An indication that the customer has pledged personal property as collateral for a loan.

What are Chattels?

You would use this CIF screen to locate any related accounts for a customer.

What is EREL?

What is the final documents list?

Outlines any changes, additions or removals to the original purchase contract (for Alberta).

What is the Residential Real Estate Purchase contract Amendment?

Confirmed true name fraud and inquiry address reported as misused are examples of this.

What are material alerts?

In AWS you would find the purpose of funds on these 2 screens.

What are the comments and product screens?

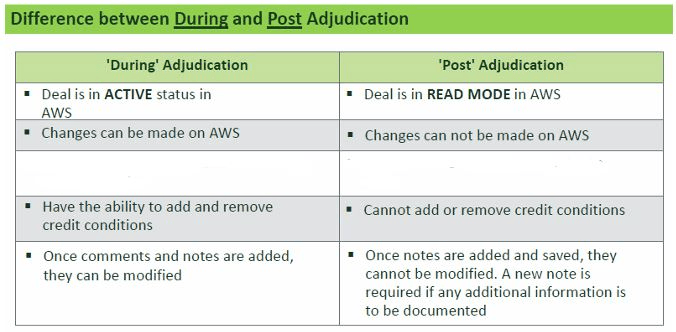

At this stage, you only have the ability to add notes in AWS and cannot modify them once they are saved.

What is Post-Adjudication?

A disclosure that will contain information relating to defects, renovations and other pertinent property information based on the seller's knowledge/experience. (BC)

What is a PDS, or property disclosure statement?

The type of revolving credit that generally does not have a set limit and may require full balance repayment monthly.

What is an Open Trade?

The platform that house the details about our security and includes details such as funding date or solicitor conditions.

What is Security Library?

FILL IN THE BLANKS

- Have the ability to add comments and notes to AWS

- Only have the ability to add notes to AWS.

This exposure group includes Credit Cards, Loans, and Auto Loans.

What is Group C?

This would be the credit rating for a loan that is more than 120 days past due, but not yet rated a 9.

What is I5?

These 3 third party sites are used to input or view details for insured deals.

What are Canada Guaranty, Sagen, and CMHC (emiliweb)?

The system used to complete compliance tasks on pending credit compliance conditions.

What is the Credit Assistant Database?

These are the 3 points on the fraud triangle.

What are Pressure, Opportunity, and Rationalization?

Acknowledge these alerts in your notes and no further action is required (unless there are red flags that prompt the underwriter to ask for additional information).

What are non-material alerts?

We use this platform to review income docs, purchase agreements, or MLS listings (amongst other things).

What is the Digital Document Viewer?

They are responsible for sending follow-ups for deficiencies through CADB as well as completing the credit compliance screen on CLK for any remaining conditions prior to handing over to the branch.

Who are Credit Assistants?

Having substantial credit card debt, with balances near credit limits and only minimum payments being made is one example of this.

Poor Credit bureau

This is a message which the customer has requested be placed on their credit bureau. The message will ask that the customer’s request for credit be verified by calling a specific phone number noted in the message.

What is the Bill 152 Identity Verification Message?

This is a site where you can submit questions to be answered by experts or search for answers to previously asked questions.

What is the credit acumen whiteboard?

These are the two responsibilities of an analyst for conditions during adjudication.

Remove the standard auto populated conditions for documents/conditions already validated

Add condition in AWS for any required/missing documents.

What is the Credit Compliance screen?