Nikita Enterprises has bonds on the market making annual payments, with twelve years to maturity, a par value of $1,000, and selling for $972. At this price, the bonds yield 7.1 percent. What must the coupon rate be on the bonds?

6.75%

Caccamise Company is expected to maintain a constant 4.6 percent growth rate in its dividends indefinitely. If the company has a dividend yield of 6.4 percent, what is the required return on the company’s stock?

11%

The Dahlia Flower Company has earnings of $1.80 per share. The benchmark PE for the company is 16. What stock price would you consider appropriate?

$28.80

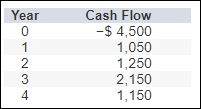

What's the payback period for these cash flows?

What's the payback period for these cash flows?

3.04 years

Treasury bills are currently paying 6 percent and the inflation rate is 3.4 percent. This is the exact real rate.

2.51%

Westco Company issued 10-year bonds a year ago at a coupon rate of 7.6 percent. The bonds make semiannual payments and have a par value of $1,000. If the YTM on these bonds is 5.9 percent, what is the current bond price in dollars?

$1,117.40

Five Star Corporation will pay a dividend of $3.22 per share next year. The company pledges to increase its dividend by 6 percent per year indefinitely. If you require a return of 11 percent on your investment, how much will you pay for the company’s stock today?

$64.40

Metallica Bearings, Incorporated, is a young start-up company. No dividends will be paid on the stock over the next nine years because the firm needs to plow back its earnings to fuel growth. The company will pay a dividend of $12 per share 10 years from today and will increase the dividend by 4 percent per year thereafter. If the required return on this stock is 12 percent, what is the current share price?

$54.09

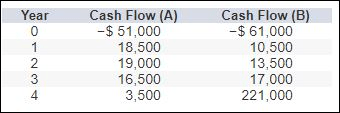

Kara, Incorporated, imposes a payback cutoff of three years for its international investment projects. Which of these, if either, do you accept, and what is the payback period for both?

Project A: 2.82

Project B: 3.09

Accept only project A.

Say you own an asset that had a total return last year of 11.9 percent. If the inflation rate last year was 7.3 percent, what was your real return?

4.29%

Yan Yan Corporation has a $3,000 par value bond outstanding with a coupon rate of 5 percent paid semiannually and 12 years to maturity. The yield to maturity on this bond is 5.6 percent. What is the dollar price of the bond?

$2,844.24

The next dividend payment by Im, Incorporated, will be $1.44 per share. The dividends are anticipated to maintain a growth rate of 6 percent forever. The stock currently sells for $26 per share. What is the dividend yield?

5.54%

You require a 15% rate of return on your investments. You are analyzing a project that has an IRR of 16%. Do you accept the project?

Yes.

An investment project has annual cash inflows of $4,700, $3,600, $4,800, and $4,000, for the next four years, respectively. The discount rate is 14 percent.

What is the discounted payback period for these cash flows if the initial cost is $5,400?

1.46 years.

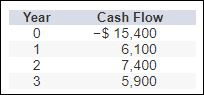

What is the IRR of the following investment?

12.55%

Union Local School District has a bond outstanding with a coupon rate of 3.2 percent paid semiannually and 23 years to maturity. The yield to maturity on this bond is 2.6 percent, and the bond has a par value of $5,000. What is the dollar price of the bond?

$5,516.88

Suppose you know that a company’s stock currently sells for $62 per share and the required return on the stock is 12 percent. You also know that the total return on the stock is evenly divided between a capital gains yield and a dividend yield. If it’s the company’s policy to always maintain a constant growth rate in its dividends, what is the current dividend per share?

$3.51

You are looking at an investment that has a payback period of 1.5 years. However, when calculating the discounted payback period, you find that the project never pays back the original investment.

What must be true about the NPV of the project?

It is negative.

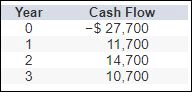

What is the internal rate of return (IRR) of these cash flows if the required return is 18%?

16.37%

You’re trying to determine whether to expand your business by building a new manufacturing plant. The plant has an installation cost of $11.9 million, which will be depreciated straight-line to zero over its four-year life. If the plant has projected net income of $1,844,300, $1,897,600, $1,866,000, and $1,319,500 over these four years, respectively, what is the project’s average accounting return (AAR)?

29.11%

A discount bond's coupon rate is equal to the annual interest divided by this.

The face value.

Hailey Corporation pays a constant $8.00 dividend on its stock. The company will maintain this dividend for the next 11 years and will then cease paying dividends forever. If the required return on this stock is 10 percent, what is the current share price?

$51.96

$0

A project that provides annual cash flows of $17,500 for eight years costs $81,000 today.

What is the NPV for the project if the required return is 7 percent?

$23,497.72

True or false: Applying the discounted payback decision rule may cause some positive NPV projects to be rejected.

True.