the opportunity!

A life insurance policy where the death benefit and premium remain the same (level) for the entire duration of the term — usually 10, 20, or 30 years.

What is DIME method?

Debt, Income, Mortgage, Education

What is a ETHOR script? & Role play the script!

Excited Training Help Opinion Referral!

250 x 12 = 3,000 points!

What does the agent have to do the moment they get started with us and sign their ICA?

Get enrolled into the course & Schedule their onboarding within 24-48 hours!

What is the difference between Whole life and IUL?

Whole life has fixed, guaranteed growth with higher premiums and limited flexibility, while an IUL offers flexible premiums, potential for higher index-linked growth, and tax-free cash value access, but without the same guaranteed accumulation.

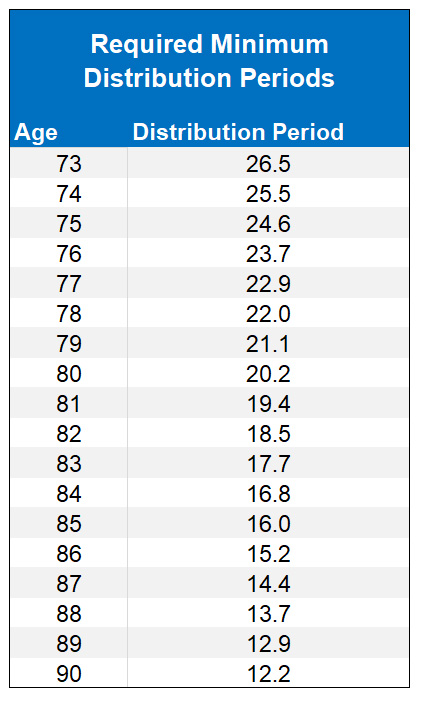

What is RMD and when does it start?

Here’s a clean, Jeopardy-style answer with a simple explanation and a visual assist:

What is an RMD and when does it start?

What is an RMD?

An RMD is a Required Minimum Distribution — the mandatory amount you must withdraw each year from certain retirement accounts so the Internal Revenue Service can tax the deferred money.

When does it start?

RMDs begin at age 73 under current law.

What is the reference script? Role Play it!

“Hello, may I speak to (NAME)? How is it going (NAME) my name is (TRAINER) and your good friend ________ referred you to us, do you know _________?

Awesome. Well I'm not sure if he told you or not but he recently took a position with our firm and we have been super impressed, so we asked him if he knew anyone that he thought could be a great fit and he thought of you.

(TRAINEE) said that you were _________, ___________, and _________, are these great things true about you? Well, that's good to hear. I really like (TRAINEE) and know he's not the type of person who would just refer anyone over to us so based on his recommendation we wanted to set up an interview with you in the next day or so to get to know you more and give more clarity on the positions to see if it's a good fit. What does your schedule look like tomorrow?"

How do you get promoted to Marketing Director?

5 licensed agents & 45k points in 3 rolling months (now changed by GFI 4 net licensed & 45k points in 3 rolling months) team points combined

What is the first promotion an agent can obtain to get their first promotion in the company?!

3/3/30! to senior associate!

What is the difference between accumulation annuity VS income annuity? Why should someone use one vs another?

Acccumulation Annuity

Designed for growth. The purpose is to accumulate value safely (often with zero market-loss protection) for future use or future income.

Income Annuity

Designed to pay income now or in the near future. Its main job is to provide guaranteed income for life or a set period.

When can client be eligible to rollover their 401K from their employer?

after 59 1/2 or if they no longer work at the company or if they are eligible for in service rollout

Answer to "I have life insurance already through work, so I don't think I need it"

*based on their answer

$6,000

List all the way we can bring on a new business partner

in person prospecting

linkedin & social media

Prophog

Referrals from others

What is Minimum Funding, Target Funding, Guideline Level, and 7-Pay in an IUL?

1. Minimum Funding (Minimum Premium)

Definition:

The lowest premium required to keep the policy in force.

Purpose:

Keeps the policy active

Builds very little cash value

Not ideal for retirement strategies

Simple version:

“Just enough to keep the policy from lapsing.”

2. Target Funding (Target Premium)

Definition:

The recommended premium amount for a balanced design.

Purpose:

Helps build moderate cash value

Helps agents receive full commissions

More stable than minimum funding

Simple version:

“The carrier’s recommended sweet spot.”

3. Guideline Level Premium (GLP) / Guideline Annual Premium (GAP)

Definition:

The maximum amount you can contribute each year under IRS rules without triggering a MEC.

Purpose:

Allows strong cash value accumulation

Keeps the policy within tax-free limits

Part of the IRS Guideline Premium Test

Simple version:

“The yearly maximum before it becomes a MEC.”

4. 7-Pay Premium / 7-Pay Test

Definition:

An IRS test that determines whether the policy becomes a MEC based on how much premium is paid during the first seven years.

Purpose:

Prevents overfunding the policy too quickly

Protects the tax-free status of distributions

Simple version:

“Do not overfund in the first seven years or the policy becomes a MEC.”

When do you pay taxes on Traditional IRA vs. ROTH IRA?

Traditional IRA

You pay taxes when you take the money out in retirement.

Contributions = usually tax-deductible

Withdrawals = taxed as ordinary income “Tax me later.”

Roth IRA

You pay taxes before you put money in.

Contributions = taxed now

Withdrawals = tax-free in retirement (if rules are met)n “Tax me now, never again.”

Role Play In-Person Prospecting!

*based off how well they did

1. Compliment

2. The reason why you are mentioning

3. We are expanding and looking for good people

4. Can't guarantee anything but when i'm back in my office will give you a call

5. Get the number

6. AND CALL!

I am marketing director and I helped a client with 285K rollover with product payout at 7%, what is my compensation for helping a client and also my points?

19,950 pts & $11,970

List all the onboardings objective and what should the new agent be doing each week after they start?

onboarding 2 - building & List building 3/3/30 promotion

onboarding 3 - compensation & booking field training

Objective to get our agents licensed & paid asap!

In my IUL or index Annuity, if the allocation did 20% in the market, if my cap was 12% what did I earn and if my participation was 62% what did I earn and if my spread was 2% what did earn?

for cap- 12%

for participation - 12.4%

for spread - 18%

How much can we contribute to 401k & IRA in 2026? and what is the additional catch up amount over 50 years old and over 60 years old?

401(k) Contribution Limits (2026)

Under age 50: up to $24,500 in elective deferrals (pre-tax and/or Roth).

Age 50 and older: additional catch-up of $8,000, for a total of $32,500.

Age 60–63: a “super” catch-up of $11,250 may apply instead of the $8,000 (if your plan allows it), for a total of up to $35,750.

Note: The total employee + employer contributions limit is $72,000 before catch-ups.

IRA Contribution Limits (2026)

Traditional & Roth IRA limit: $7,500 total across all IRAs if you’re under age 50.

Age 50 and older: catch-up amount adds $1,100, for a total of $8,600.

Overcoming the Objection: “I need to think about it."

“I completely understand. This is an important decision and I want you to feel confident about it.”

“Just so I can best support you, what part specifically do you feel you need more time to think about?”

Acknowledge and Normalize & Determine the real objection, answer the objection & provide clarity & provide solution.

What is all the main promotion levels and how to get promoted?

A - everyone starts there, SA - 50% (3/3/30), MD - 60% (4 net licenses & 45k pts in 3 rolling months), EMD 80% + 5% bonus (12 net licenses, 100K income, 100k pts in 3 rolling months or 150K in 6 months or 240K in 12 months, 1 marketing director on your team, half pts must come from you and half from team)