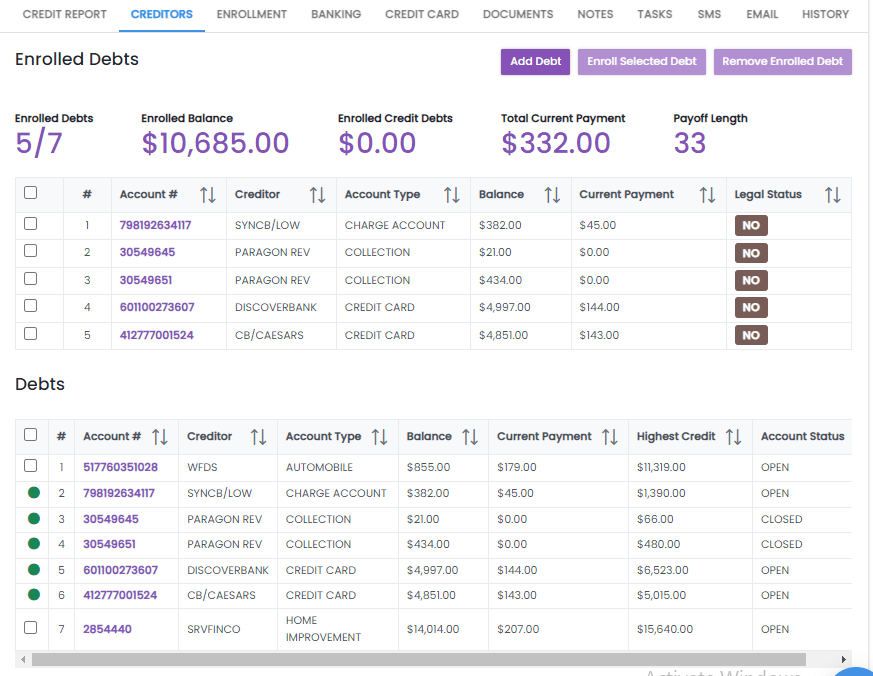

What accounts can not be added to the program? Do they qualify?

Home improvement, automobile, and the two collection accounts bc they are closed.

After taking those off yes they still qualify.

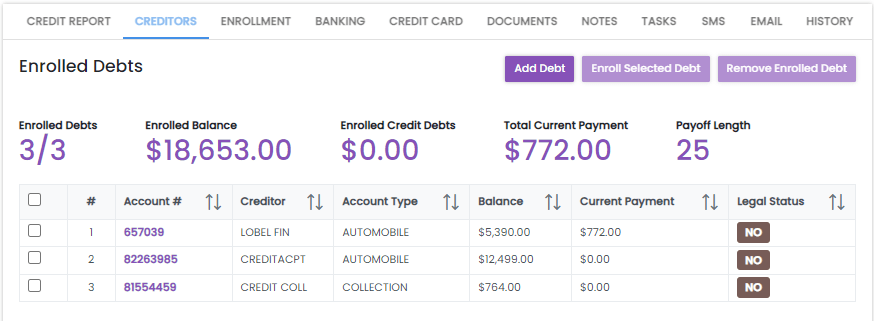

Which one of Maria's vehicles were repossessed?

The automobile financed through Creditacpt

What are the benefits of this program?

A chance to remove negative marks from my credit report

Become debt free

No longer harassed by collections and creditors

What do you have to put in the notes on debt tracker?

the hardship

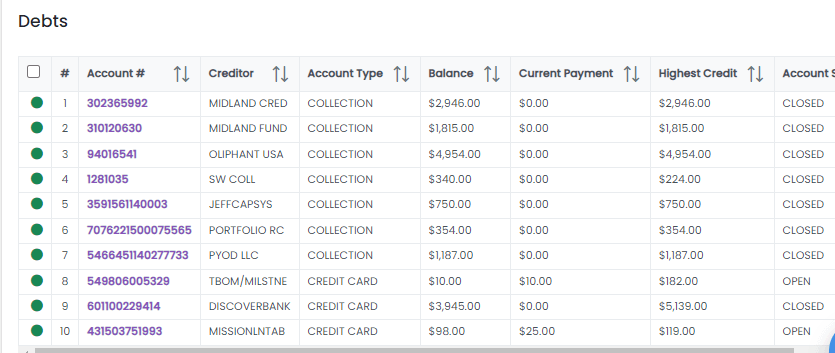

Does Aaron qualify for the program?

No all the accounts are closed

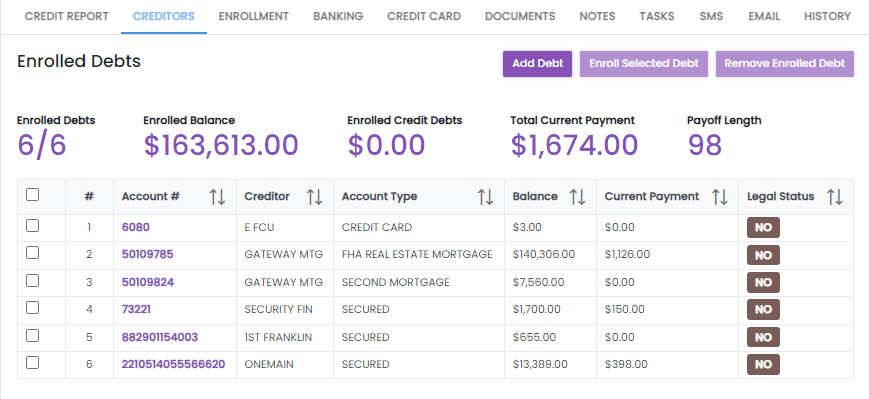

Security Fin: a repossessed car

1st Franklin: a repossessed jetski

Oneman: current vehicle

Does this person qualify?

No, they do not have enough debt to enroll.

You will get refunded

What account type can a client make their monthly payments from?

Non-prepaid account

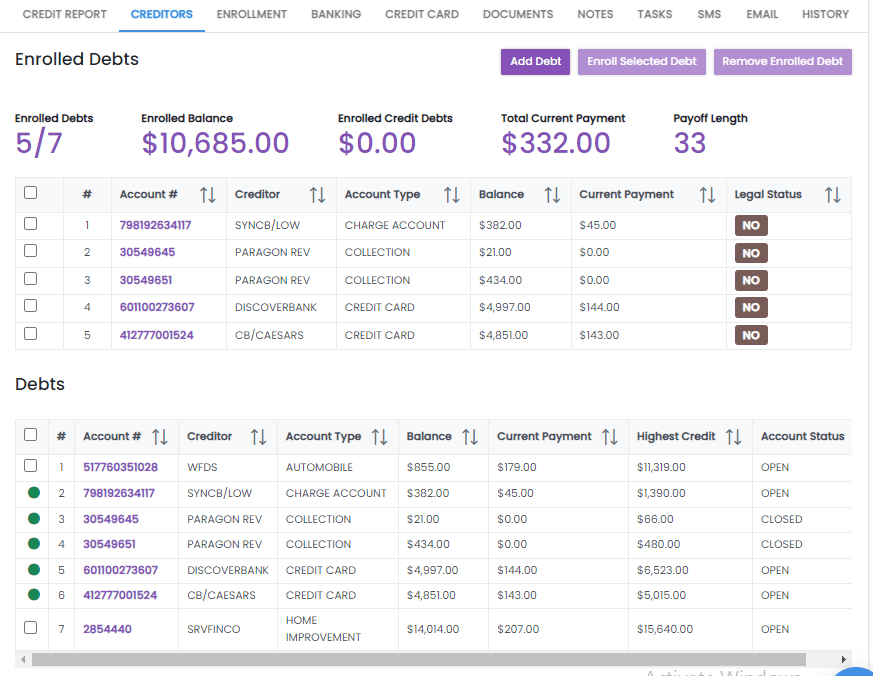

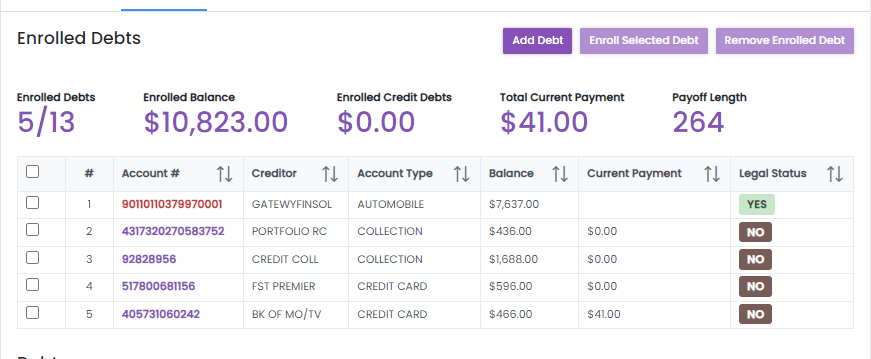

What debt cannot be added to this program? Will they still qualify?

Yes, they still qualify.

What is different about this client?

They have a legal status on their account.

I don't feel safe giving you my SSN

Without your social security number I cannot pull up your debts which will allow me to help you remove these stressful creditors and/or collection agencies. Do you have any questions that I can answer to help you feel more comfortable?

What do you do when you are waiting for the e-signs to be done by the backend team.

Read the Post-sale disclosure for the 5-6 min wait.

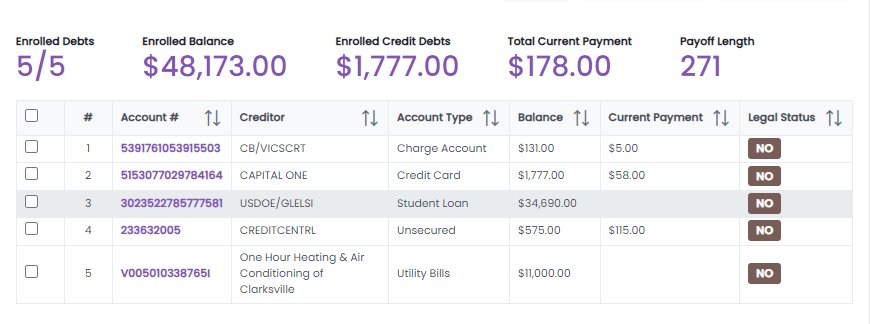

Does this person qualify for the program?

No, we do not accept utility debt or student loans.

What is the first question you should ask when you see a secured loan on a account?

Ask what this loan is secured to.

Can I use a credit card to pay my monthly installments to your company?

No

What is the minimum amount of debt you can enroll with a creditor?

$300, you can have multiple cards with the same creditor it just has to equal to a minimum amount of $300

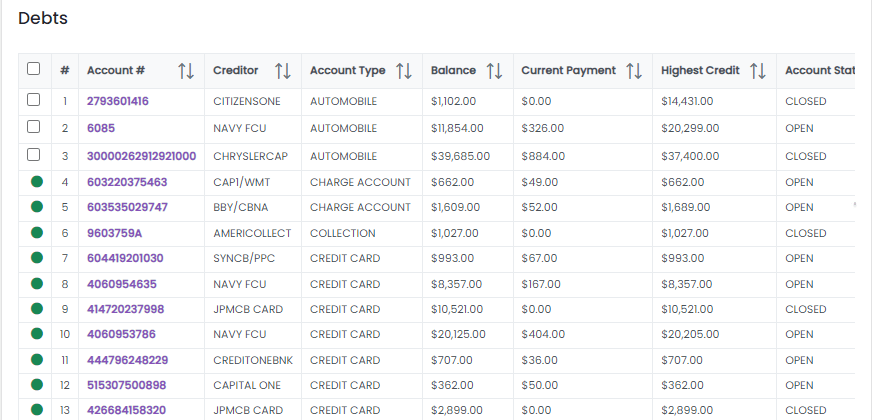

Kevin banks with JPMCB, will he have enough debt to enroll?

No, we can not add any of the debt from JPMCB that would be cross collateral. We also can not add the debt to Navy FCU bc they will go after the automobiles.

I have a secured loan I want to enter into this program, but it is tied to my furniture. Can I still enroll this loa?

Yes, the only thing we can not enroll is anything motorized.

What do you mean if i get sued, are you saying i may get sued for the things your company is helping me with?

We are only handling your debt, we are not a lawyer for any other needs that you may possibly have. We only handle your debt settlement needs. If you need a lawyer for anything outside of your debt settlement, you will have to find that on your own.

Charles is enrolling in our program today, with a debt amount of $22,000. He had a vehicle that was repossessed in 2016 with a remaining balance of $12,000 the rest were credit cards. His first payment is set for 04/02. He is ready to start this program. Why was this deal pushed back?

His first payment date was out of the 15 day period.