If an employee steals money and hides it in the books, this is called this.

What is fraud?

The primary purpose of this report is to show a company’s financial position at a specific point in time.

What is the balance sheet?

This equation forms the foundation of accounting: Assets = Liabilities + ________.

What is Equity?

This federal form is most commonly used by individuals to file their annual income tax return.

What is Form 1040?

This tax form is filed annually by most U.S. corporations to report income, gains, losses, and deductions.

What is Form 1120?

(FAR) Which of the following is the annual report that is filed with the United States Securities and Exchange Commission?

A. Form 8-K

B. Form 10-K

C. Form S-1

D. Form 10-Q

B. Form 10-K

The standards U.S. auditors must follow when conducting an audit.

What are Generally Accepted Auditing Standards (GAAS)?

The financial statements of public companies in the US must be prepared in accordance with these standards.

What are GAAP (Generally Accepted Accounting Principles)?

This term refers to the record of money owed to a business by its customers.

What are accounts receivable?

Interest paid on this type of loan may be tax deductible, up to certain limits, for homeowners.

What is a mortgage?

This form is used by partnerships to report their income, deductions, and other information to the IRS.

What is Form 1065?

What is the level of assurance provided by auditors in an audit of financial statements?

A. Limited

B. None

C. Reasonable

D. Absolute

C. Reasonable

These are policies and procedures put in place to safeguard assets and ensure accurate financial reporting.

What are internal controls?

This statement shows how cash moves in and out of a business from operating, investing, and financing activities.

What is the statement of cash flows?

At the end of the month, bookkeepers do this to ensure that the bank statement matches the accounting records.

What is bank reconciliation?

The deadline for filing individual tax returns is usually this date in April, unless it falls on a weekend or holiday.

What is April 15?

A business that has only one owner is called this.

What is a sole proprietorship?

(Audit) Which of the following evidence provides the greatest assurance of reliability?

A. Bank statement

B. Cash receipts journal

C. Bank reconciliation

D. Cash disbursements journal

A. Bank statement

This term refers to the information auditors collect to support their opinion.

What is audit evidence?

Accounts payable are listed under this section of the balance sheet.

What are current liabilities?

Depreciation expense is recorded at the end of each period with a corresponding credit to this account.

What is accumulated depreciation?

Jessica’s husband passed away in June of last year. She has not remarried. She has a 6-year-old son who lived with her all year and whom she supported entirely. What is Jessica’s most advantageous filing status for this year?

What is Qualifying Surviving Spouse (also known as Qualifying Widow(er) with Dependent Child)?

Businesses may deduct up to this percentage of qualified business meals provided the expense is properly documented.

What is 50%?

Which of the following best describes a permanent difference between book income and taxable income?

A. An expense that is deductible for tax purposes in a different year than it is recognized for book purposes

B. Income that is recognized on the books but never included in taxable income

C. Depreciation expense calculated differently for book and tax but eventually equal in total

D. Revenue that is deferred for tax purposes but recognized immediately for book purposes

B. Income that is recognized on the books but never included in taxable income

To reduce theft and fraud, businesses should always keep this separate: the person who writes checks from the one who approves them.

What is separation of duties?

Review the provided balance sheet as if you are a quality control reviewer. Identify and list four review notes or recommendations for improving the presentation, accuracy, or clarity of the financial statement.

AGK, JJE, ACF to provide explanation

Income received but not yet earned by the end of the period is recorded in this type of liability account.

What is unearned revenue?

Withdrawals from this type of IRA are generally tax-free if certain conditions are met.

What is a Roth IRA?

Review the provided list of expenses in the handout. For each item, indicate whether it is tax-deductible or non-deductible for a business under current IRS rules.

AGK, JJE, ACF to provide explanation

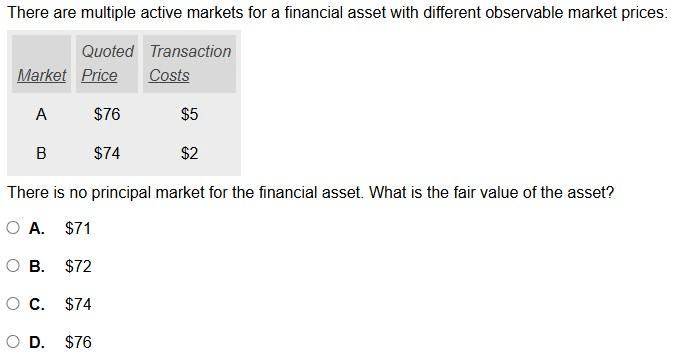

C. $74

Opportunity, Rationalization, Pressure/Motivation

This agency requires public companies in the U.S. to file annual financial statements.

What is the SEC (Securities and Exchange Commission)?

A company sells merchandise inventory to a customer for $15,000 cash. The cost of the merchandise sold was $5,200. What journal entries should be recorded?

Dr Cr

Cash $15,000

Sales Revenue ($15,000)

"To record the sale of merchandise"

Dr Cr

Cost of Goods Sold $5,200

Credit Inventory ($5,200)

"To record the cost of merchandise sold"

Charitable contributions are only deductible if made to organizations with this tax-exempt status.

What is 501(c)(3)?

This number, needed to file business taxes and hire employees, is often called a business’s “tax ID.”

What is an EIN (Employer Identification Number)?

What penalty could a tax preparer face if they fail to sign a client's tax return?

A. No penalty

B. A $65 penalty for each unsigned return

C. Imprisonment

D. A penalty only if the taxpayer's income is understated by more than $10,000

B. A $65 penalty for each unsigned return