, and ATM Fee Refunds up to $25

Potential Reasons/Causes for concerns members have over having to qualify.

*EXTRA 100 FOR SOLUTION TO OBJECTION

Skepticism- sounds too good to be true. How can you pay these rewards out?

Why do I have to do all this to get the rewards?

I've had an account here for years, doesn't that count as a qualification

Revity-Vison

“Making lives better.”

A

ASK TO QUALIFY

To qualify we ask that you do a few simple things you may already be doing.

This CONDITION is in place to SAVE REVITY FCU money. Hint: it's electronic

E-Statements

Did you know a paper statements cost about $2.15 and an e-statement cost about 15 cents!

This is the reward for qualifying in Revity Cash Back Checking?

The Member earns 6.00% on debit card purchases up to $200 for a max reward of $12.00, and ATM Fee Refunds up to $25.

Potential Reasons/Causes for a member not wanting to set up a Direct Deposit.

*Additional 100 Points for how to overcome the objection.

Payroll Direct Deposit goes somewhere else

Self employed and don't receive Direct Deposit

Doesn't know HOW to switch their Direct Deposit

Company doesn't offer Direct Deposit

What Year did Revity FCU (GMFCU) win the first of five Yes! Weekly Best Credit Union in the Triad Awards?

2019

N

NO PENALTY

No penalties for not qualifying! Your account is still free and you can try again next cycle

This qualifier is in place to create STICKINESS of account -- because members don't like to switch these!!

1 Direct Deposit/ACH Debit or Credit

The reward in Revity Rewards Savings when the member qualifies in Revity High Yield Checking or Revity Cash Back Checking?

The member earns 2.50% on their balance up to $100,000.00 and 0.50% on the balance over $100,000.00

AND Their Revity High Yield Checking, Revity Cash Back Checking reward is swept into their Revity Rewards Savings account where they earn interest on it!

Potential Reasons/Causes for a member to say;

"I don't use a debit card"

*EXTRA 100 PTS IF HAVE A SOLUTION IN MIND

Concerned about safety or fraud

Prefers their rewards credit card

Prefers cash

Prefers to use cash for budgeting

Doesn't think they can use it 15 times

Doesn't understand how debit cards work

What Year was Greensboro Municipal Credit Union Chartered?

November 30th, 1937

CD vs Revity High Yield Checking Consumer Benefit

•No Penalties

•Liquidity

•Diversify their Deposits

This is how the MEMBER qualifies for rewards in Revity Rewards Savings.

There is no separate qualifier for Saver! As long as they meet the qualifications in their Revity High Yield Checking or Revity Cash Back Checking, they qualify for Revity Rewards Savings.

At what average daily balance does Revity High Yield Checking provide more value than Revity Cash Back Checking?

$2,500.00 Average Daily Balance

This is the first step in handling an objection

Ask why to determine the root cause of the objection.

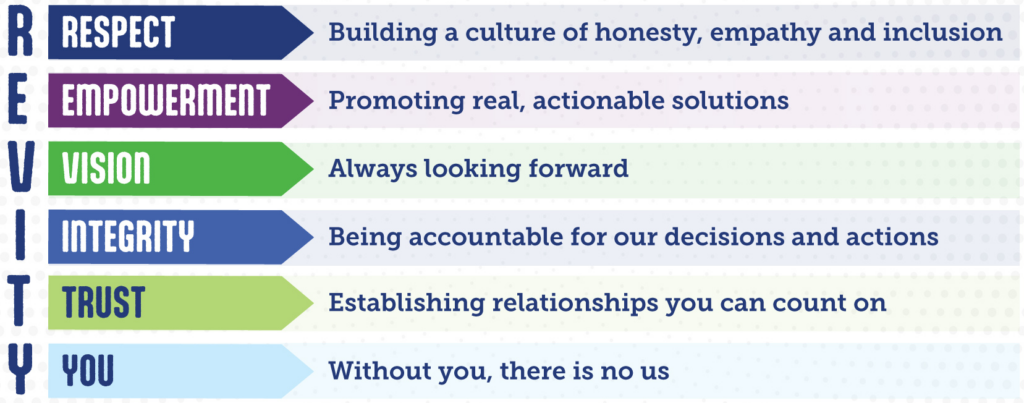

Revity-Values