Cash and other assets that can be converted into cash or used up within a relatively short period of time without interfering with normal business operations.

What is a current asset?

These represent a decision by a corporation to distribute a portion of its income to stockholders.

What are dividends?

Another name for temporary accounts.

What are nominal accounts?

The generally accepted accounting principle that determines when expenses should be recorded in the accounting records. The revenue earned during an accounting period is offset with the expenses incurred in generating that revenue.

The Matching Principle

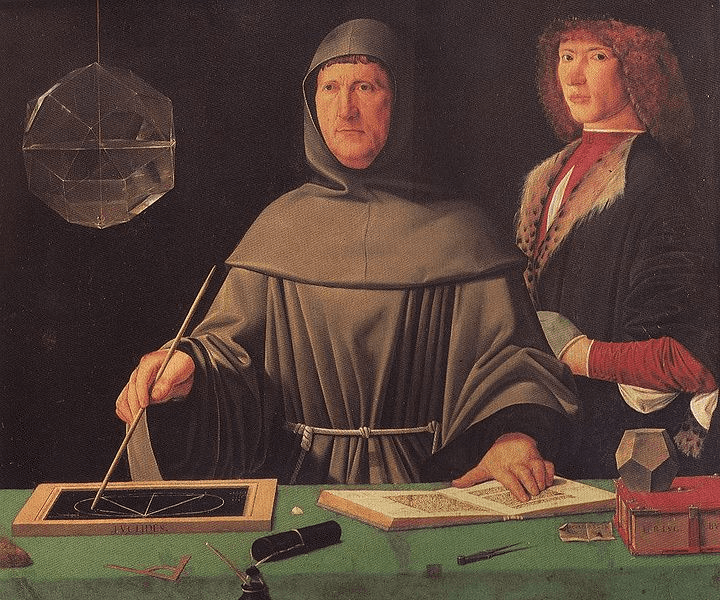

Who is Luca Pacioli

Working Capital

Current Assets - Current Liabilities

Existing obligations that are expected to be satisfied with a company’s current assets within a relatively short period of time.

What is a current liability?

The formula for the statement of retained earnings is

Retained earnings at the beginning of the period + net Income - Dividends = Retained Earnings at the end of the period.

Another name for permanent accounts.

What are real accounts?

The generally accepted accounting principle that determines when revenue should be recorded in the accounting records. Revenue is realized when services are rendered to customers or when goods sold are delivered to customers.

The Realization (Revenue Recognition) Principle

Which Big 4 firm has saying near their logo

"Building a Better Working World"

E & Y

Net Income percentage =

Net Income / Total Revenue

The summary account in the ledger to which revenue and expense accounts are closed at the end of the period. The balance is transferred to the Retained Earnings account.

What is income summary?

Publicly owned companies must file their audited financial statements and detailed supporting schedules with this organization.

What is the Securities and Exchange Commission (SEC).

The 4 steps in the closing process (in order) for a Corporation.

1. close revenues accounts to Income Summary

2. close expense accounts to Income Summary

3. close Income Summary to Retained Earnings

4. close dividend account to Retained Earnings

The accounting principle of providing with financial statements any financial and other facts that are necessary for proper interpretation of those statements.

Disclosure

What does PWC stand for?

Price Waterhouse Coopers

This refers to a company's ability to meet its cash obligations as they become due.

LIQUIDITY?

Supplemental disclosures that accompany financial statements. These provide users with various types of information considered necessary for the proper interpretation of the statements.

What are notes (accompanying financial statements)?

Many companies group together as separate balance subtotals those assets and liabilities considered current. This type of balance sheet is called...

What is a classified balance sheet?

The 4 steps in the closing process (in order) for a Sole Proprietorship.

1. close revenues accounts to Income Summary

2. close expense accounts to Income Summary

3. close Income Summary to Capital

4. close drawing/withdrawal account to Capital

The traditional accounting practice of resolving uncertainty by choosing the solution that leads to the lower amount of income being recognized in the current accounting period. This concept is designed to avoid overstatement of financial strength or earnings.

Conservatism

I am an expense in the Profit and Loss statement that is remitted to the government.

What is Federal Income Tax Expense?

(Income Tax expense will be accepted, just Tax expense is not acceptable)

Current Ratio

Current Assets / Current Liabilities

Financial statements prepared for periods of less than one year (includes monthly and quarterly statements).

What are interim financial statements?

PCAOB stands for

What is the Public Company Accounting Oversight Board?

Some publicly held companies do not use an Income Summary Account. What would the closing process be if there were no income summary account used? You can use two steps or three to illustrate this.

1. Close revenue accounts to retained earnings.

2. Close expense accounts to retained earnings.

3. Close dividends to retained earnings.

OR

1. debit revenue accounts, credit expense accounts and credit the difference to retained earnings (if net income).

2. close dividends to retained earnings.

An assumption by accountants that the monetary unit used in the preparation of financial statements changes at a sufficiently slow rate that the resulting impact on financial statements does not distort the information.

Stable-dollar assumption

Where is the place to negotiate with the IRS?

What is a Tax Table?

Return on Equity =

Net Income / Average Stockholders' Equity