________________ is an economic and political system in which a country's trade and industry are controlled by private owners for profit.

Capitalism

What is a deficit?

What is a surplus?

Deficit: the shortfall created when income is lower than expenses

Surplus: the excess created when income is higher than expenses

What does the term Public Debt mean?

the total amount of money owed by the federal government

This is a tax on a specific individual

direct tax

___________ is an area of the production, distribution and trade, as well as consumption of goods and services.

An economy

Economists usually describe an economy in which private enterprise and governmental participation coexist as a mixed economy.

This is our economy

Mixed Economy

What is Monetary Policy?

the government’s power to influence the economy by regulating the money supply and the availability of credit

Describe what Inflation is.

a general increase in prices throughout the economy

What is Fiscal Policy?

the government’s powers to tax (receive money) and spend to influence the economy

What are two of our economic goals?

Full Employment

Price Stability

Economic Growth

___________economic theory of social organization which advocates that the means of production, distribution, and exchange should be owned or regulated by the community as a whole.

Socialism

What is the Federal Reserve (FED)?

The Fed is the central banking system of the United States, made up of 12 regional banks.

It exercises monetary policy by adjusting the federal funds rate.

The Fed tries to promote price stability, full employment, and economic growth.

What is a tariff?

Customs duties: also called tariffs or import duties, are charged on many goods imported into the United States.

A tariff is a tax on imported goods or services

How can the government get money without using taxes?

The government receives interest on money borrowed from the Federal Reserve System and other loans.

The government also charges fees for issuing passports, copyrights, patents, and trademarks.

The sale or lease of public lands also generates government income.

What is Demand Side Economics?

the view that increased government spending will create higher employment, boost the economy, and raise tax revenues

______________ economic system where property is publicly owned and each person works and is paid according to their abilities and needs. Classes are in conflict with themselves.

Communism

This institution sets rules for international trade and provides a place to settle disputes and negotiate trade agreements

World Trade Organization (WTO)

What is GDP?

gross domestic product: the total value of all goods and services produced in a country each year

Explain what controllable and uncontrollable spending is.

Controllable spending: items in the federal budget that the government can increase or decrease spending on each year

Uncontrollable spending: budget expenses that are either fixed by federal law or are largely out of the government’s control from year to year

What is Supply Side Economics?

the view that lower taxes, not greater government spending, will boost the economy

What are two characteristics of Socialism?

AND

What are two characteristics of Communism?

Socialism-

Nationalism, Public Welfare, Taxation, Centrally Planned Economy

Communism-

Communist Party holds all the power.

State Ownership

Collectivization

a. Merging small private farms into large

government-owned agricultural enterprises.

4. Central Planning

FED TOOL-Open market operations: the process of buying or selling government securities from the nation’s banks

FED TOOL-Reserve requirement: the amount of money that the Federal Reserve Board says banks must keep on reserve

FED TOOL-Discount rate: the rate of interest a bank must pay when it borrows money from a Federal Reserve bank.

Raising the discount rate slows borrowing, which reduces the flow of money. Lowering it does the opposite.

____________theory holds that government should play a very limited, hands-off role in society.

Laissez-faire theory

Explain Globalization and Protectionism.

Globalization: the growing economic interdependence among the nations of the world

Protectionism: the practice of limiting imports to protect domestic industries from foreign competition

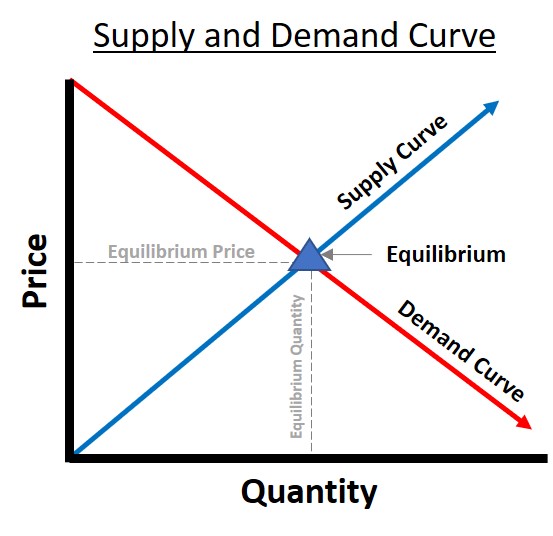

Explain Supply and Demand.

Price adjusts to equate quantity supplied and quantity demanded. Competition is drives this adjustment. When there is excess demand, buyers compete with each other to access to scarce goods.