9. A way to pay off debts by starting with the smallest balance first, then rolling the payments into the next debt as each one is paid off.

Snowball Method

5. A detailed record of your credit history, including your borrowing and repayment activity, that lenders use to assess your creditworthiness.

Credit Report

14. Range of possible credit scores

300 to 850

10. How long does it take to establish your first credit score?

Roughly 3 to 6 months

13. A debt repayment strategy where you focus on paying off debts with the highest interest rates first to save more on interest costs over time.

High Rate Method

8. One of the three credit bureaus/reporting agencies

Experian OR Equifax OR Transunion

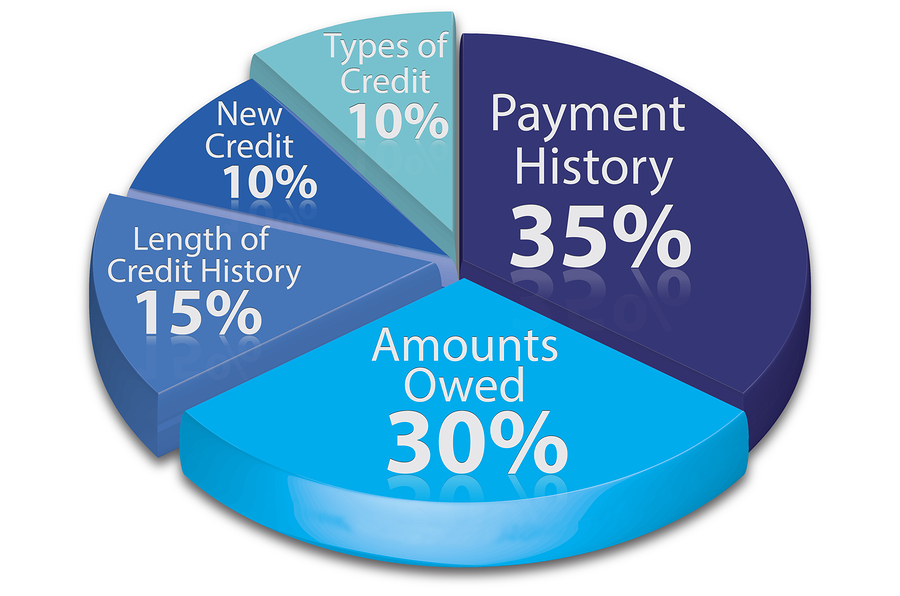

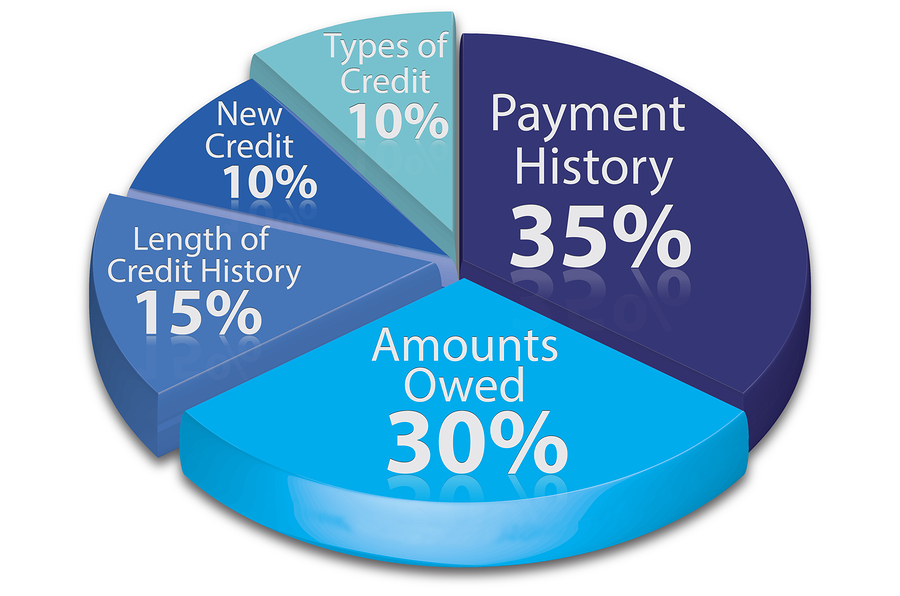

17. Largest factor in a credit score calculation

Payment history (35%)

11. One reason it's important to build credit as a young person

Answers could include leasing an apartment after graduation, setting up utilities, buying a car, getting a cell phone, getting access to better loans and rates, etc.

3. The amount of money you owe or have available in an account.

Balance

20. What types of companies could check your credit?

Answers could include credit card, insurance, and telecommunications companies, banks, your employer, utilities, landlords

12. The ratio of your current credit card balances to your total credit limits, expressed as a percentage, indicating how much of your available credit you are using.

Credit Utilization

7. Someone who agrees to take responsibility for a loan or credit account alongside the primary borrower, helping them qualify for credit.

Co-signer

2. The percentage charged by a lender on the amount borrowed over time.

Interest Rate

6. The maximum amount of money you can borrow on a credit card or line of credit.

Credit Limit

19. One factor that goes into calculating your credit score

16. How old do you have to be to apply for a credit card?

18 years old (with proof of income or a co-signer)

4. Taking action to solve a problem before it happens or gets worse.

Proactive

18. The process where unpaid debts are turned over to a third-party agency to recover the money owed.

Collections

15. Why is it better to have a high credit score than a low one?

Answers could include it saves you money, access to better loans, and lower interest rates.

1. A type of credit card backed by a cash deposit made by the cardholder, which serves as collateral and typically sets the card's credit limit.

Secured credit card