a bookkeeping worksheet in which the balance of all ledgers are compiled into debit and credit account column totals that are equal

What is the trial balance?

Only the effects of cash transactions are shown on this statement.

What is the statement of cash flows?

These accounts are all closed to retained endings at the end of the year.

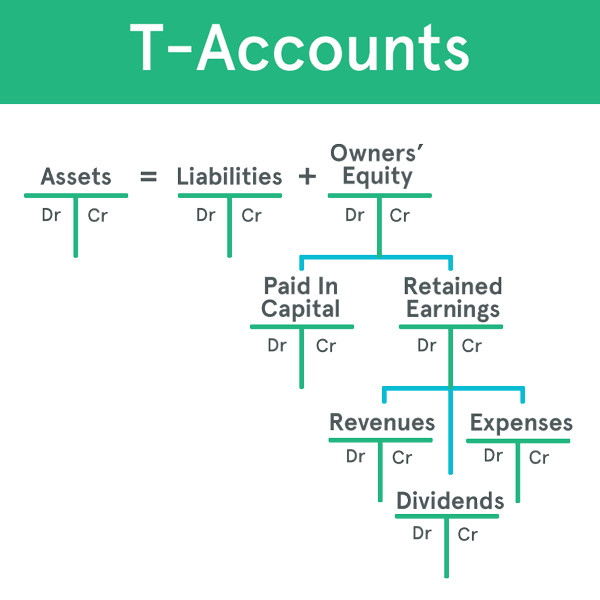

What are revenue, expense and dividend accounts?

Assets=Liabilities+Owner's Equity

What is the accounting equation?

COMPANY has $4000 in assets and $2500 in liabilities. What is the total owner's equity?

$1500

This step of the accounting cycle is represented in this image:

What is the general ledger?

This statement includes the assets, liabilities and equity of a company

What is the balance sheet?

an entry in a company's general ledger that occurs at the end of an accounting period to record any unrecognized income or expenses for the period

What is an adjusting entry?

This includes these accounts: accounts receivable, prepaid insurance, buildings, inventory.

What is "assets"?

Create the journal entry for this transaction:

COMPANY owes employees $10,000 in salaries. They will pay them in one week.

DR Salary expense $10,000

CR Salaries payable $10,000

It initiates the accounting cycle.

What is a transaction?

This statement details the various revenues and expenses of a company.

What is the income statement?

What is current liabilities? (Revenue and, therefore, equity would be understated.)

This includes these types of accounts: common stock, sales revenue, dividends and advertising expense.

What is "owner's (or stockholder's) equity"?

Create the journal entry:

COMPANY purchases $600 in inventory. They pay for half now and will pay the rest in a month.

DR Inventory $600

CR Cash $300

CR Accounts Payable $300

This is always indented when written in a general journal entry.

What is a credit record?

This statement showing net income less dividends is created by many companies, but is not required.

What is the statement of retained earnings?

These two accounts are impacted by when I account for rent used from a prepaid account.

What are prepaid rent and rent expense?

This includes these notes payable, but not accounts payable.

What is "long-term liabilities"?

Company has $100 in supplies on June 1st. They purchase and pay for $40 in supplies June 8th and $25 in supplies June 23rd. On June 30th they have $38 in supplies remaining. What is the journal entry for June 23th?

DR Supplies $25

CR Cash $25

This statement shows users the various capital contributions a company has received.

What is the statement of stockholder's (or owner's) equity?

The journal entry accounting for accrued interest expenses includes a credit to this account.

What is interest payable?

These accounts are used to determine the retained earnings balance at the end of the year.

What are revenue, expense and dividend accounts?

Company has $100 in supplies on June 1st. They purchase $40 in supplies June 8th and $25 in supplies June 23rd. On June 30th they have $38 in supplies remaining. What is the adjusting entry for June 30th?

DR Supplies Expense $127

CR Supplies $127