2. Supports use of expert knowledge;

3. Improves customer relations;

4. Provides training;

5. Improves motivation and retention

Define relevant information

A company is planning to replace an old machine with a new one. Define one sunk cost.

The original cost of the old equipment

The income statement for Sweet Dreams Company is divided by its two product lines, blankets and pillows, as follows:

Blankets Pillows Total

Sales revenue$620,000$320,000$940,000

Variable costs 465,000 260,000725,000

Contribution margin155,00060,000215,000

Fixed costs 66,000 106,000172,000

Operating income (loss)$89,000$(46,000)$43,000

If Sweet Dreams can eliminate total fixed costs of $32,000 by dropping the pillows line, operating income will

Decrease by $28,000.

Total Profits with pillows $43,000

Profits without pillows $15,000

New contribution margin = $155,000

New fixed costs 140,000

= New operating income $15,000

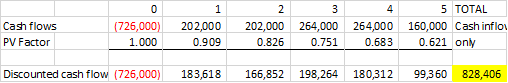

Zoey Company is considering purchasing new equipment that costs $726,000. Its management estimates that the equipment will generate cash inflows as follows:

Year 1$202,000

2 202,000

3 264,000

4 264,000

5 160,000

The company's required rate of return is 10%. Using the factors in the table below, calculate the present value of the cash inflows. (Round all calculations to the nearest whole dollar.)

Present value of $1:

6% 7% 8% 9% 10%

10.9430.9350.9260.9170.909

20.8900.8730.8570.8420.826

30.8400.8160.7940.7720.751

40.7920.7630.7350.7080.683

50.7470.7130.6810.6500.621

$828,406

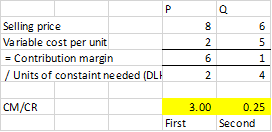

Effie Corporation produces two products, P and Q. P sells for $8.00 per unit; Q sells for $6.00 per unit. Variable costs for P and Q are $2.00 and $5.00, respectively. Fixed costs are $1.00 and $2.00 per unit, respectively. There are a maximum of 7300 direct labor hours per month available for producing the two products. Product P requires 2.00 direct labor hours per unit, and product Q requires 4.00 direct labor hours per unit. The company can sell as many of either product as it can produce. The product that Effie should produce is

Product P - highest CM/CR per unit

Two methods of financial analysis that use the theory of time value of money are

Net present value

Internal rate of return

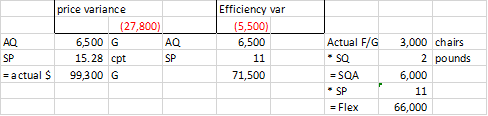

Allen's Boats produces deck chairs. It has the following standards for direct materials: 2 pounds per unit at $11 per pound.

Allen's produced 3,000 deck chairs this month. It used 6,500 pounds of materials and paid $99,300 for such.

Allen's direct material efficiency variance is

$5,500 unfavorable

Pen Inc. has the following data:

Operating income for year $100,000

Sales for year $500,000

Assets Jan 1 $580,000

Assets Dec 31 $610,000

The return on investment for the year is

16.81%

Income $100,000

/ Avg assets $595,000

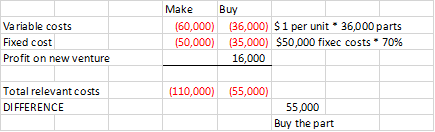

Voltaic Electronics uses a standard part in the manufacture of different types of radios. The total cost of producing 36,000 parts is $110,000, which includes fixed costs of $50,000 and variable costs of $60,000. The company can buy the part from an outside supplier for $1 per unit and avoid 30% of the fixed costs. Assume that the company can use the freed manufacturing space to make another product that can earn a profit of $16,000. If Voltaic outsources, the effect on operating income will be _______

Increase $55,000

Nubela Manufacturing is considering an investment proposal with the following data:

Proposal X

Investment$10,700,000

Useful life 5 years

Estimated annual net cash inflows for 5 years$2,140,000

Residual value$50,000

Depreciation method Straight-line

Required rate of return 12%

The payback period for Proposal X is

5 years

10,700,000 / 2,140,000 = 5 years

Home Decor Company manufactures special metallic materials for luxury homes that require highly skilled labor. Home Decor uses standard costs to prepare its flexible budget. For the first quarter of the year, direct materials and direct labor standards for one of their popular products were as follows:

Direct materials: 3 pounds per unit; $3 per pound

Direct labor: 4 hours per unit; $16 per hour

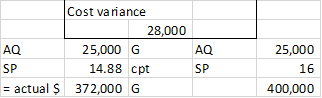

Home Decor produced 4000 units during the quarter. At the end of the quarter, an examination of the labor costs records showed that the company used 25,000 direct labor hours and actual total direct labor costs were $372,000. The direct labor cost variance is: (Round any intermediate calculations to the nearest cent, and your final answer to the nearest dollar.)

$28,000 Favorable

Target Company has the following data:

Operating income $125,000

Sales $500,000

Average assets $300,000

Debt $100,000

RRR 15%

The residual income for Target is

$80,000

Operating income $125,000

less:

RRR 15%

* Assets $300,000

= Required return $45,000

Equals residual income $80,000

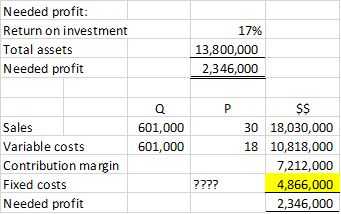

Fowler Company is a price-taker and uses target pricing. Refer to the following information:

Production volume601,000 units per year

Market price$30 per unit

Desired operating income17% of total assets

Total assets$13,800,000

Variable cost per unit$18 per unit

Fixed cost per year$5,500,000 per year

With the current cost structure, Fowler cannot achieve its profit goals. It will have to reduce either the fixed costs or the variable costs. Assuming that variable costs cannot be reduced, what do fixed costs need to be to achieve Fowler's profit goals?

$4,866,000

1. If the IRR of a project is 16% and the discount rate is 12%, what impact does this have on the net present value?

2. If the discount rate of a project is 12% and the net present value = 0, what impact does that have on the IRR?

1. The NPV would be positive

2. The IRR is 12%