What is the main advantage to the corporate form of ownership?

Stockholders have limited liability.

What are the set of rules (in the US) that govern how companies report financial information, and who sets them?

The Generally Accepted Accounting Principles (GAAP) are set by the Financial Accounting Standards Board (FASB).

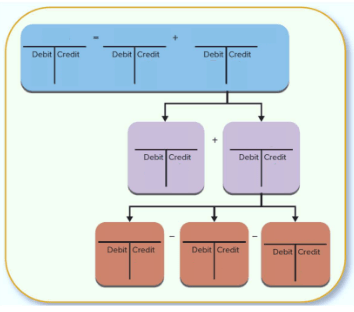

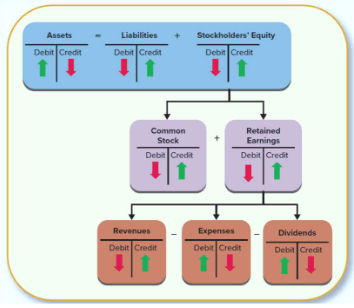

What is a normal balance?

Which side makes the account larger (debit or credit)

True or False: Adjustments always touch a revenue or expense account.

True

When is revenue recognized?

Recognition occurs at a single point in time when control of a good or service is transferred to the customer on a specific date. Not when cash is received.

Which financial statement features the accounting equation?

Balance Sheet

Which of these liability accounts are considered short-term liabilities? Why?

- Note Payable

- Accounts Payable

- Bond Payable

Accounts Payable, obligation due within the year.

Fill in the account names and normal balances for the expanded accounting equation.

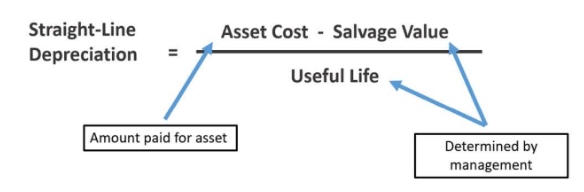

What is the definition and equation for depreciation?

the allocation of cost for long-lived assets over the expected useful life

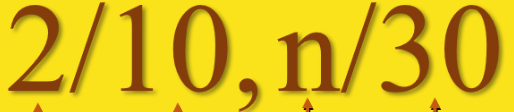

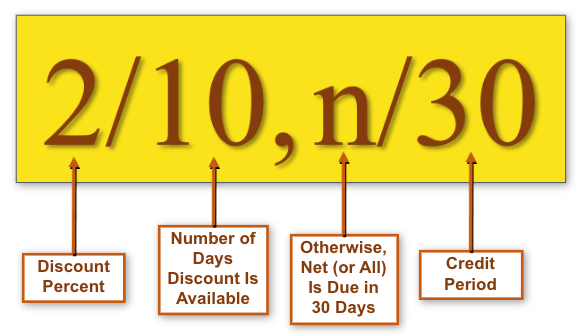

Label each of the components of this sales discount term.

Which of these accounts would be considered a liability?

- Accounts Receivable

- Prepaid Expenses

- Accounts Payable

- Dividends

Accounts Payable

What is the equation to find operating income?

Operating income = Gross profit - additional expenses related to the operating activities of the company.

Gross profit = sales revenues - cost of goods sold

When expenses are accrued, what accounts (4) are affected, and in what way (increase/decrease)?

Expenses increase

Net Income decrease

Retained Earnings decrease

Stockholders Equity decrease

What type of account tracks a reduction of it's "related" account? What is an example?

Contra-Asset, example is accumulated depreciation.

What is one criteria that allows for revenue to be recognized over time?

The customer consumes the benefit of the seller’s work as it is performed (example: a subscription)

The customer controls the asset as it is created (example: constructing a building extension)

The seller is creating an asset that has no alternative use to the seller and the seller has the legal right to receive payment for progress to date (example: an order of jets customized for the U.S. Air Force)

What equation does the income statement show?

Revenues - Expenses = Net Income/Profit/Net Earnings

What are the 2 main sources of equity?

Contributed capital (Common stock, additional paid-in capital), and Retained earnings.

What does "on credit" mean, and what account would we use for a transaction made on credit when the company is buying something?

Supplier (vendor) has given our company time to pay them (typically 30 days). Use the Accounts Payable (liability) account to track amounts owed to vendors.

By December 31, $3,000 in salaries have been earned by employees for the final three days of the month. These salaries are owed but not paid by December 31.

What is the journal entry for the adjustment?

Salaries Expense 3,000

Salaries Payable 3,000

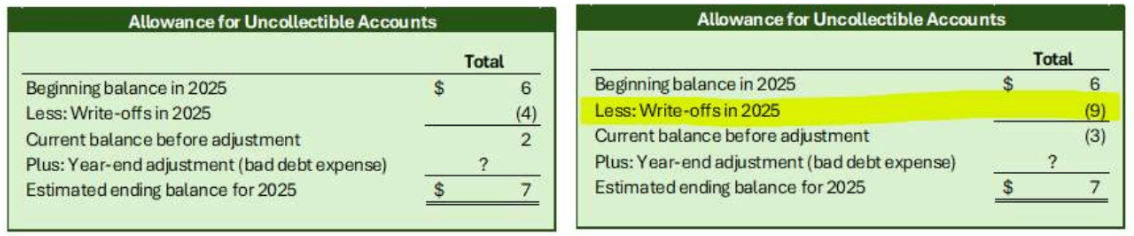

When it becomes clear a customer will not pay, the company writes off the customer’s account balance as uncollectible, what is the effect on total assets?

The write-off has no effect on total assets (balance sheet) or total expenses (income statement).

What type of business activity (think cash flows) would the purchase of another company's stock be?

Investing

What category of the cash flows statement would this transaction fall under, and is it an inflow or outflow?

Collecting the principal (not interest) on loans

Inflow of cash in the investing category.

Write the journal entry for this transaction:

Big lots sells five TV's at a price of $50,000 per unit on account. Assume that the units were made by the company at $22,000 per unit.

Accounts Receivable 250,000

Sales Revenue 250,000

Cost of Goods Sold. 110,000

Inventory 110,000

On December 1, purchased one year of rent in advance for $180,000 ($15,000 per month). By December 31, one month of rent has expired.

What is the journal entry for the adjustment?

Rent Expense 15,0000

Prepaid Rent 15,000

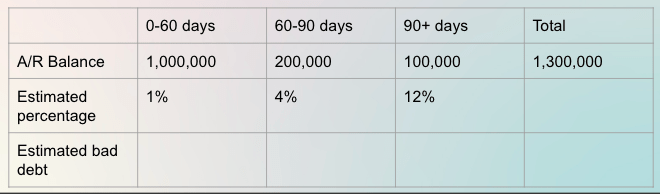

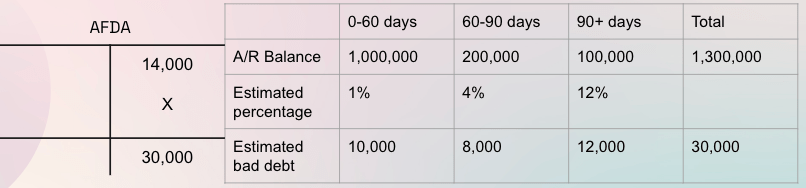

On December 31st Johnny Company has $1.3 million in A/R balance, split up based on the age of the account. Each grouping has an estimated % of bad debt. There is a beginning balance of $14,000 in the AFDA account. What is the journal entry for bad debt expense during this period?

Bad Debt Expense 16,000

AFDA 16,000

X = 16,000