When a bond is issued at more than its face value, it is issued at:

Premium

Capital stock that has been assigned a value per share in the corporate charter.

Par value stocks

The combined effect of the declaration and payment of a cash dividend on a company’s financial statements is to:

decrease total assets and decrease stockholders’ equity.

What is the normal journal entry for recording bad debt expense under the allowance method?

Debit Bad Debt Expense, credit Allowance for Doubtful Accounts.

What are the depreciation methods that we covered in this course?

Straight-line

Units-of-Production

Declining balance

A long-lived tangible asset acquisition cost less the accumulated depreciation from the acquisition date to the balance sheet date.

Book value

The date in which the company establishes who will receive the dividend payment

Record date- no journal entry is made.

a contra-equity account

Treasury stock

Mountain View Company buys back 3,000 shares of its $10 par value common stock from investors at $126 per share. This stock repurchase would be recorded with:

a debit to Treasury Stock and a credit to Cash for $378,000.

A company sells 1 million shares of common stock with no par value for $16.50 a share. In recording the transaction, the journal entry will be:

debit Cash and credit Common Stock for $16.50 million.

Ordinary repairs and maintenance are recorded as:

expenses.

An expense paid, but not incurred.

Prepaid expenses

The amount of stock that a corporation is authorized to sell as indicated in its charter.

Authorized Stock

Cumulative net income less any net losses and dividends since inception

Retained earnings

A corporate charter specifies that the company may sell up to 39 million shares of stock. The company issues 31 million shares to investors and later repurchases 12.5 million shares. The number of issued shares after these transactions have been accounted for is:

31 million shares.

A company issues 1 million shares of common stock with a par value of $0.07 for $15.50 a share. The entry to record this transaction includes:

a debit to Cash for $15,500,000, a credit to Common Stock for $70,000, and a credit to Additional Paid-in Capital for $15,430,000.

Saeed Company uses the allowance method for recording bad debts. On February 1, Saeed wrote off a $3,500 customer account balance when it became clear that the specific customer would never pay. On May 29, Saeed unexpectedly received a check for $3,500 from the customer. On May 29, Saeed will:

Debit Accounts Receivable and credit Allowance for Doubtful Accounts for $3,500; debit Cash and credit Accounts Receivable for $3,500.

Calculate the amount of depreciation to report during the year ended December 31 for equipment that was purchased at a cost of $55,000 on October 1. The equipment has an estimated residual value of $5,000 and an estimated useful life of five years or 20,000 hours.

Assume the company uses double-declining-balance

$5,500

Year 1 Depreciation = ($55,000 − $0) × (2 ÷ 5)

= $22,000 per year

October 1 – December 31 = 3 months, so depreciation is $22,000 × (3 ÷ 12) = $5,500.

Issued Shares minus Treasury Shares

Outstanding shares, which are stocks that has been issued and are being held by stockholders.

The date in which the corporation records an increase in Dividends Payable

Declaration date

Galveston, Incorporated has 308,000 shares authorized, 140,000 shares issued, and 14,000 shares of treasury stock. How many shares are outstanding?

126,000

= 140,000 − 14,000 = 126,000

Masa Corporation declared a $0.80 per share cash dividend. The company has 200,000 shares authorized, 90,000 shares issued, and 84,000 shares of common stock outstanding. What is the journal entry to record the dividend declaration?

Debit Dividends and credit Dividends Payable for $67,200.

Hashem Corporation loaned $100,000 for three months on November 1 to one of its customers at the rate of 6%. The principal amount of the loan plus interest is due on the following February 1. Which of the following is the adjusting journal entry that will be recorded on December 31?

Debit Interest Receivable and credit Interest Revenue for $1,000.

$100,000 × 6% × 2 ÷ 12

Calculate the amount of depreciation to report during the year ended December 31 for equipment that was purchased at a cost of $55,000 on October 1. The equipment has an estimated residual value of $5,000 and an estimated useful life of five years or 20,000 hours.

Assume the equipment was used for 1,000 hours from October 1 to December 31 and the company uses units-of-production depreciation.

Depreciation expense = $2,500

= ($55,000 − $5,000) × (1,000 ÷ 20,000) hours = $2,500.

Name 2 Contra-Asset accounts we have studied this semester.

1) Allowance for doubtful accounts

2) Accumulated Depreciation

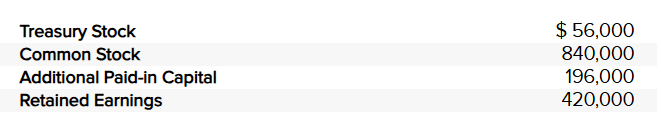

The following information is available from the accounting records of Pecos Company:

What is the amount of Stockholders' Equity for Pecos Company?

$1,400,000

Galaxy Industries buys back 300,000 shares of its stock from investors at $45 a share. Two years later it reissues this stock for $65 a share. The stock reissue would be recorded with:

a debit to Cash for $19.50 million, a credit to Treasury Stock for $13.50 million, and a credit to Additional Paid-in Capital for $6.00 million.

On February 16, Faisal Company declares a $1.36 dividend to be paid on April 5. There are 1,900,000 shares of common stock issued and outstanding. The entry recorded by the company on April 5 includes a debit to:

a debit to Dividends Payable and a credit to Cash for $2,584,000.

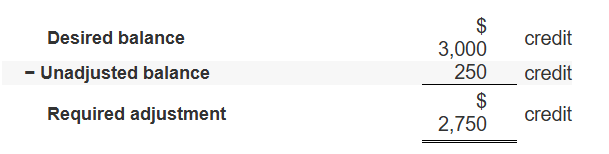

Assume that Mariyam Company had credit sales of $250,000 and cost of goods sold of $150,000 for the period. Mariyam uses the aging method and estimates that the appropriate ending balance in the Allowance for Doubtful Accounts is $3,000. Before the end-of-period adjustment is made, the Allowance for Doubtful Accounts has a credit balance of $250.

What amount of Bad Debt Expense would the company record as an end-of-period adjustment?

2,750

During the closing process, we close temporary accounts. Which accounts are closed?

Revenues / Expenses /Dividends

Equipment costing $16,000, with accumulated depreciation of $12,000 on Dec. 31 of previous year, was sold on March 31 for $7,000 cash. the company uses straight-line depreciation at $4,000 per year. What is the gain/loss on the sale, if any?

Gain on sale of equipment =$7,000 − $3,000 = $4,000 gain.

A truck is purchased for $35,000. It has a five-year life and $5,000 residual value. Using the straight-line method, what is the truck’s carrying value after three years?

$ 17,000

Abeer Corporation uses the allowance method. Abeer writes off a $560 customer account balance when it becomes clear that the customer will never pay. Abeer should prepare the following journal entry:

debit Allowance for Doubtful Accounts and credit Accounts Receivable for $560.

Your company issues $50,000 of one-year, 10% bonds at face value. The journal entry to record the issuance of the bond will include a debit to:

Cash and a credit to Bonds Payable for $50,000.

Seif Company purchased equipment for $40,000. Sales tax on the purchase was $2,400. Other costs incurred were freight charges of $600, and installation costs of $675. What is recorded as the cost of the equipment?

$43,675

$40,000 + $2,400 + $600 + $675 = $43,675.

Muhammad Company began the year with a balance in the Supplies account of $3,200. During the year, Muchachi purchased supplies for $25,800. An inventory of the Supplies at year-end showed supplies on hand of $4,100. Supplies Expense reported on Muchachi’s income statement for the year is

$24,900

$25,800 + $3,200 - $4,100 = $24,900.