The primary output of the Planning phase of the Portfolio Management Process, this document contains the investment plan for a client or investor.

INVESTMENT POLICY STATEMENT (IPS)

This investment strategy involves actively selecting and managing securities in an attempt to outperform a benchmark index by taking advantage of short-term opportunities, market inefficiencies, or expert analysis.

ACTIVE INVESTING

When using Relative Return, the performance of a portfolio is compared against a relevant benchmark. For example, a portfolio primarily invested in U.S. equities may be benchmarked relative to the:

A. FTSE 100

B. PSEi

C. S&P 500

D. All of the above

E. None of the above

C. S&P 500

The client's preference to invest in "green" or environmentally friendly companies is best discussed in the _____________ section of the IPS.

A. Unique Preferences

B. Liquidity Requirements

C. ESG Considerations

D. Regulatory Concerns

E. Investment Restrictions

C. ESG Considerations

Which of the following activities are typically conducted as part of the KYC (Know Your Customer) process to better understand the client's financial situation, investment objectives, risk tolerance, and investment constraints?

A. Client Interviews

B. Market Trend Analysis

C. Risk Assessment Questionnaires

D. A and B only

E. A and C only

F. B and C only

G. A, B, and C

E. A and C only

(Client Interviews and Risk Assessment Questionnaires)

This investment strategy combines elements of passive investing by tracking an index, while also making selective adjustments to the portfolio in an attempt to marginally outperform the benchmark.

ENHANCED INDEX APPROACH

(2 min) Your client plans to invest P100,000 today, aiming to grow it to P2,000,000 in 20 years. Additionally, the client plans to withdraw P5,000 at the end of each year to cover personal expenses.

What annual rate of return is required to achieve the client's goal? (Assume annual compounding and round your answer to three decimal places.)

The client's return objective is 17.984% per year.

The client plans to have a 1-month vacation in Europe one year from now and would thus need to withdraw 10% of the investment. This will be included and discussed in the ____________ section of the IPS.

A. Time Horizon

B. Liquidity Requirements

C. ESG Considerations

D. Unique Preferences

E. None of the above

B. Liquidity Requirements

This investment objective focuses on minimizing the risk of capital loss while aiming to achieve returns that outperform inflation, ensuring the preservation of purchasing power over time.

CAPITAL PRESERVATION

This asset allocation strategy involves making short-term adjustments to asset class or sub-asset class weights to take advantage of short-term market fluctuations, aiming to enhance the portfolio’s overall return.

TACTICAL ASSET ALLOCATION (TAA)

(2 min) A client plans to retire in 5 years with a retirement fund equivalent to P1,000,000 in today’s purchasing power. They can invest P450,000 right now and can make additional contributions of P90,000 at the end of every year. Inflation is likely to average 3% per year over the next 5 years.

What annual rate of return must the investment achieve to meet the client’s goal? (Assume monthly compounding, round answer to 2 decimal places, and make sure to include the percentage sign.)

Step 1. Find the future value of P1,000,000 in 5 years, accounting for 3% annual inflation. = P1,159,274.07

Step 2. Calculate the required real rate of return that would allow the initial investment and additional contributions to grow to meet the inflation-adjusted desired retirement amount. (ANSWER = 7.03%)

(30 seconds) Your clients are a couple planning to retire in three years, at which time they intend to withdraw all their investments. Given their Conservative risk profile, which combination of investment options would be most suitable for their portfolio?

A. T-bills and Pag-IBIG MP2 Savings

B. 3-Year Peso Corporate Bonds and Dollar-Denominated Bond Mutual Funds

C. PSEi Stocks and PSE Dividend-Paying Stocks

D. 360-day Peso Time Deposits and 3-Year FXTNs

D. 360-day Peso Time Deposits and 3-Year FXTNs

Investors with this investment objective require a regular stream of money that can be withdrawn from their investment to pay for their kids' tuition, housing or car loans, or household or personal expenses.

CURRENT INCOME

This strategy involves adjusting a portfolio's asset allocations to restore them to the target levels specified in the Investment Policy Statement.

REBALANCING or PORTFOLIO REBALANCING

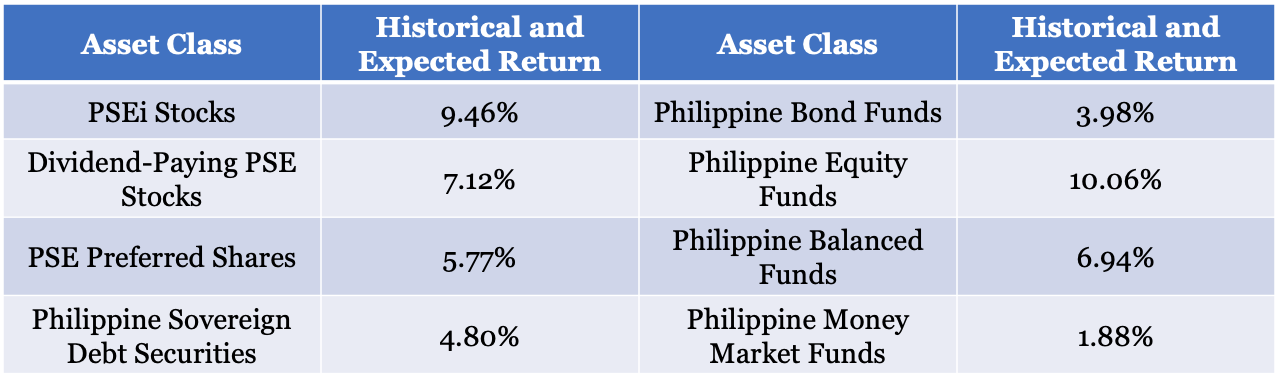

(2 min) Using the table of historical and expected returns for asset classes, calculate the expected return of a client’s portfolio with the following asset allocation: 2/3 in Philippine Government Bonds, 1/4 in PSEi Stocks, and the remainder in Philippine Balanced Funds. (Round your answer to two decimal places.)

Calculate the total expected return of the portfolio by getting the sum of the weighted returns of each asset class according to their allocated percentages.

Philippine Government Bonds: 66.67% × 4.80% = 3.20%

PSEi Stocks: 25% × 9.46% = 2.37%

Balanced Funds: 8.33% × 6.94% = 0.58%

EXPECTED RETURN = 3.20% + 2.37% + 0.58% = 6.15%

(30 seconds) Your client is a Filipino investor with a Moderately Aggressive risk profile and 1-year investment time horizon. The best investments to include in their portfolio are:

A. PSEi Stocks and FXTNs

B. T-bills and Money Market Funds

C. High-yield Peso Savings Accounts and PSE Dividend Stocks

D. 360-day Peso Time Deposit and Bitcoin

B. T-bills and Money Market Funds

(The liquidity and riskiness of the investment should match the investor's time horizon.)