What is a checking account?

What is: A checking account is a deposit account at a bank or credit union that allows you to deposit, withdraw, and transfer money for everyday financial transactions.

What is the difference between a wage and a salary income?

What is: Salaries refer to a fixed amount of money that is paid to an employee regardless of the number of hours worked each week.

Wages typically refer to the amount of money paid for the number of hours worked in a given week.

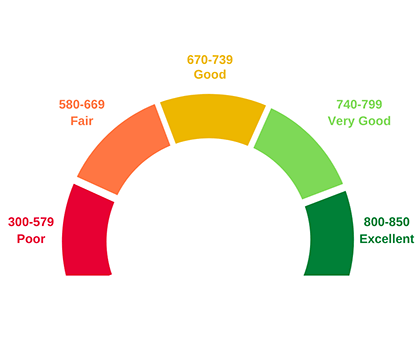

What is the typical range for credit scores?

Lowest and Highest

What is: 300-850

What is a debit card?

What is: A debit card is a tool used to access funds in your checking account. You can only make purchases with a debit card that are covered by the amount of money currently in your account.

What is the minimum wage in Rochester, NY?

What is: $15 an hour

As of January 1, 2024, the minimum wage in Rochester, New York is $15 per hour, which is the same as the rest of New York State outside of New York City, Long Island County, and Westchester County.

What is a budget?

What is: A budget is a written plan that helps you manage your money by outlining how you do and will spend and save your income each month.

Where can you get your full credit report for free?

What is: AnnualCreditReport.com

The only federally authorized website that provides free credit reports from the three major credit reporting agencies (CRAs) once a year: Equifax, Experian, and TransUnion. You can request your reports online, by phone, or by mail:

- Online: Visit AnnualCreditReport.com

- By phone: Call 1-877-322-8228 (TTY: 1-800-821-7232)

- By mail: Fill out the Annual Credit Report request form and mail it to: Annual Credit Report Request Service, PO Box 105281, Atlanta, GA 30348-5281

What are the names of the three big credit bureaus in the U.S.?

What is a credit card?

A credit card is a type of short-term loan. You can spend up to your credit limit whether you currently have the money or not. If you do not pay your credit card bill in full at the end of the month you will start accruing interest.

What is Gross Income?

What is: Gross income is the total amount of earnings before taxes and deductions.

What’ is the difference between a bank and a credit union?

What is: Banks are for-profit, they are either privately owned or publicly traded. Credit unions are nonprofit institutions.

How can you rebuild and protect your credit score?

What is: 1) Pay your bills on time 2) Keep balances low on credit cards relative to their credit limits 3) Pay off debt rather than moving it around 4) Don't open new credit cards just to increase your available credit 5) Open new credit accounts only as needed

What is: A bank fee charged when a transaction causes your bank account balance to go negative.

This can happen when you don't have enough money in your account to cover a purchase or withdrawal, but the bank still allows the transaction to go through. The cost for overdraft fees varies by bank, but they may cost around $35 per transaction (FDIC.gov)

What is Net Income?

What is: Net income is the total amount of earnings minus (after) taxes and deductions.

What are the three types of expenses in a budget?

Hint: A mortgage is a ______ expense in a budget.

What is: Fixed, Flexible (Variable), and Discretionary

Fixed - Costs that are the same on a regular basis, such as car payment or mortgage.

Flexible - Costs that change over time, such as groceries.

Discretionary - Non-essential costs that can be adjusted or eliminated to free up money for other financial goals.

What can negatively impact your credit score? (5)

What is: 1) Making late payments 2) High debt to Credit Utilization Rate 3) Applying for a lot of credit 4) Closing credit card accounts 5) Credit report errors

What percentage should you use on your credit card?

What is: To maintain a healthy credit score, you should generally keep your Credit Utilization Rate (CUR) below 30%.

How is net worth calculated?

What is: (Assets) – (Liabilities)

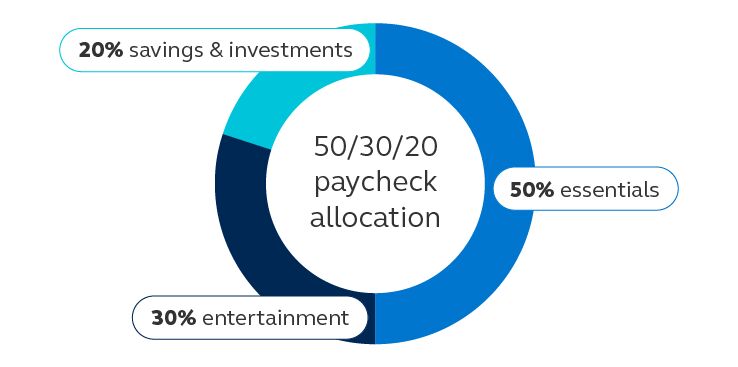

What is the 50/30/20 Rule?

What is: 50% of net pay for essentials. 30% for spending on discretionary expenses. 20% for personal saving and investment goals.

How is a credit score calculated? (5)

What is: 1) Payment History 2) Credit Utilization Rate 3) New Applications 4) Credit History and 5) Types of Credit (mix)

What kind of credit card can you get with bad credit, no credit, or to build your credit?

What is: Secured Credit Card

A credit card that requires a cash deposit as collateral when the account is opened and is a tool to build credit.