This analyst would win in a fist fight

Lee

The definition of capital

Cash or liquid assets being held or obtained for expenditures

The definition of debt

Money owed

The definition of equity

Ownership of assets

Definition of interest

the amount of money a lender or financial institution receives for lending out money

World's largest supermarket of consumer goods

Walmart

The difference between hurdle rate and WACC

Hurdle rate is the minimum required return for a project, while WACC represents the cost of capital for the firm. Generally the WACC is used as a benchmark for setting the hurdle rate needed to offset the costs and yield positive NPV.

A way to calculate cost of debt

YTM, Bond Spread, or Book Debt

CAPM or DDM

Scenario where using DDM to estimate cost of equity is appropriate

DDM is suitable for more established and mature companies that have stable dividend payouts

(We x Ke) + (Wd * Kd * (1-t))

Should BV or MV "debt/equity value" be used in Walmart's case?

Market value

One reason why short term yields are usually lower than long term yields

1. Investors demand higher compensation for greater risk over a longer time horizon

2. Inflationary risk

Two reasons why debt is cheaper than equity

1. Debt holders are paid back before equity holders

2. Interest expenses are tax-deductible

27%

Walmart's weight of equity

85%

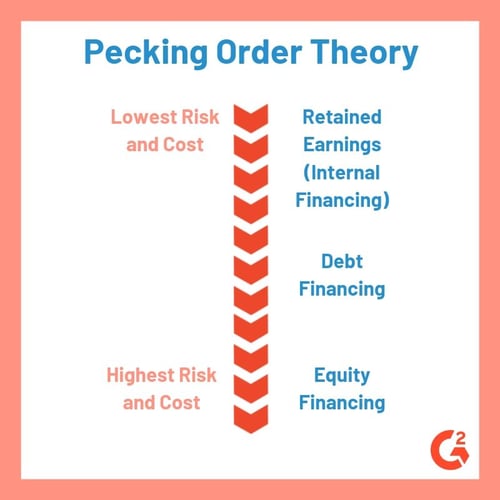

The relevancy of pecking order theory

Pecking order is important since it signals to the public how the company is performing

Walmart can implement pecking order, since they are financially healthy and have available internally generated funds

The best way to estimate cost of debt

Yield to maturity approach is best since it is based on market expectations

Market value of Walmart's equity

301 billion

Impact of deferred income taxes

Deferred income taxes may exist from tax vs book differences, but will not be included in WACC calculation. Not treated as a source of financing.

A reason why Walmart may need to calculate more than one cost of capital

Walmart has different divisions, including their online segment, US vs international, and private label arm. Each division will carry different levels of risk, and the overall firm risk represents the average risk.

Impact of preferred shares on cost of capital

issuing preferred stock may increase or decrease a company’s WACC in the short term

Method of calculating cost of debt if Walmart had no debt

Comparables analysis or credit spread

Difference between arithmetic and geometric returns for calculating MRP

Geometric accounts for compounding and accounts for positive/negative changes

Reason why Walmart's reported tax rate would be higher than 21%

Local, state, and international taxes