What involves collecting, recording, classifying, summarizing, reporting, and analyzing firm’s financial activities according to a standard set of procedures?

Accounting

What are the two types of financial reports?

Internal and External

What is an Annual Report?

A yearly document that describes a firm’s financial status.

What are the 2 types of Accountants?

Public and Private

What are the pros for Public Accountants?

Job advancement

Position allows for specialization

Work with a variety of people

Networking Opportunities

Travel opportunity

Give examples of collecting financial data.

bank statements, contracts, agreements, verification statements, transportation receipts, invoices, vouchers, bank statements, cash register tape, credit card receipts and sales orders.

Describe internal financial reports.

Used within the organization; managerial accounting is used

What are the 3 financial statements in an annual report?

Balance Sheet

Income Statement

Statement of Cash Flows

Describe public accountants.

Independent Accountants work for a fee

Audit (review) financial statement (important responsibility)

Must complete an approved bachelor’s degree program and pass a test prepared by the American Institute of Certified Public Accountants (CPA).

What are the cons for Public Accountants?

Very stressful

Competitive

Long work hours

CPA is usually required

Give examples of recording financial data.

- General ledger

- Subsidiary ledgers

- Cash receipts

- Bank statements

- Invoices

Describe external financial reports.

Used by outsiders that do not work for the organization; financial accounting is used

What does annual means?

Yearly

Describe private accountants.

Work for one organization

To become a private accountant, you must pass an examination

What are the advantages of Private Accounting?

More relaxed atmosphere

Steady, flexible work environment

Can reach management level without a CPA

Balance sheet

Income Statement

Statement of Cash Flows

What does GAAP stand for?

Generally Accepted Accounting Principles

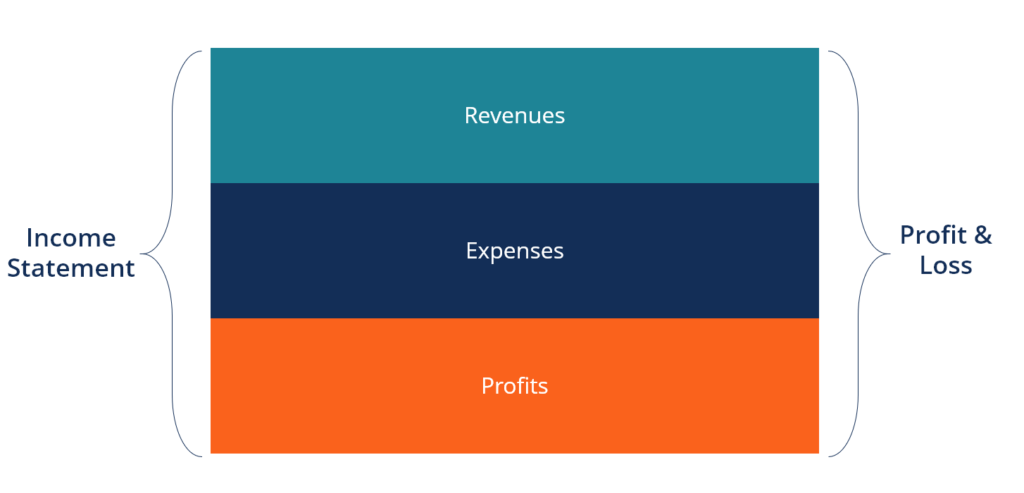

What is an income statement?

An income statement is one of the three important financial statements used for reporting a company’s financial performance over a specific accounting period.

About 1.4 million accountants in the United States that are either public accountants or private accountants.

True

What are the cons of Private Accounting?

Lack of variety in job duties

Fewer opportunities to specialize in the field

What does analyzing financial data means?

breaking data apart, being detail-oriented, being very specific

What is the Financial Accounting Standards Board (FASB) responsible for?

Financial Accounting Standards Board(FASB) is a private organization that is responsible for establishing

financial accounting standards in the United States.

Give examples of an income statement.

According to the Bureau of Labor Statistics, jobs will increase to 10 percent by 2025.

False, it's 2026.

What are the 3 basic Accounting Procedures?

The Accounting Equation ( 3 Main Accounting Elements)

Assets

Things owned by a firm

Liabilities

What a firm owes to its creditors

Owner’s Equity or Net Worth

Total amount of investment in the firm minus any liabilities.