Illustrates how an economy uses it's resources for the production of one good vs. another good

Production Possibilities Curve

Model of an economy featuring businesses and households exchanging resources and goods/services

Circular Flow Diagram

What causes shifts in the AD curve?

Changes in consumption, investment, government spending and net exports (exports - imports)

What is the relationship between the price of previously issued bonds and interest rates

They are inversely related

(ex. as interest rates go UP, the value of previously issued bonds at lower interest rates go DOWN)

What does the short run Phillips Curve illustrate?

The short run trade-off between inflation and unemployment

What is included in the current account?

Net exports, net income from abroad and net unilateral (one way) transfers

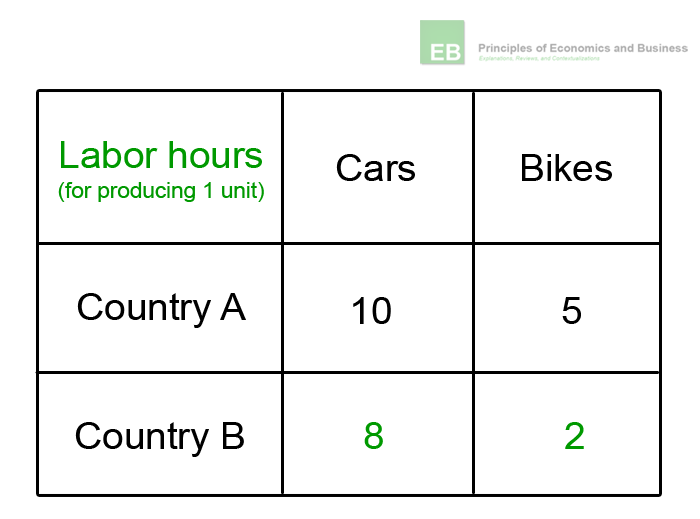

Determines who should produce a good or service

Comparative Advantage (i.e. who has the lowest opportunity cost)

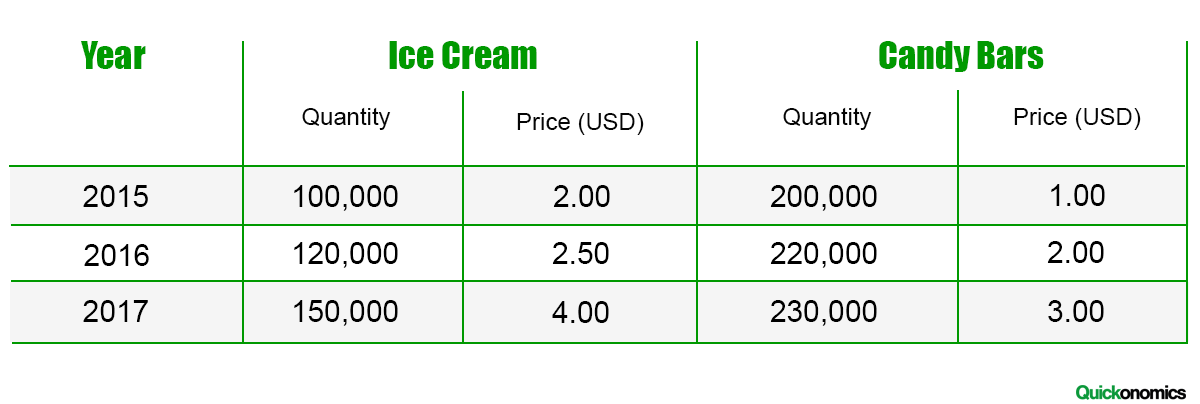

Expenditure, Income and Value Added

Three ways to calculate GDP, they should all result in the same total

Quantifies the size of the change in AD as a result of a change in any of the components of AD

Spending multiplier

What is fractional reserve banking and what does it create?

Fractional reserve banking is when deposits in a bank create required reserves and excess reserves. Excess reserves are loaned out creating a chain of money creation.

On the Phillips Curve, where are inflationary gaps and where are recessionary gaps?

Inflationary gaps are left of the LR equilibrium

Recessionary gaps are right of the LR equilibrium

What is included in the Capital and Financial Account (CFA)?

Financial capital transfers/purchases and sales of assets between countries

An inverse relationship between price and quantity demanded

Law of Demand

The percentage of adult population that is in the labor force

Labor Force Participation Rate

The change in consumer spending divided by the change in disposable income

MPC - Marginal Propensity to Consume

1/RR

Money multiplier

How do demand shocks and supply shocks effect the Phillips Curve?

Demand shocks move along the SRPC

Supply shocks shift the SRPC

What drives demand for a nation's currency?

Demand for their goods, services and financial assets

A positive relationship between price and quantity supplied

Law of Supply

Types of unemployment that are unavoidable

Frictional + Structural Unemployment = the Natural Rate of Unemployment

Why is the SRAS curve upward sloping?

Sticky wages and prices

In the money market, when is equilibrium achieved?

When the nominal interest rate is such that the quantities demanded and quantities supplied of money are equal.

What is crowding out?

The adverse effect of increased government borrowing, which leads to decreased levels of interest sensitive private sector investment/spending in the short run

Appreciation of a nation's currency will effect their net exports in what way?

Appreciation > their exports seem more expensive > so exports will fall > net exports will move toward a negative

When quantity supplied equals quantity demanded

Market equilibrium

Fluctuations in aggregate output and employment because of changes in aggregate supply and/or aggregate demand

Business Cycle

How does the LRAS curve correspond to the PPC?

They both represent maximum sustainable capacity

Three tools of monetary policy in a limited reserves framework

Discount rate, open market operations and reserve requirement

How do we measure economic growth?

Change in real GDP per capita over time

Depreciation of a nation's currency will effect their net exports in what way?

Depreciation > their exports look comparatively less expensive > exports will increase > net exports move toward a positive

Who has the comparative advantage for bikes?

Country A

What is the real GDP for 2017 (with 2015 as the base year)?

$530,000

Three automatic stabilizers

Progressive income tax, unemployment insurance, welfare programs

In the loanable funds market, who supplies and who demands?

Savers supply loanable funds

Borrowers demand loanable funds

What are supply side fiscal policies?

Fiscal policies that affect aggregate demand, aggregate supply and potential SR and LR output by influencing incentives that affect household and business spending.

Financial capital will flow toward the country with the relatively higher interest rate