The lower your credit score the higher the ______ rate

you will pay on loans

Interest

An instant monthly deduction towards your credit balance

Auto Pay

A yearly fee that may be charged for having a specific credit card, independent of how you use the card

Annual Fee

The cost you pay each year to borrow money, including fees, expressed as a percentage

Annual Percentage Rate (APR)

A plastic card that allows you to make purchases now with borrowed money, which then you must repay to the lender in one lump sum or in monthly payments with interest

Credit Card

A number that reflects your financial responsibility

Credit Score

The total amount spent on your credit card

Something valuable that the lender can take as payment if you can't or don't repay your secured loan

Collateral

Someone who legally agrees to take responsibility for a person's debt if they cannot repay it

Cosigner

A list of past financial behaviors

Credit Report

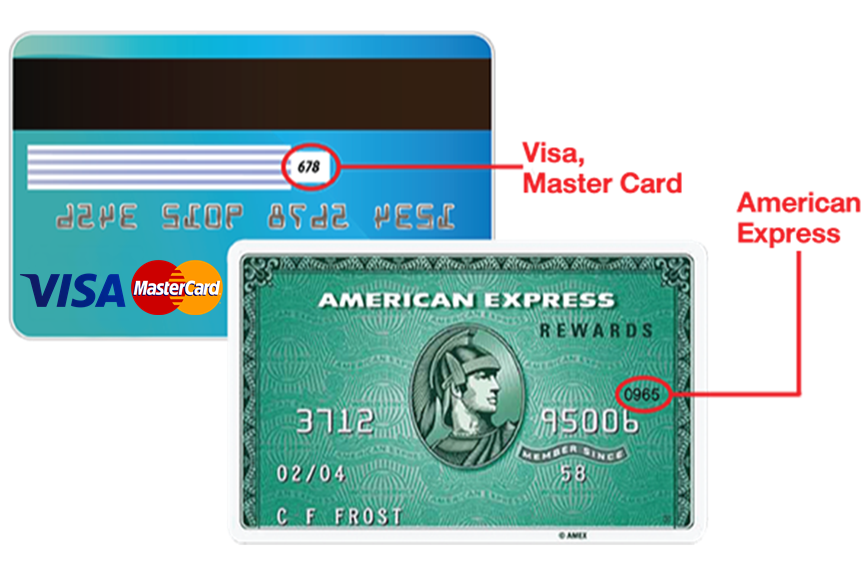

This 3 numbered code appears on the back of most debit and credit card. For American Express, it is 4 numbers.

What is CVC or CVV code

The maximum amount that may be borrowed on a credit card

Credit Card Limit or available balance

The amount you owe as the cost of borrowing money

Interest

A method to getting your credit started with the help of someone else

Authorized user

The smallest amount of a credit card bill that a credit card holder must pay during a billing cycle to remain in good standing with the lender

Minimum Payment

The monthly payment made on a house; used by individuals and businesses to make large real estate purchases without paying the entire value of the purchase up front

mortgage

The number of days between your last bill and your current bill. Usually 28-31 days.

Billing Cycle

A continuous loan based on spending and repayment

Revolving loan

Nothing

The 3 Bureaus that create credit scores

Experian Transunion Equifax

A not-for-profit financial institution that is owned by its members and organized for their benefit

Credit Union

The type of credit card that you provide the backing for

Unsecured Credit Card

The table that appears below reflects

Terms or contract for the loan or product

The highest credit score one can have

850

The aspect that makes us the most of your credit score

Payment history