This tax pays for health insurance for people 65 and older.

Medicare Tax

Derek earns $12.65 per hour and worked 29 hours. How much did he make?

$368.85

Linda makes $14.35 per hour and time and a half for overtime. If she works 8 hours of overtime, how much overtime pay will she earn?

$172.24 or $172.20

Jill makes 5% commissions on all furniture sales. If she sells a sectional couch for $2,549.99, how much did she make from the sale?

$127.50

How many checks does someone receive in a year if they are paid biweekly?

26

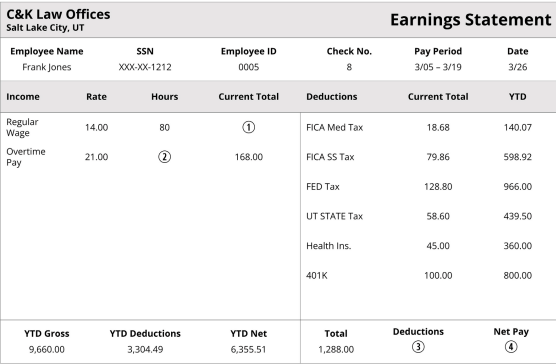

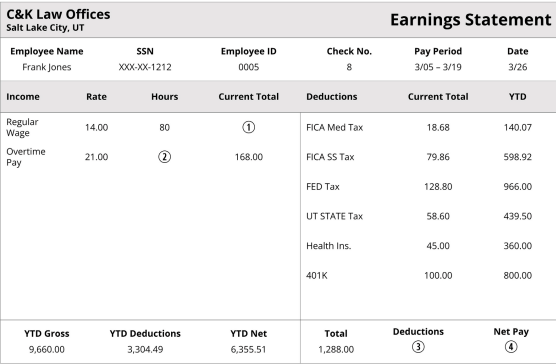

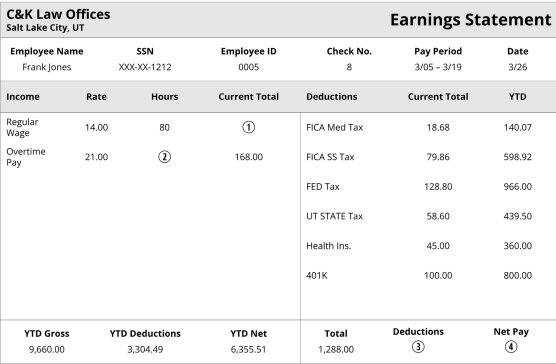

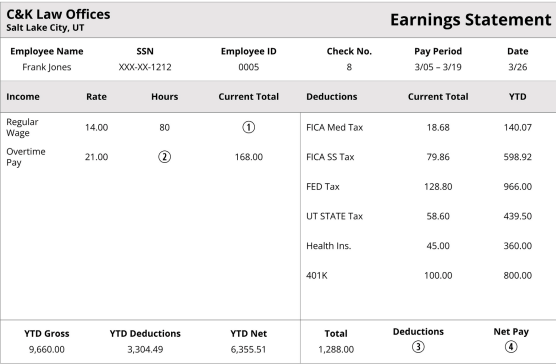

Locate 1 on Frank’s pay stub. What is the total Frank earned from his regular wages this pay period?

$1,120

Alexander worked 47 hours last week at the local Amazon warehouse. If he gets paid $15.00 an hour. How much did he earn in regular, overtime and total wages?

Regular- $600

Overtime- $157.50

Total-$757.50

This tax pays for retirement income for people 62 and older.

Social Security Tax

Sara's annual salary is $64,000. How much does she make weekly? (Assume she works 50 weeks annually)

$1,280

Robert makes $18 per hour and double time for holiday hours. If he works 6 hours on Memorial Day, how much will he earn in overtime pay?

$216

Danielle sells kitchen cabinets for 9.4% on commissions. If her sells average $12,000 per week, what is her annual income?

$54,144 or $56,400 or $58,656

Regina makes an annual salary of $73,450. She is paid bimonthly. How much does she make each paycheck?

$3,060.42

Locate 2 on Frank’s pay stub. How many hours of overtime did he work this week?

8 hours of overtime

Which method will give you more paychecks in a year bi-weekly or bi-monthly?

bi-weekly = 26

semi-monthly = 24

So bi-weekly will give you 2 more paychecks in a year

Daily Double (must get all three parts correct in order to get the 600 points):

What is commission?

What are two types of commission?

Commission: A percentage of sales or a fixed amount of money

Two types are: A percentage of sales or a fixed amount of money

Bobby makes $11.25 an hour plus tips. Last week he worked 26 hours and earned $156 in tips. What were his total earnings?

$448.50

Pamela makes $17.40 during her regular weekday hours, and time and half for weekend hours. Last week she worked 40 hours during the week and 9 hours on the weekend. How much did she make in total?

$930.90

Cassandra has an annual salary of $53,600 in addition to a 4.2% commission rate on her sales. If she sells $119,000 worth of products, how what is her total income for the year?

$58,598

Carl's paystub shows his gross wages to be $4,268.19, and his net pay to be $3,137.60. What were his total deductions?

$1,130.59

How much federal income tax has Frank paid this year?

$966.00

Beyonce is disappointed in your choice of question.

She takes 300 points from you as punishment.

Terribly sad.

What is the difference between gross pay and net pay?

Net pay, also known as take-home pay, is the amount of money an employee receives after taxes and other deductions are subtracted from their gross pay.

Gross pay is the total amount of money an employee earns before taxes and other deductions are taken out. It can include salary, bonuses, commissions, and overtime pay.

Joanne earns $14.65 for every bicycle she assembles. If she assembles 12 bicycles in a shift, how much will she make?

$175.80

Sam makes $14.25 per hour and double time for overtime. Last week he worked 47 hours. If his normal amount of hours is 40, how much did he earn last week?

$769.50

Fred makes an annual salary of $49,500 plus 7.3% in commissions on sales. Last year his sales totaled at $42,100. What was his total income for the year?

$52,573.30

Taylor's pay stub listed the following deductions: $268.34 to federal taxes, $82.60 to state taxes, $45.09 to social security, $130.20 to health insurance, and $45 to dues. If her gross pay was $1,199.58, what was her net pay?

$628.35

Locate 4 on Frank’s pay stub. How much will Frank receive on payday?

$1,288.00 - $430.94 = $857.06

You are given a choice between a salary of $36,000 a year or an hourly wage of $18.25 an hour. Assuming both jobs are the same and you will work 40 hours a week, 50 weeks a year, which job will pay more?

Hourly = $36,500 per year

Entitles eligible employees of covered employers to take unpaid, job-protected leave for specified family and medical reasons with continuation of group health insurance coverage

Family Medical Leave Act (FMLA)

Tyrone makes $16.50 an hour making solar panels. At another company, Melissa makes $26.73 for every solar panel she completes. If Tyrone woks 40 hours per week, and Melissa completes 5 solar panels per day, who makes more money per day and by how much?

Melissa makes $1.65 more per day.

Thomas makes $15.75 an hour with time and a half for overtime. Gerald makes $14.60 per hour with double time for overtime. If they both work 45 hours in a week, who makes more money and by how much? (40 hours is the normal amount for each)

Thomas by $18.13.

William and Tiffany both sell houses. William earns a 5% commission and Tiffany earns a 5.7% commission. If William sells a house for $280,900 and Tiffany sells a house for $260,300, who made more from their sale and by how much?

Tiffany by $792.10.

Stacy's annual salary is $64,500 and she is paid biweekly. Her last paystub listed $634.92 in total deductions. What was her net pay for that check?

$1,845.85

Locate 3 on Frank’s pay stub. What is the sum of Frank’s deductions from his paycheck this pay period?

$18.68 + $79.86 + $128.80 + $58.60 + $45 + $100 = $430.94

Kelly works on commission and earns 2.9% on stock sales but is also guaranteed a weekly salary of at least $1500. This week she sold $59,812 worth of stock. She is paid either $1500 or her commission, whichever is larger. How much should Kelly get paid this week?

59812x 0.029 = $1734.55

The commission is bigger, so she earns $1734.55