What allows you to do your banking using your computer or phone?

Online Banking

True/False: Checking accounts charge a service fee if you have too many withdrawals in one month.

False

Which of the following describes how to calculate simple interest?

a. Interest = Principle ÷ Rate × Time.

b. Interest = Principle ÷ Rate ÷ Time.

c. Interest = Principle x Rate ÷ Time.

d. Interest = Principle × Rate × Time.

e. None of the Above

d. Interest = Principle × Rate × Time.

What does a CD stand for?

Certificate of Deposit

What is a transaction?

The movement of money from one bank's computer to another computer.

What allows you to make purchases without using cash by deducting the money from your checking account?

Debit Card

Sondra’s checking account had a $762.35 balance. Later that day she used her debit card to pay $14.80 for gasoline and $56.94 for groceries. She also transferred $500 from her savings account to her checking account using her bank’s ATM.

What was the balance of her checking account at the end of the day?

$1190.61

Which of the following best describes compound interest?

a. The calculated interest is subtracted from the compound amount every cycle

b. When you add up all the interest you have ever earned

c. The calculated interest is added to the initial balance

d. All of the above

e. The calculated interest is added to the compound amount every cycle

e. The calculated interest is added to the compound amount every cycle

Which of the following describes the length of time that money must be left on deposit in a CD?

a. term

b. APR

c. maturity date

d. balance in the account

e. DL (Deposit Length)

a. term

What is interest that builds on itself?

Compound Interest

Joanne’s bank statement shows a balance of $539.22. Checks outstanding are #656 for $42.98, #657 for $122.35, and #659 for $13.90. She also has a deposit of $660 outstanding. What was the balance on her bank statement?

$1019.99

Darla deposits $500 in a savings account that earns 2% compounded semiannually. If no deposits or withdrawals are made, how much will be in the account after 1 year.

How much interest was earned?

$510.05 Total

$10.05 Interest

Which of the following is NOT true about certificate of deposit accounts?

a. The balance must be kept in the account for the term specified.

b. The interest rate paid is fixed for a period of time.

c. A small number of checks may be written against the account.

d. Certificate of deposit accounts typically offer higher interest rates than regular savings accounts.

e. All of the Above

c. A small number of checks may be written against the account.

What is a bank statement

A monthly report sent out by a bank that lists the account transactions.

Define a balance

The amount of money in an account.

16. A deposit slip lists these items: (bills) 8 fifties, 22 twenties, 9 tens, 30 fives; (coins) 24 dimes, 18 nickels, 90 pennies; (checks) $45.67, $99.12. The depositor received no cash back.

What total deposit was made?

$1228.99

Peter made an ATM deposit of $800 in a savings account that pays 2% annual interest, compounded quarterly. What will be the compound amount after 5 years?

How much of that will be compound interest?

$1188.76 Total

$388.76 Interest

Mark Snyder deposited $2,200 in a six-month CD that pays 4.5% simple annual interest. How much interest did he earn at the end of the term?

$49.50

What is an outstanding Check?

A check that has not been received or paid by the bank

Esther had a balance of $3,245.88 in her checking account. She wrote checks for $58.90, $110.26, and $334.75. Her deposits were $685 and $220.15.

What was Esther’s new balance after these transactions?

$3647.12

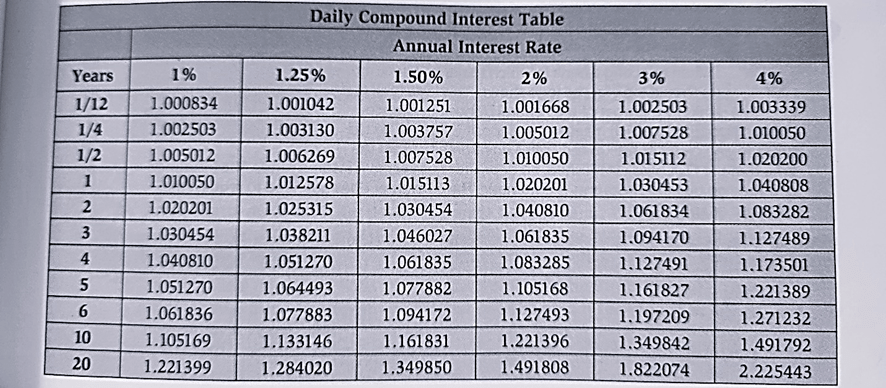

Joseph Banks deposits $1500 in a savings account that earns 3% compounded daily. If no other deposits or withdrawals are made, how much will be in the account after 1 years?

$1545.68

Susan had $35,000 on deposit in a six-month CD paying 6.25% simple annual interest. At the end of three months when she cashed out the CD, her penalty for early withdrawal was one month’s interest.

How much of a penalty did Susan have to pay?

$182.29

Adele Govern saves $250 per month and deposits the money in an annuity earning 3% annual interest compounded monthly. How much will be in the account after 2 years? How much of that money is interest?

$8606.62

$2606.62