The simplest form of account, which is used to analyze transactions.

T- Account

Describes a companies financial position (types and ammounts of assets, liabilities, and equity) at a point in time

Balance Sheet

If totalliabilities increased by $89,000 and stockholder's equity increased by $27,000 during a period of time, then total assets must change by what amount and direction during that same period?

$ 116,000 increase

Normal balance of an expense

Debit

This principle is a core element of the accrual basis of accounting, which holds that revenues are recognized when earned and expenses when consumed.

Expense Recognition Principle

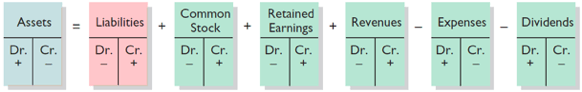

Expanded Basic Equation

Structure of retained earnings statement

Beginning RE

+/- NetIncome/Loss

- Dividends

= Ending RE

Sheffield Corp. began the year with retained earnings of 393,000. During the year, the company recorded revenues of $485,000, expenses of $377,000, and paid dividends of $38,500. What was Sheffield retained earnings at the end of the year?

$ 462,500

MUST EQUAL

The process of allocating the cost of an asset to expense (depreciation) over its useful life.

Depreciation

April 19 - Kaylena issued common stock in exchange for $10000 cash.

April 27- Kaylena borrowed $5000 from the bank by signing a note.

May 3- Kaylena bought a used car for $500.

4/19- Increase $10000 in cash, Increase 10000 in Stockholder's Equity.

4/27- Increase $5000 in cash, Decrease $5000 in Note Payable.

5/3- Increase $5000 under Asset for Vehicle, Decrease $5000 in cash.

Four Basic Financial Statements

1. Income Statement (aka Statement of Earnings)

2.Statement of Retained Earnings

3.Balance Sheet (aka Statement of Financial Position)

4.Statement of Cash Flows

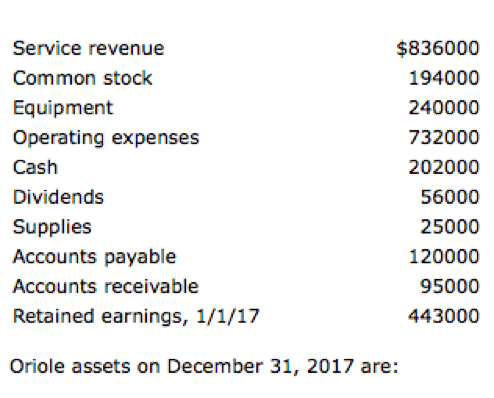

$ 562,000

Normal balance of a Contra Account

Always opposite to the relevant normal account. The normal balance of a contra account can be a debit balance or a credit balance

Adjusting entries for accrued revenues

Increase (debit) an asset account

Decrease (credit) an revenue account

If total liability increases $5000, then

Assets must have increased by $5000 or stockholder's equity must have decreased $5000.

Unearned Revenue belong to which financial statement?

Balance sheet

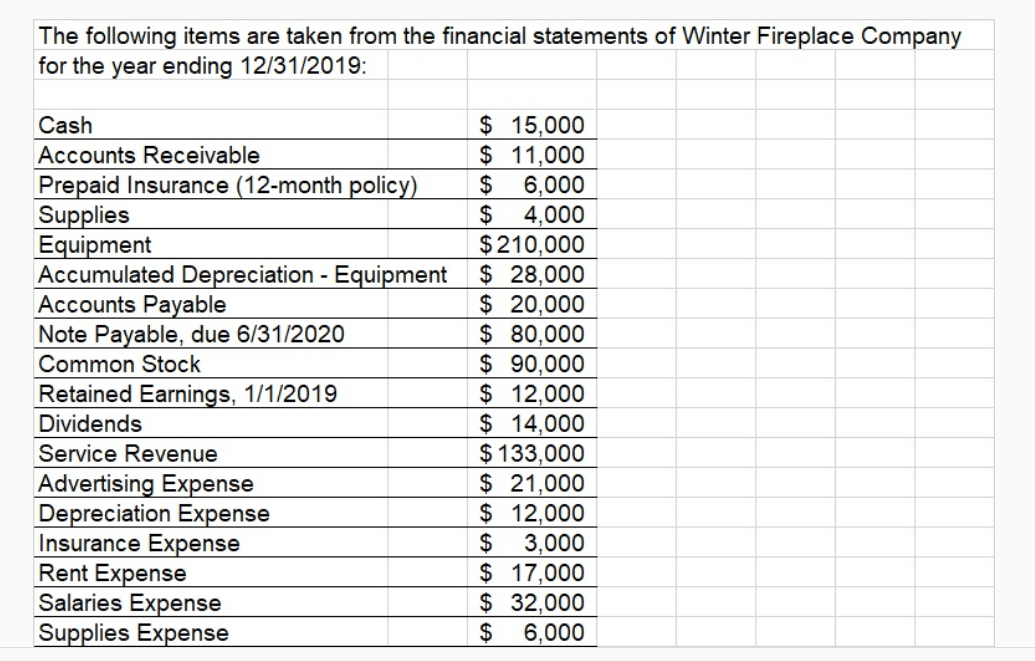

What is total Stockholders' Equity at 12/31/2019?

$ 130000

If Credits are smaller than Debits, what happens to the account?

It has DEBIT BALANCE

Total assets minus intangible assets

Book Value

Oct 5 -Received $1,300 in cash from customers for accounts receivable due.

Oct 10- Billed customers for services performed $5,100.

Oct 15- Paid employee salaries $1,200.

Oct 17- Performed $600 of services in exchange for cash.

Oct 20- Paid $1,900 to creditors for accounts payable due.

Oct 5- Debit Cash $1,300, Credit Accounts Receivable $1,300 (Received collections from customers on account)

Oct 10- Debit Account Receivable $5100, Credit Service Revenue $510 (Billed customers for services performed)

Oct 15- Debit Salaries and Wages Expense $1,200, Credit Cash $1200 (Paid employee salaries)

Oct 17- Debit Cash $600, Credit Service Revenue $600 (Performed services for customers)

Oct 20- Debit Account Payable $1900, Credit Cash $1900 (Paid creditors on account)

The proper sequence for the accounting cycle is:

Analyze, Journalize, Post (transfer), Adjust, Prepare statements, Close

Sand Agency started the year with total assets of $20,000 and total liabilities of $5,000. During the year, the business recorded $16,000 in catering revenues and $8,000 in expenses. Stockholders made additional investments of $3,000 and the company paid dividends of $5,000 during the year.

Stockholders' Equity changed by what amount from the beginning of the year to the end of the year?

$ 6000

Each transaction must affect ______ or _____ _____ ____ to keep the basic accounting equation balance.

two / more accounts

All businesses are involved in these three types of business

Financing, Investing and Operating