If Fred deposited $1000 in this commercial bank, what would the immediate change in total bank reserves be?

Increase $1000

($100 required and $900 excess)

Define interest on reserves

The interest that the central banks pays to commercial banks that deposit their reserves with the central bank

If the Fed purchases treasury securities on the open market, what will the effect on the money supply be?

Money supply increases

As depicted in the image, what is the major change that has happened to US monetary policy since 2008?

Reserves became ample

What type of monetary policy is designed to reduce aggregate demand and correct inflation?

Contractionary

The central bank purchases $1000 of bonds from this commercial bank. What is the immediate change to the amount of required and excess reserves held by the commercial bank?

Required reserves- no change

Excess reserves- increase $1000

The market is crashing. How will the central bank adjust administered rates?

Reduce administered rates

The central bank of Kyrgyzstan increased the reserve requirement for their country's commercial banks from 9.5% to 15% between 2015 and 2024. What effect would this have had on the money supply of the Kyrgyzstani Som?

Money supply decreases

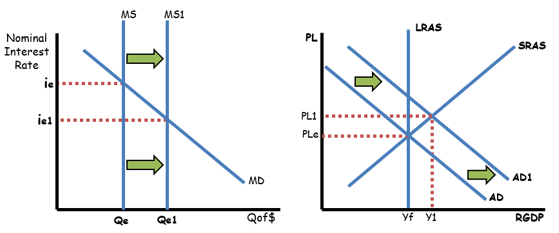

The Federal reserve implements the policy decision depicted in the graph below. What macroeconomic change are they likely trying to effect with this decision?

Reduce inflation

The nominal interest rate is 5% and the real interest rate is 2%. What is the rate of inflation?

3%

What is the reserve requirement?

10%

Will the Federal Funds rate typically be greater than or less than the interest on reserves and the discount rate?

>="interest on reserves"

<="discount rate"

The central bank (the Fed) buys bonds on the open market. What are the effects (increase or decrease) on:

- the supply of money

- the federal funds rate

- the amount of loans taken out

- aggregate demand

- prices

- output

- the supply of money UP

- the federal funds rate DOWN

- the amount of loans taken out UP

- aggregate demand UP

- prices UP

- output UP

At the supply of reserves depicted, does this country have limited or ample reserves?

Ample

What is one possible reason that the supply of loanable funds might decrease?

Decrease in private savings

Decrease in government savings

Net capital outflow

If Carlos withdraws $5000 cash from his checking account at Mi Tierra Bank, what is the immediate change to the M1 and M2 money supply?

No change to either

The Fed decides to sell bonds. What will happen to the price of bonds and their interest rate?

Price decreases

Interest rate increases

The Fed believes that the USA is falling into a recession. What changes will it make to the discount rate and reserve requirement, and what open market operation will it perform (3 answers).

Lower discount rate

Lower reserve requirement

Buy bonds

What is one possible cause for the shift depicted in the graph? AND what effect will this shift have on the amount of investment occuring?

Increase in savings or net capital inflow

Causes increase in investment

What are the components of the M2 money supply?

M1 (currency, checking & savings accounts) plus small time deposits (CDs)

This bank is only holding the minimum amount of required reserves.

If Leonardo deposits $1000 of cash into his bank account, what is the maximum possible increase in the money supply?

$1500 increase

Under ample reserves, what are the two administered rates that the Federal Reserve adjusts to change the policy rate?

Discount rate & interest on reserve balances

Under limited reserves, what are the Federal Reserve's three monetary policy tools?

Discount Rate

Open Market Operations

Reserve Requirement

What is one monetary policy action the Federal reserve might have taken to effect the depicted change, and what would the effects of this change be on national output and price level?

Lower discount rate OR lower reserve requirement OR buy bonds

Effect: increase in price level and output

What are two differences between the loanable funds market and the money market?

Loanable funds market is trading long-term loans, money market is trading money (overnight loans)