This type of account does not accrue interest, because it is designed to be drawn from frequently.

Checking Account

What does it mean for a debt to be 'secured'?

The person receiving the loan has put up 'collateral' that can be seized if they default.

Why is it important to begin investing when you're young?

The power of compound returns!

It is the amount you must pay for services before your insurance coverage kicks in.

This is the form you must fill out if you want to receive federal student aid for college.

FAFSA

This type of fee penalizes an individual for requesting funds beyond those available to them; you receive the funds, but you also have to pay (the CFPB was working on this until recently...)

Overdraft Fee

Why is taking out a 7-year auto loan a bad idea?

This creates a situation where your interest will accrue at an alarming rate, potentially putting you 'upside down' in the loan (i.e. paying more in interest than you're paying for the car itself!).

individual stocks, mutual funds, bonds

What is an insurance premium?

It is the amount you pay to the insurance company each month, regardless of use of insurance services.

What is a key difference between a resume and a cover letter?

It can be less specific than a cover letter.

This is the budgeting percentage structure most commonly suggested by financial advisors (you are free to quibble with the categories, but you must name the percentages and what they correspond with!)

50/30/20

50 - Needs

30 - Wants

20 - Savings

Give one advantage and one disadvantage of a fixed-rate mortgage.

Advantage - Allows you to lock in an interest rate regardless of future fluctuations

Disadvantage - This can be frustrating if interest rates drop sharply!

Why do investing experts often suggest NOT looking at your investments regularly?

Because 'time in' is more important than 'timing.'

When you start a new job, you fill out a W-4. What does this form do?

It lets the IRS know how much you plan to withhold in taxes from each paycheck.

True or False: Dental insurance is included in most standard 80/20 or 70/30 health insurance plans.

False (unfortunately :( )

This is the fundamental difference between a private bank and a credit union.

Credit Unions are not-for-profit, and private banks are some of the most profitable institutions in the world. (The implications of this are manifold!)

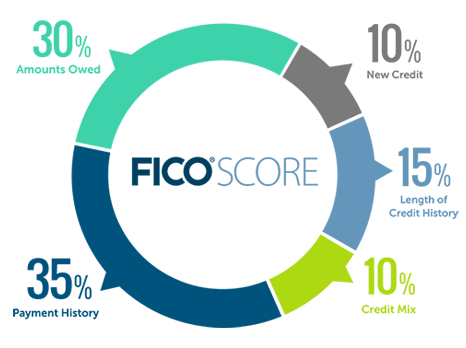

Name TWO of the factors that comprise your credit score.

Name one reason cryptocurrency is a volatile investment, and one that should be approached with caution?

Where do we start?

What is 'tax day' in the U.S. ?

April 15th

What is the key difference between a traditional IRA and a ROTH IRA?

A traditional IRA is taxed when retirement is drawn upon later in life, while a ROTH is taxed before it enters a retirement account.

This type of savings account is most often available online rather than from brick-and-mortar banks. Name the account type AND explain why it's offered online.

High-Yield Savings Account

Online companies can avoid the costs of brick-and-mortar institutions

Name TWO ways young people can build credit from scratch (i.e. when they don't yet have a credit score)

- Open a secured credit card

- Become an authorized user on a parent or guardian's card

Explain how the interest rates of newly-issued bonds affects the prices of bonds already being traded on the secondary bond marked.

When a new bond is issued, it will be more desirable than existing bonds if the interest rate is higher that existing bonds, and less desirable if the interest rates are lower than existing bonds.

Which type of life insurance is often considered to be a scam, and why?

Whole Life Insurance, because it requires huge premiums with the promise of an investment of those funds--but fees eat away at any benefit of this.

What is a key difference between a pension and a 401k?

A pension is a 'defined benefit' program, where you receive a set amount after many years of service. 401ks must be contributed to over the course of a career, and are only worth as much as they grow in value over that time.