Which accounts are affected when the owner withdraws money from the company's bank account?

The bank account and the owner's equity

What is the Objectivity Principle?

It is the G.A.A.P that says all accounting will be recorded with evidence

Where are the beginning balances taken from?

The most recent balance sheet.

Would an electric bill count as a source document?

Yes

Decide wether or not this is considered a business transaction: A business paying their rent for the month ($600)?

Yes because they are paying their lease holder which is a creditor

When an owner puts money into the buisness it is called?

An Investment

What is a source document?

Evidence such as a telephone bill, a receipt, or a copy of a cheque

When updating the equation analysis sheet, what is the minimum amount of accounts that need to change to keep it balanced?

2

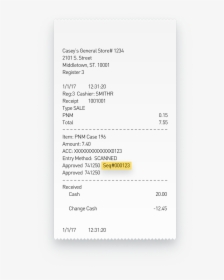

Is this considered a source document?

Yes because a receipt contains the names, the date and the amount that changes hands in the transaction

A business purchases a new car with cash($20000). Is this considered a business transaction

Yes because the company is aquiring a new asset

What is the definition of a business transaction?

It is a financial event that causes a change in the financial position

Is it ok that a source document contains amounts that are based off of personal opinion?

No, the objectivity principle requires that all transactions will be recorded on fact and not opinions or feelings

If an equation analysis sheet was ordered Liabilities, Owner's Equity, and Assets is this correct?

No it is in order to line up with the fundamental accounting equation A=L+OE

Is an employee's time card considered a source document?

Yes because it shows the hours that employee worked

Would an employee buying lunch for themselves be considerd a business transaction?

No because the employee is buying for themselves with their own money

If there was a fire in the office building and it was destroyed but the insurance paid for it in full, would the accountant have to record this?

No because no money was spent or paid so the financial position of the company would stay the same.

Why is it called the source document?

Because it is the original record of the transaction

What is an equation analysis sheet?

It is a tool to display individual transactions and the new financial position after these transactions

Is this considered a source document? (Letter of intent for business

No because it is only discussing the posibility of doing buisness

If a company vehicle gets repaired and it cost $400 but only $200 was paid. Would the accountant count this as a business transaction?

Yes because it was a company car as well as the company paid for it to repaired