The section of the IRC dealing with the Qualified Business Income (QBI) deduction.

What is Section 199A?

Also acceptable: What is 199A?

Google search phrase: irc qbi

Uber and Uber Eats drivers can save up to this percentage on certain TurboTax Self-Employed products, excluding Full Service.

What is 50 percent?

Please note the driver MUST use the affiliate link, as with any of these special discount affiliate links. The link is apparently accessible through their online Uber driver portal.

95% sure the 50 percent is off is on Federal prep only, not on the entire cost including State plus any Max etc.

The income threshold amount for Additional Medicare Tax liability for a Married Filing Separate filer.

What is $125,000?

The image depicted by the slack emoji that begins with the characters :team_arnold

What is a CROWN?

The cure for the Mac TTD blue SmartLook screens of death.

Expected answer is a URL.

What is turbotaxshare.intuit.com?

ALL Lyft drivers get this percentage off from TurboTax DIY or Live Self-Employed products.

What is 25%?

Platinum get 50%. Federal tax prep only.

The income threshold amount for Net Investment Income Tax for a joint filer, if some of the income is net investment income.

What is $250,000?

The TTO product tier enlisted military personnel get for free.

What is DIY?

Enlisted here refers to PAY GRADES E-1 through E-9.

PAY GRADES are not ranks. Ranks are words such as Sergeant.

The 4/14/23 closing price for INTU.

What is $441.62?

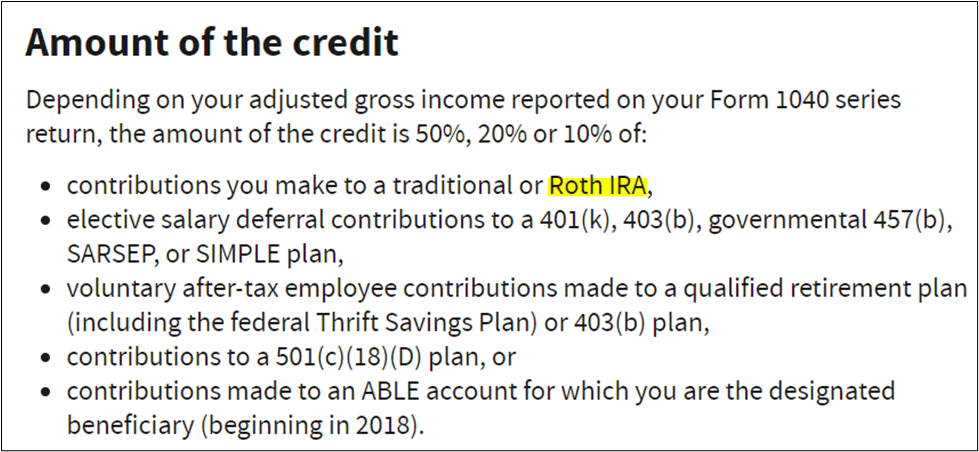

A taxpayer with income low enough to qualify for this credit actually gets an up-front benefit for making a Roth IRA contribution.

What is the Retirement Savings Contributions Credit (Saver’s Credit)?

The amount of Net Investment Income for an individual with $20,000 in rental income, $350,000 in operating income from a nonpassive business, $2,000 in interest, $10,000 in net capital gains (all short-term), and $2,000 in dividends.

What is $34,000?

The law which allows a nonmilitary spouse of a service member to keep the same resident state of the military spouse regardless of which state they live in.

Acronym is acceptable answer.

What is the MSRRA?

Military Spouse Residency Relief Act.

https://ttlc.intuit.com/community/military/help/military-spouses-and-state-taxes/00/26149

What is Form 982?

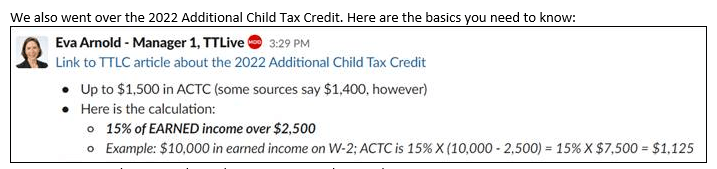

Regular Child Tax Credit a taxpayer with zero Federal income tax liability but $6,000 in earned income gets.

What is ZERO?

The Regular Child Tax Credit is nonrefundable.

This taxpayer would get $1,500 x 15% in ACTC, so... whatever that is.

The Federal income tax bracket a non-itemizing Single college athlete is in, if their NIL gross pay is $600,000 but their agent gets 10%. The only other deductible expense is $1,200 for a 100% business cell phone, and there is no other income.

What is 35%?

Remember tax brackets are based on taxable not AGI. Single 37% starts at $539,000 taxable.

10% of $600,000 is $60,000.

$600,000 - $60,000 is $540,000. That’s right there but we haven’t haven’t factored in the standard deduction yet.

Factor in the cell phone plus the standard deduction, and you’re still in the 35% bracket. This can be reasoned out mentally because the 10% of $600,000 clearly gets you down to $540,000 before the standard deduction. But here are the exact numbers:

$540,000 - $12,950 - $1,200 = $525,850 taxable, so below the 37% threshold of $539,000.

The IRS publication where the infamous rule stating a property's basis must be reduced by "allowed or allowable" depreciation can be found.

What is Publication 946?

https://www.irs.gov/publications/p946

Google search term: irs publication allowed or allowable

Agents in this industry are the most likely instances you'll see of statutory employees.

What is INSURANCE?

Approximate amount Uma Uber will get back in her pocket if you help her recall $200 in legitimate ordinary and necessary business expenses involved in generating her Uber income. Assume 12% marginal Federal income tax bracket and no income other than Schedule C net profit.

Ignore any state effects or potential effects on other parts of the Federal return such as lowering APTC payback.

What is $54?

(12% + 15%) x $200 =

27% x $200 = $54

The upper AGI limit for claiming the 2022 Child and Dependent Care credit (aka the Childcare Credit).

NULL – there is no upper AGI limit for claiming this credit.

However, higher income taxpayers are almost always better off maximizing their dependent care FSA, if applicable, vs. claiming the credit. That’s because their marginal Federal tax rate will be greater than 20%, which is the credit calculation percentage here for any taxpayer with > $43,000 AGI.

Because FSA maxes out at $5,000 and the allowable expense amount for the credit maxes at $6,000, a higher-income taxpayer maxing out their FSA will get $1,000 x 20%, or $200, of Child and Dependent Care credit.

Exact amount Castor and Pollux must pay during 2023, assuming payments are made reasonably during the year, in order to avoid underpayment penalty on their 2023 tax return. Assume $155K joint income both years and 2022 1040 Line 24 tax liability of $25,000.

What is $27,500?

110% of prior year AGI safe harbor for filers with over $150K in AGI.